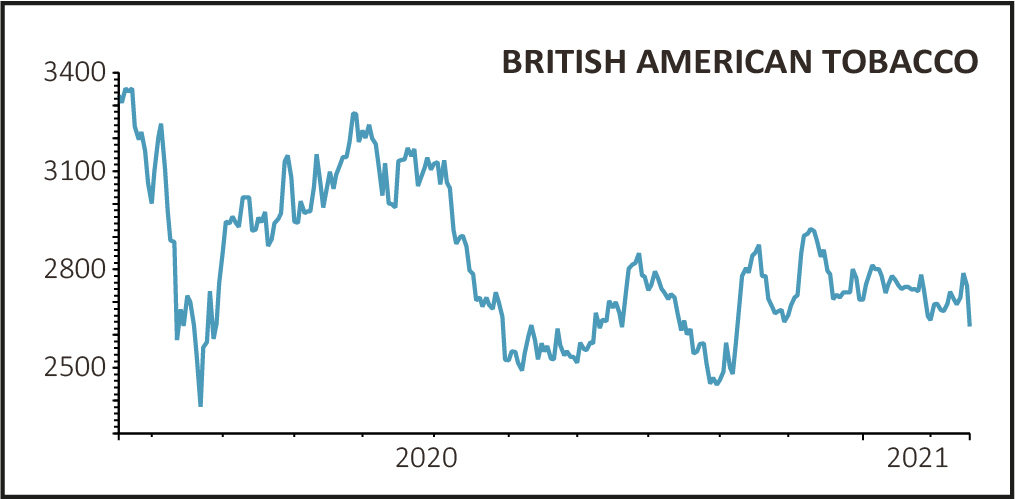

Shares in British American Tobacco (BATS) cheapened 6% to £25.88 on Wednesday despite the Dunhill-to-Lucky Strike maker beating expectations with its full year results.

‘BAT’ shrugged off the impact of the global pandemic to deliver growth in group earnings and new categories for 2020, but an uncertain outlook for 2021 weighed on sentiment towards the stock, with the tobacco titan warning of a likely currency headwind of ‘around 7%’ on earnings per share growth this year.

COST CUTTING TO THE RESCUE

Results for the year to December revealed a near-10% rise in pre-tax profit to £8.67 billion despite a 0.4% drop in revenue to almost £25.8 billion, as higher prices and a better product mix offset lower volumes.

Strong cash generation supported a 2.5% hike in the full year dividend to 215.6p.

BAT’s earnings were boosted by £660 million of cost savings, so investors may be concerned about the sustainability of future growth.

While revenue from new categories including vaping, tobacco heating products (THP) and nicotine pouches rose by 15% overall and accelerated in the second half, harmful cigarettes and tobacco still account for the overwhelming bulk of sales.

CLOUDY OUTLOOK

In terms of the 2021 outlook, BAT expects global tobacco industry volume to be down ‘around 3%’, with the key US market dependent on Covid-19 uncertainties.

BAT guided towards constant currency revenue growth of 3%-to-5% and continued progress towards its New Categories revenue target of £5 billion in 2025.

However, earnings per share growth is likely to be limited to a ‘mid-single figure’ amid ongoing Covid impacts and BAT faces a 2021 currency headwind of ‘around 7%’ on full year adjusted earnings per share growth.

THE EXPERT’S VIEW

‘Like its rivals British American is investing in so-called new categories, essentially vaping, but traditional products still make up more than 90% of sales despite material growth in this area through the course of the year,’ said AJ Bell investment director Russ Mould.

‘British American Tobacco in many ways faces a similar challenge to the oil and gas sector, replacing a revenue stream which is widely perceived as harmful with one which is as yet much less profitable and where its ability to dominate the market is less certain.

‘The growth in ethical investing is arguably even more of a problem for the likes of British American than the oil industry because, while fossil fuels perform a useful function alongside their less beneficial polluting qualities, it’s hard to make a case for cigarettes having any sort of positive impact alongside the harm they cause to people’s health. And no amount of marketing spiel around “A Better Tomorrow” can alter that fact.’