- Goldman Sachs makes stock buyback prediction

- Magnificent Seven spent $208 billion on buybacks in year to June

- Apple stock jumped 8% after unveiling record $110 billion programme

A bit controversial, but share buybacks are one of the easiest ways for a company to return value to shareholders without the tax complications that dividends might entail. By buying back stock, earnings are spread over a smaller share base, so in theory, earnings per share should rise, and potentially, the share price follows.

Controversial, because the perceived boost to earnings, and the share price, is difficult to assess. Even so, big buyback plans are often cheered by investors and give the stock a hefty nudge higher.

Take Apple (AAPL:NASDAQ), for example. At the start of May 2024, the iPhone maker unveiled an enormous $110 billion stock buyback plan, the biggest in US history.

The new buyback smashed Apple’s previous $100 billion buyback in 2018 and is more than 20% higher than its $90 billion buyback last year.

So, what happened to Apple’s share price? In two days, the stock jumped from $169.30 to $183.38, or more than 8%. In fact, the Apple rally hasn’t stopped since, the stock surging to a current all-time high $234.82, although how much of that is down to the buyback programme is impossible to determine given the multitude factors that drive share prices in general.

MASSIVE BUYBACKS

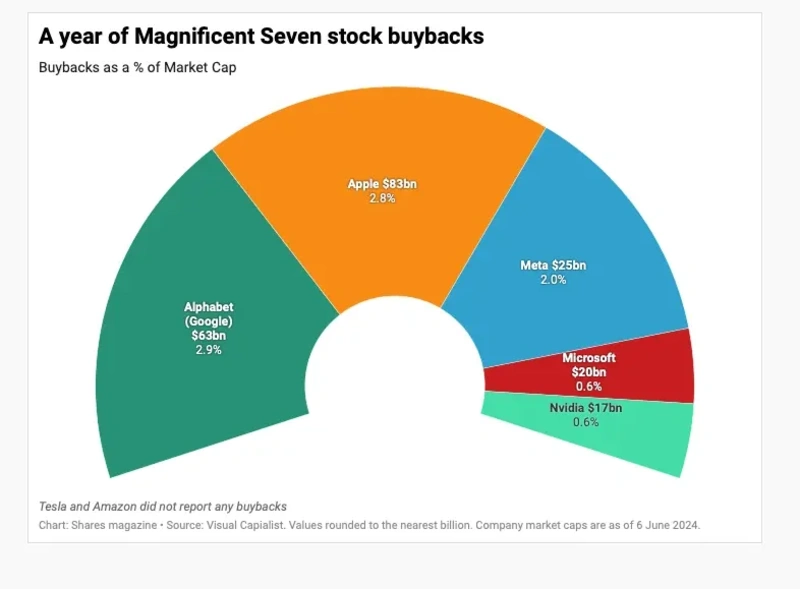

Ultimately, investors can probably expect more large buyback programmes to be announced as the months drift by, not least from the Magnificent Seven – Apple, Alphabet (GOOG:NASDAQ), Amazon (AMZN:NASDAQ), Meta Platforms (META:NASDAQ), Microsoft (MSFT:NASDAQ), Nvidia (NVDA:NASDAQ), Tesla (TSLA:NASDAQ) – most of which have already been busy buying back stock over the past year.

Gathering data from the year to 1 June 2024, you can see just how much these enormous companies have spent buying back their own shares.

By 2025, Goldman Sachs predicts that total US stock buybacks will exceed $1 trillion. The bank sees this growth being driven by strong tech earnings growth and lower interest rates.

That said, both Amazon and Tesla have not bought back stock in the last four quarters. Amazon’s chief financial officer Brian Olsavsky recently emphasised the company’s strategy of reinvesting in the business. He says Amazon is focused on reducing debt and building data centres to take advantage of AI.