Industrial services firm Bodycote (BOY) surprised the market on Friday with a double-digit increase in 2018 pre-tax earnings, sparking a 10% rally in the shares to 852p. Investors are also being treated to a 20p special dividend, on top of a 9% hike in the full year ordinary dividend to 19p.

While the core heat-treatment business, which makes up three quarters of revenues, grew by a fairly sedate 5%, the rest of the businesses generated a 12% increase in revenues with some individual units recording over 30% growth.

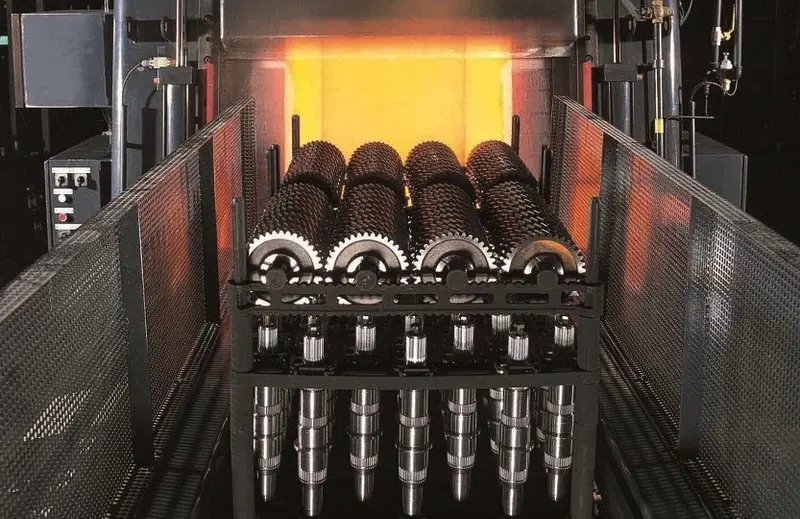

Bodycote is the world’s leading provider of heat-processing services for metal and alloy components. Heat-treating makes parts more durable and extends their life, reducing costs for the end customer.

READ MORE ABOUT BODYCOTE HERE

Typical customers are car-makers and plane-makers that need specially-toughened or coated high-performance parts but Bodycote also supplies the energy industry, rail and marine markets and even food and beverage companies.

Automotive industry sales were up 7% last year, which is pretty impressive given the weak performance of new car markets in Europe and the US.

Sales to the aviation industry were up 8% with a major pick-up to 12% growth in the second half as supply-chain bottlenecks eased and US production of fuel-efficient LEAP engines ramped up, increasing the demand for parts.

Energy sector sales were up 13% thanks to demand from the Permian basin in west Texas but there was also a pick-up in shipments for subsea contracts and this segment is continuing to grow.

There was a strong contribution from emerging markets with revenues up 21% driven by Mexico and China and Bodycote is upping its investments in these markets to tap into future growth.