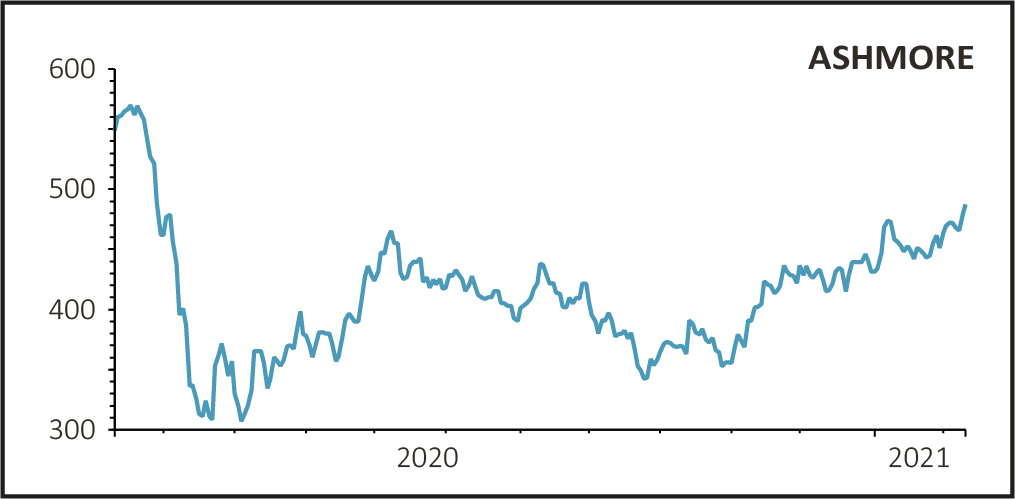

Specialist emerging-market fixed-income focused fund manager Ashmore (ASHM) posted an impressive increase in earnings and asset growth for the first half of the year to December, sending its shares to a nine-month high of 493p in early trading.

Pre-tax profits for the period rose 14% to £150.6 million thanks to strong fee generation related to the performance of its funds and a healthy gain on a seed capital investment.

INSTITUTIONS FUELING GROWTH

Investment gains during the half reached $10.8 billion as a weak US dollar, relative valuations and increasing allocations to emerging markets by institutional investors drove asset prices higher.

As a result, assets under management (AuM) increased 11% to $93 billion, with net outflows reduced to $1.4 billion from $5.8 billion a year earlier as retail investor redemptions were offset by the increase in institutional interest.

While Ashmore is best known for its fixed income investments, its equity business saw a sharp jump in AuM, up 41% to $6.5 billion, thanks to strong returns and continued net inflows.

The firm’s local asset management platforms also enjoyed strong growth in AuM, reaching $6.9 billion in the half, up 39% on the previous year.

EMERGING MARKET APPEAL GROWING

Chief executive Mark Coombs was upbeat about the results and the outlook: ‘Ashmore's performance in this period reflects the early stages of a typical recovery cycle, with strong investment performance driving AuM growth and delivering mark-to-market gains on the firm's seed capital investments.’

With the dollar set to remain weak, ‘investors will seek higher growth and returns than are available in developed markets, and will continue the trend of increasing allocations to the emerging markets, which offer superior growth and attractive valuations’, added Coombs.