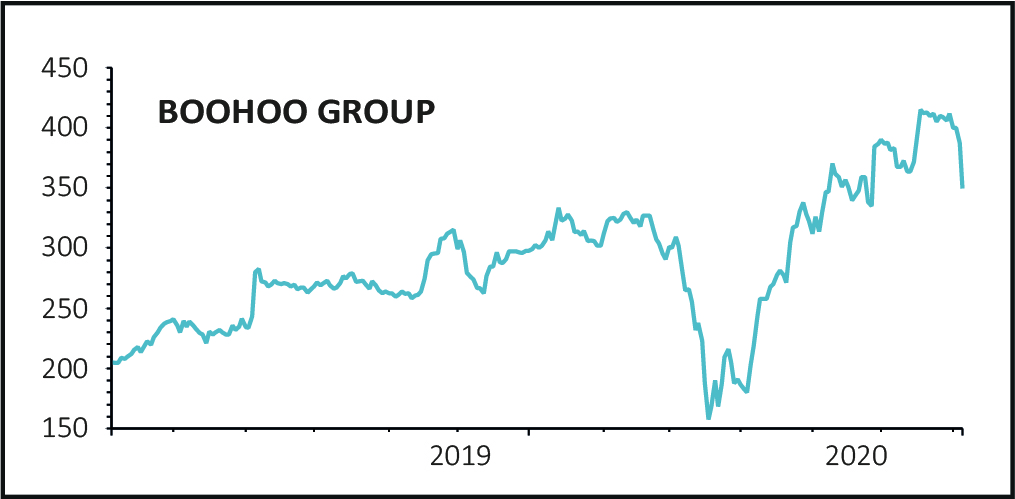

Shares in online fast fashion seller Boohoo (BOO:AIM) cheapened 9.2% to 352p on Monday as the market reacted to damaging weekend newspaper headlines alleging illegal practices are afoot in some supplier factories in Leicester.

Rattled Boohoo responded by highlighting its determination ‘to drive up standards where this is required’ and ‘ensure that everyone working to produce clothing in our supply chain is properly remunerated, fairly treated and safe at work’, although the statement didn’t do go far enough to placate panicked investors.

‘SWEATSHOPS’ SCANDAL BREWING

Lockdown winner Boohoo’s highly rated shares hit fresh highs last month in a blow to short-seller ShadowFall Research.

But the Manchester-based retailer is potentially facing significant reputational damage following a report in The Sunday Times which suggested workers in some of its supplier factories in the East Midlands city are being paid as little as £3.50 an hour. That is well below the UK minimum wage.

The report also indicated some of these ‘sweatshops’ were even operating during last week’s localised coronavirus lockdown in Leicester without additional hygiene or social distancing measures in place. Workers, it is alleged, had no personal protective equipment provided either.

BOOHOO RESPONDS

In today’s short response to the weekend’s media reports, Boohoo reiterated its commitment to supporting the UK manufacturing industry and insisted it will terminate relationships with suppliers that are not acting within the supplier code of conduct.

Boohoo even expressed gratitude towards The Sunday Times for uncovering the conditions at Jaswal Fashions, which it said are ‘totally unacceptable and fall woefully short of any standards acceptable in any workplace’.

The group’s early investigations have revealed that Jaswal Fashions is not a declared supplier and ‘it therefore appears that a different company is using Jaswal’s former premises and we are currently trying to establish the identity of this company’. Boohoo also promised to ‘urgently review our relationship with any suppliers who have sub-contracted work to the manufacturer in question’.

A RATNER MOMENT?

Shore Capital is unsure whether the headlines will stick with Boohoo’s shopper base but said it will ‘watch developments with interest’.

The broker also highlighted the fact that ‘many younger shoppers do have a particular interest in business ethics, labour practices and sustainability. Hence, the group will no doubt be praying that this is not analogous to a Gerard Ratner moment.’

Sticking with its ‘hold’ rating on Boohoo’s shares, the broker added: ‘If there is substance to these stories then there can only be rating contraction risk as knowingly underpaying workers in the UK, modern slavery and breaking coronavirus crisis rules are most certainly not matters that should or, most probably, would be associated with a premium rated stock, whether on-trend and pure-play or not.’

MORE QUESTIONS THAN ANSWERS

Liberum Capital believes Boohoo’s response doesn’t go far enough as the statement ‘only really speaks of investigating the particular factory in question and raises the question of how many other breaches management is potentially unaware of. The rest of the statement speaks of procedures and checks that management has already put in place, which if the allegations are true, have clearly not been robust enough to stop significant breaches happening.’

The broker added: ‘While we are huge fans of Boohoo’s strategy, with concerns on corporate governance and ethics escalating, the outlook for the shares becomes less certain.’