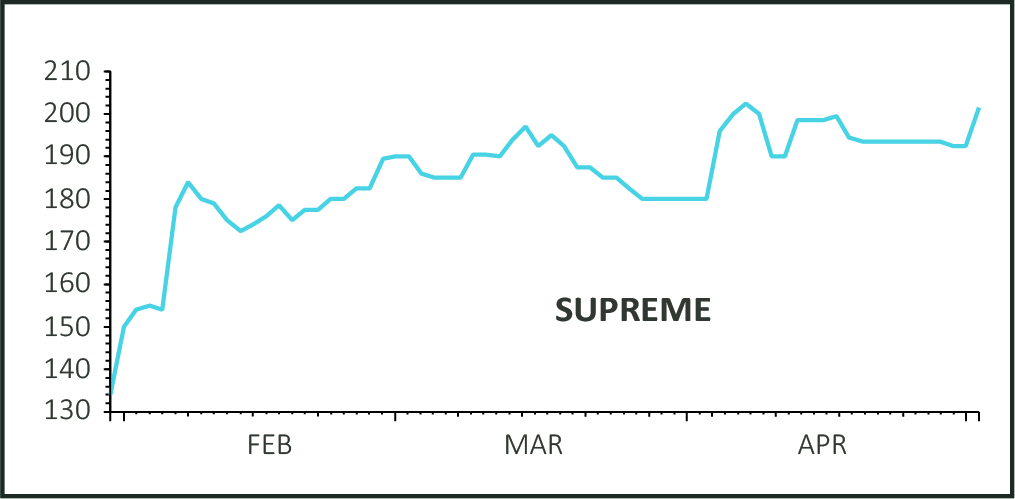

Shares in Supreme (SUP:AIM) puffed 4.5% higher to 200.9p after the fast-moving consumer products supplier behind the 88Vape brand posted an impressive maiden trading update following an oversubscribed IPO in February.

Thanks to a strong performance across key growth categories including vaping and sports nutrition and wellness, adjusted earnings before interest, taxation, depreciation and amortisation (EBITDA) for the year to March 2021 is expected to exceed expectations and Supreme insisted the new financial year has started well.

SUPREMELY CONFIDENT

Steered by entrepreneurial CEO Sandy Chadha, Supreme now expects to report a 30% surge in annual sales to at least £121 million, in-line with management’s expectations and representing impressive 31% year-on-year growth.

Adjusted EBITDA of ‘at least £19 million’ is now anticipated, which is slightly ahead of expectations and marks a 20% increase year-on-year.

During the year, Supreme saw high levels of demand across all core categories. These include batteries - it distributes globally recognised brands such as Duracell and Energizer - as well as lighting, vaping, sports nutrition & wellness, and branded household consumer goods.

88VAPE HAS TRACTION

Supreme benefitted from bumper demand across sports nutrition and wellness, seeing tasty sales of meal replacement powders, protein snack bars and early success with private label vitamins.

It also saw high demand in vaping, with the in-house developed 88Vape brand, the UK market leader in vaping e-liquids, continuing to achieve ‘strong customer traction’. It is now being rolled out across convenience retailer McColl’s entire store estate.

Berenberg thinks there is ‘more consolidation to come in the fragmented vaping market, and with Supreme’s 88vape brand the leading brand by volume share, it looks well placed to continue growing nicely in the years ahead.’

Delivered in the face of the pandemic and associated restrictions, Supreme believes its performance ‘reinforces the company’s resilience, the strength of its brands and the importance of its diverse routes to market and extensive retail network’.

Retail customers span the likes of B&M, Home Bargains and Poundland, as well as Sports Direct, Asda, Halfords and Iceland.

‘We continue to build on our strong track record of growth, with our strategy to focus on high growth categories such as vaping and sports nutrition really coming to fruition,’ enthused Chadha.

‘Innovation and entrepreneurship continue to be at the heart of what we do and our exciting pipeline of new products, coupled with the potential to increase the penetration of our existing categories, continues to be underpinned by our market leading distribution network.’

THE BERENBERG VIEW

Berenberg continues to believe Supreme can ‘scale materially in the years ahead’ and reiterated its ‘buy’ rating on the stock accordingly.

‘In terms of delivering on its IPO promises, the company is off to an excellent start, with FY21 EBITDA modestly ahead of our estimates, vaping momentum continuing, and the Sports Nutrition & Wellness division delivering particularly exceptional growth (both organic and inorganic) in the most recent half.’