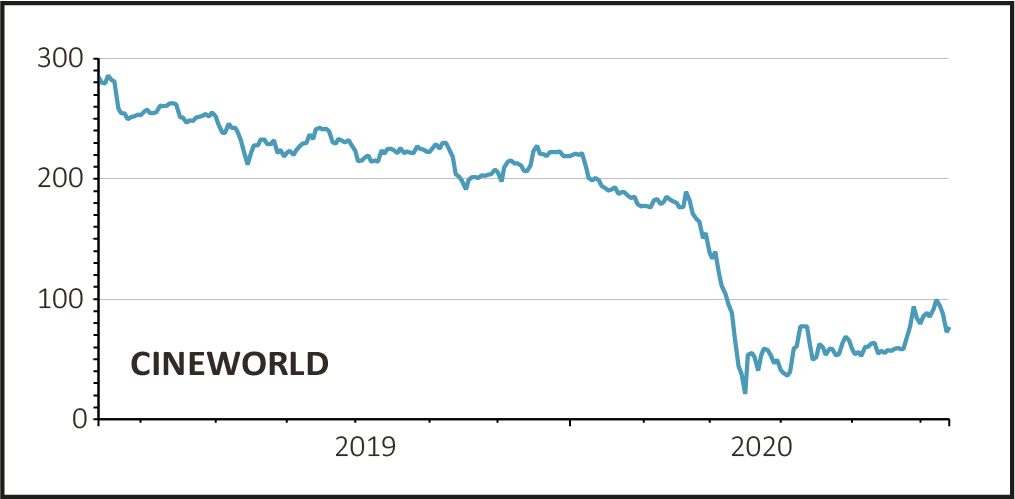

Shares in cinema operator Cineworld (CINE) fell 2% to 73.4p after it pulled out of its previously agreed $2.3bn acquisition of Canada’s largest cinema chain, Cineplex.

Cineworld has sparked a legal row after claiming Cineplex had breached certain terms of the blockbuster deal.

LEGAL WRANGLING

Cineplex counter-claimed it hadn't breached any terms of the deal and that Cineworld is in breach of its obligations to proceed with the acquisition.

The crux of the dispute seems to revolve around whether the original deal explicitly excluded pandemics or other ‘acts of god’.

While litigation presents a distraction of management time, broker Jefferies believe any damages will be limited to the fees already incurred. Cineworld’s shareholders approved the deal on 11 February.

MORE LIQUIDITY

On 7 April the company announced the closure of its entire 787 cinema estate and subsequently moved to shore-up finances.

Banking covenants tests were waived for June 2020 testing while the December 2020 test was increased to 9 times net debt to earnings before interest, tax, depreciation and amortisation (EBITDA), up from the prior limit of 5.5 times.

The company also increased its revolving credit facilities by $110m while applying for $45m from the UK coronavirus loan scheme and $25m through the equivalent US scheme.

This was expected to provide sufficient headroom to support the group in the ‘unlikely event’ of cinemas remaining closed until the end of the year.

Following the withdrawal of the Cineplex deal, Jefferies estimated cash burn would be around $40m a month, effectively giving the company a ‘handful of extra months of liquidity’ beyond the end of 2020.

The original deal was expected to result in huge cost savings on integrating the two businesses with around $120m this year and a further $130m by the end of 2021.