UK housebuilding will be thrust into the spotlight this week as three heavyweights report their results, while we’ll also get a better insight into what house prices might be like after Brexit.

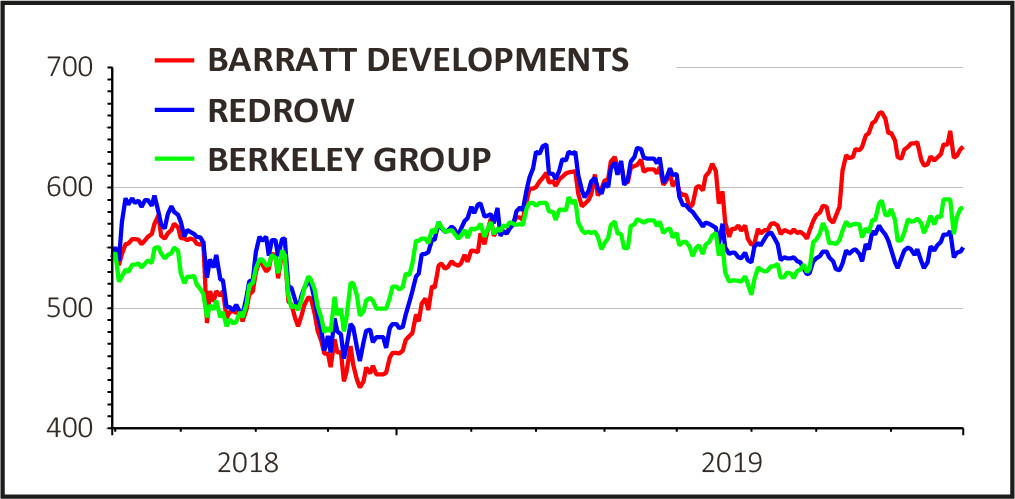

Barratt Developments (BDEV) announces its full year results on Wednesday, with Redrow (RDW) announcing it full year numbers on Thursday and Berkeley Group (BKG) giving a trading update on Friday.

Also on Friday, the UK’s largest mortgage lender Halifax will publish its house price index for August, showing how house prices moved last month.

According to accountant KPMG, houses prices could drop by 6.2% on average if there’s a no-deal Brexit, though it added a shortage in houses overall could prop up prices over time.

AS GOOD AS IT GETS

As far as the housebuilders are concerned, this could be as good as it gets for some of them.

Shore Capital analyst Robin Hardy believes that Barratt’s profits in particular will peak with its results on Wednesday, before being dented by lower margins and weak house prices going forward.

Hardy said that Barratt will feel the impact of rising build costs more than its rivals, and estimates that construction costs are equal to 61.5% of the selling price of its houses, compared to 55-to-58% elsewhere in the sector.

So if costs are rising at 4%, Barratt needs a 2.5% increase in house prices to maintain its current profit margins, but Hardy added that prices today are flat nationally and falling in the southern counties.

COULD THERE BE A SURPRISE?

As for Redrow, the chance for a surprise in the housebuilder’s results could be higher as the company doesn’t give an update between its half year and full year results.

But given the weakening market, its results are expected to be in line with guidance with its move away from focusing on central London more towards outer London pulling down its average selling price.

Berkeley will post a first quarter trading update at the end of this week. Housebuilders’ first quarter updates rarely give much away and tend to be more of a comment on issues in the property market.

Hardy said this is particularly the case for Berkeley. He expects its trading update to contain little in the way of numbers and more in the way of venting about stamp duty, which is currently in the news as Prime Minister Boris Johnson calls for reform of the controversial tax.