In a surprise announcement, the £370m closed-end European Investment Trust (EUT) has served ‘notice of termination’ on current managers Edinburgh Partners and will appoint Baillie Gifford as the new manager within the next three months.

This is not the first time the trust has sought a change of management to revive its fortunes, kicking out F&C in 2010 and appointing Edinburgh Partners.

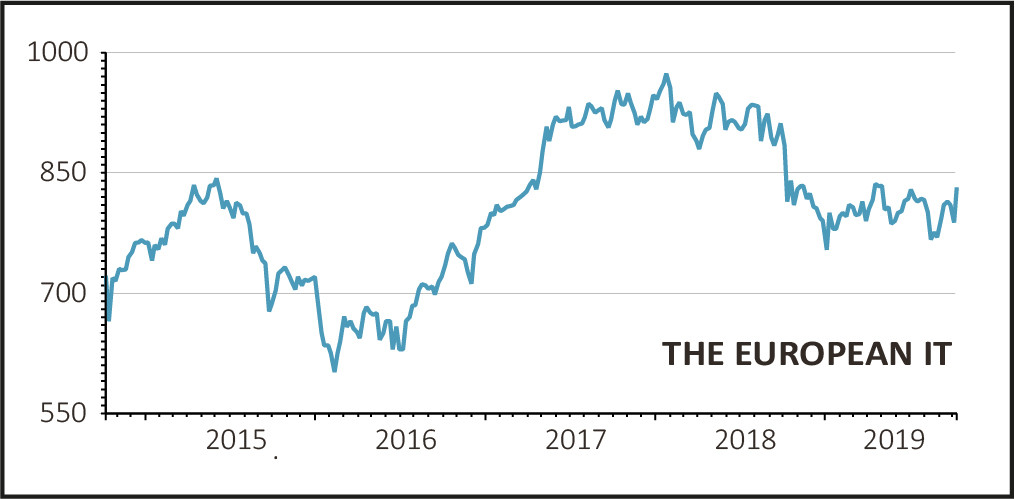

Today's news caused shares in the trust to jump 30p or 3.8% to 830p, narrowing the discount to net asset value (NAV) which had remained stubbornly above 10% for the best part of the last three years.

As well as the ‘persistent and wide discount’, despite the use of share buybacks, the trust was unhappy with the performance record since the current managers took over.

Over three and five years - standard measurement periods in the fund management industry - to 30 September the trust had not only lagged the FTSE All-World Europe ex-UK benchmark but had also lagged Edinburgh Partners’ own ‘style’ benchmark, the MSCI Europe ex-UK Value Index.

MAJOR CHANGE IN STYLE

As well as providing ‘an improved investment outcome for existing investors’ and hopefully attracting new investors, the appointment of Baillie Gifford gives the trust the opportunity ‘to introduce a new investment approach targeting investment returns primarily from capital growth ’.

Baillie Gifford is an established manager of investment trusts with a long-term track record in achieving capital growth from global equities rather than buying ‘value’ stocks.

As a result the fund will be realigned to invest in a concentrated portfolio of 30 to 50 European growth companies, up to a maximum of 60 companies, with a market capitalisation of €500m or more.

The trust will also be allowed to invest up to 10% of its assets by value in unlisted securities, taking advantage of Baillie Gifford’s expertise in picking winners before they get to the stock market.

This is a far cry from the current portfolio which is heavily weighted towards mega-cap healthcare, industrial and telecoms stocks, which are considered cheap on price to earnings, price to book value or dividend yields.

| Stock | Sector | Weighting Sept 2019 |

| Sanofi | Healthcare | 4.4% |

| Roche | Healthcare | 3.5% |

| Deutsche Post | Transportation | 3.4% |

| Royal Dutch Shell A | Energy | 3.4% |

| Telefonica | Telecoms | 3.3% |

| Nokia | IT Hardware | 3.2% |

| Orange | Telecoms | 3.2% |

| Adecco | Staffing | 3.0% |

| Gerresheimer | Healthcare | 2.9% |

| Stora Enso | Materials | 2.9% |

Source: Association of Investment Companies, Shares magazine

The trust will be managed by an experienced team of Stephen Paice and Moritz Sitte, who currently co-manage the Baillie Gifford European Fund (0605825) which is a top-decile performing fund over five and ten years in the Investment Association's Europe Excluding UK sector.