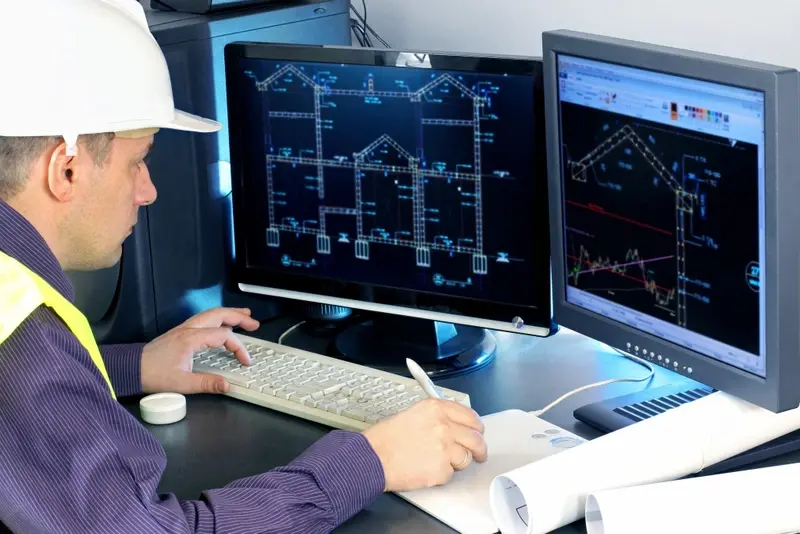

Engineering software firm Aveva (AVV) gave investors a huge lift after emerging from a tough pandemic year optimistic and in resilient form.

Aveva’s full year results to 31 March 2021 were the first following the completion of the roughly $5 billion acquisition of OSIsoft and the proforma results give the clearest picture to-date on the shape of the combined business.

Adjusted earnings before interest, tax, depreciation and amortisation rose 4.4% to £226 million on a 1.6% decline in revenues to £820 million. That implied a decent rebound in in demand considering the double-digit declines in the first half.

SHAPE OF THINGS TO COME

But the pro forma figures, that include OSIsoft are more meaningful going forward. These showed an 8.1% increase in earnings before interest and tax to £355 million on just shy of £1.2 billion revenue.

For context, underlying earnings before interest and tax were flat at £218 million in contrast to OSIsoft’s 23% hike to £137 million. This led to adjusted earnings per share up 11.9% at 105p.

The continued migration toward a recurring revenue model is also encouraging, with pro-forma annualised recurring revenues growing 8.6% year-on-year to £704.8 million, ‘with the contribution improving in each quarter, which should enhance resilience moving forward,’ said Dan Ridsdale, Edison’s head of technology, media and telecoms.

The business ‘looks in good shape to move forward,’ said Edison’s Ridsdale as it continues to ride customers’ shift to digitisation across industry, something that Covid has accelerated.

Aveva saw its shares rally 4.5% to top the FTSE 100 leaderboard, bouncing off recent £31 lows to hit £34.19.