- Shares fall to $13 in after hours trading

- The stock had hit $239 after it floated in 2019

- Net revenues fell 30.5% year-on-year to $102.1 million

Shares in Beyond Meat (BYND:NASDAQ) fell over 14% to around $13 in after hours trading in New York as the plant-based meat company saw its sales fall by a third in the second quarter.

The decrease in net revenues to $102.1 million (compared to $147 million in the same year ago period) was driven by a 23.9% decrease in volume of products sold and an 8.6% decrease in net revenue per pound.

The plant-based meat company reported a net loss of $53.5 million in the second quarter ending 1 July 2023 or $1.53 per common share, in the year-ago period.

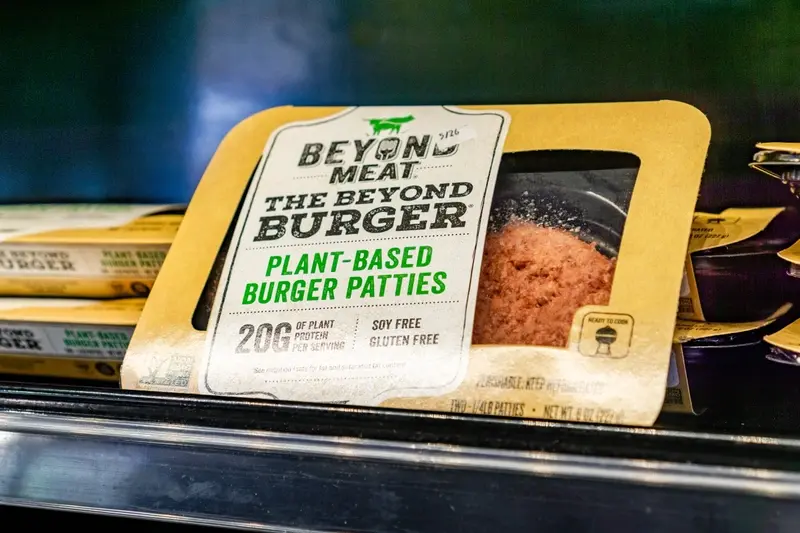

Founded in 2009, Beyond Meat products ‘are designed to have the same taste and texture as animal-based meat while being better for people and the planet,’ according to their website.

Last October, Beyond Meat announced that it was to cut its workforce by a fifth to reduce costs – approximately 200 jobs - as consumers were going elsewhere to find cheaper alternatives.

Feed the world: How to invest in the future of food

EXPERT VIEW

Russ Mould, investment director at AJ Bell said: ‘The problem is its product is too expensive and people don’t really have the budget to look beyond the cheaper meat option right now.

‘Question marks over the health credentials of its product and how processed it is are also a problem given a key driver for the increased adoption of vegan diets in recent years has been people looking to get healthier.

‘Larger diversified food producers are also eating Beyond Meat’s lunch, launching their own plant-based products which, thanks to their scale, they can sell at more attractive price points.

‘In its current state Beyond Meat looks an easier to swallow morsel for one of these competitors who may see continuing value in a brand which, after all, has an attractive supply agreement with fast food giant McDonald’s.’

TYSON FOODS FALLS VICTIM TO SLOWING DEMAND

Another victim of slowing demand from US consumers was Tyson Foods (TSN:NYSE).

Net quarterly sales fell 3% to $13.14 billion in the quarter ending July 1, below analysts’ expectations of $13.59 billion, according to Refinitiv data.

The company blamed falling chicken and pork prices as well as slowing demand for its beef products, and said it was closing four more chicken plants.

Tyson's average sales prices fell 16.4% for pork and 5.5% for chicken, while rising 5.2% for beef.

DISCLAIMER: AJ Bell is the owner of Shares magazine. The author (Sabuhi Gard) and editor (Tom Sieber) of this article also own shares in AJ Bell.