Agriculture-to-engineering combine Carr’s (CARR) has beefed up its capabilities and presence in the nuclear sector through the £9.6m acquisition of NW Total Engineered Solutions.

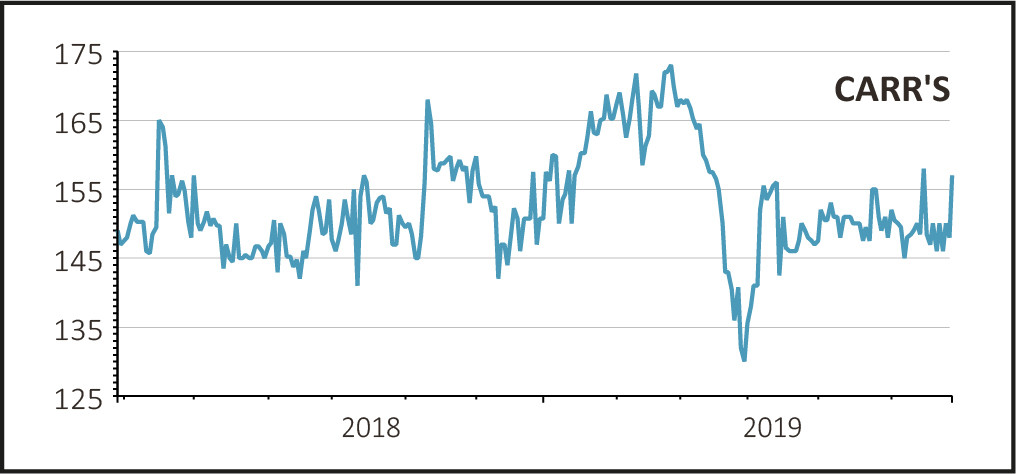

Yet shares in the Carlisle-headquartered company softened 3p (2%) to 154p this morning, investors perhaps disappointed by the absence of near-term earnings upgrades reflecting acquisition-related integration costs, not to mention Brexit uncertainty and climatic challenges in the US.

Barrow-in-Furness-based ‘NW Total’ generated taxable profits of £1.5m on £9.1m turnover in the year to March 2019 and is a trusted supplier to some of the globe’s biggest companies in the nuclear sector.

The acquisition bolsters Carr’s engineering division, one seeing strong order books according to April’s half year results statement, although the company is best known for its bigger agriculture arm, which makes and supplies livestock feed blocks and distributes farm machinery.

THE NUCLEAR OPTION

NW Total provides equipment packages and on-site technical support, installation and condition monitoring services to the nuclear defence, nuclear decommissioning and nuclear power generation sectors as well as other highly regulated markets (utilities, energy and pharmaceuticals).

READ MORE ABOUT CARR’S HERE

Encouragingly, the management who have been responsible for driving its growth will remain with the business post acquisition.

Carr’s chief executive officer (CEO) Tim Davies said NW Total ‘significantly expands our expertise and capabilities in engineering across multiple sectors. The acquisition provides significant opportunity for us to cross-sell our existing services and for NW Total to partner with other businesses within our engineering division, as it fulfils its potential and capitalises on the significant opportunities in its markets.’

THE ANALYSTS’ VIEW

Shore Capital regards NW Total as ‘an attractive deal’, especially given that nuclear defence is a market with ‘long term growth drivers’.

The acquisition comes at a time of significant opportunity in nuclear defence. These opportunities are expected to continue into the longer term through projects such as the £31bn UK Dreadnought submarine programme and with current and planned decommissioning of the UK’s nuclear power capabilities throwing up money-spinning opportunities for specialist providers.

However, the broker left its year to August 2019 forecasts unchanged, explaining that integration costs will offset any additional benefit from the deal.

For financial year 2020 however, the first full year of ownership, Shore upgraded its pre-tax profit estimate by £500,000 to £18.8m.

Investec’s Nicola Mallard made no change to her 2019 forecasts, although the consumer analyst upgraded her 2020 pre-tax profit estimate by £400,000 to £18.6m.

The upgrade includes the contribution from the acquisition, but also factors in ‘a small trim’ to assumptions for the agriculture business to reflect severe flooding in the US mid-west as well as ongoing UK Brexit uncertainty.

‘For full year 2021, our upgrade is greater at £600,000 to £19.2m, assuming some US recovery,’ says Mallard. ‘Our target price moves up to 214p from 206p and we reiterate our “buy” recommendation.’