Jet2 owner Dart Group (DTG:AIM) sees pre-tax profits slightly ahead of market expectations for the year ended 31 March 2019, but a cautious outlook has left the share price unmoved at 878p.

Pre-tax profit for the last year is likely to reach £177.5m according to broker Canaccord Genuity whose estimates are slightly above the consensus.

However Dart has warned that forward bookings for its peak summer period 'reflect some consumer uncertainty' as holidaymakers may be deterred from flying while the UK continues to navigate the Brexit process.

READ MORE ABOUT DART GROUP HERE

This uncertainty means that Dart has had to keep its prices for flights and package holidays competitive to encourage sales, which could put pressure on future trading.

Investors are right to be wary of Dart’s optimism that it can keep delivering after Thomas Cook (TCG) and TUI (TUI) both recently warned on profits, with the latter blaming overcapacity and the weaker pound.

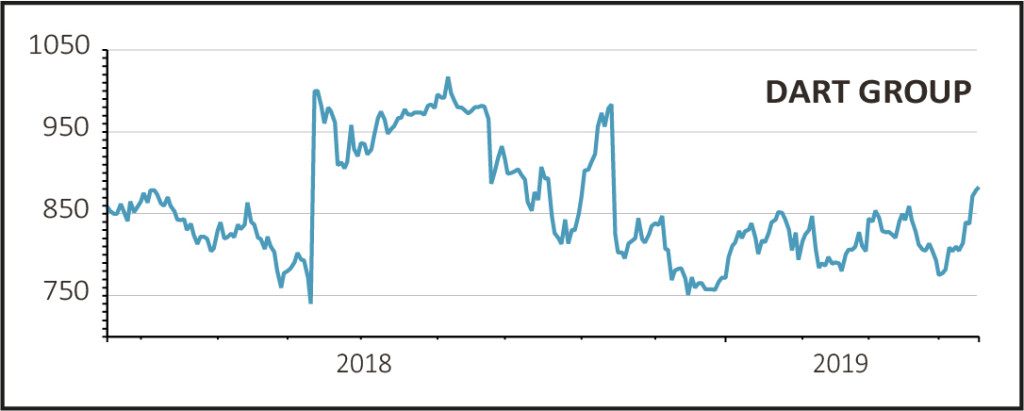

While Dart shares are up 3% over the last year, their performance has been volatile: despite bucking downbeat sector trends with strong trading, Brexit-related uncertainty has continued to weigh on the outlook.

Canaccord Genuity analyst Gert Zonneveld remains upbeat, arguing Dart's investment in growth, quality and service levels should boost its competitive position and drive shareholder value.