After this week's headline-grabbing Apple Pay launch, apparently things have not got off to quite the start the US tech colossus may have hoped for. According to early toe-in-the-water research by marketing intelligence platform supplier Brandwatch, iPhone, iPad and Apple Watch owners are not not overwhelmingly impressed.

Since Shares looked at the mobile payments space just two weeks ago in our 'Apple Pay is here' cover story, I thought it might be useful to flesh out Brandwatch's findings. As we flagged in out feature, while the launch of Apple Pay's near-field communication-based (NFC) wallet has significant implications for Apple device owners, we also believe that there is compelling proof points for others in the payware space, Android especially. As we explained, Apple has a long-standing record for moving the pace of market transition through the gears when it launches a device or iPhone service.

'Just look how the iPhone transformed the smartphone market; how iTunes turned the way many of us buy music and movies on its head; and how the iPad created an entirely new form factor. This is a trick that the company hopes to repeat with the long-awaited Apple Watch. Other device manufacturers and service suppliers simply do not carry the same clout.'

We expect to see a minor deluge of payware media announcements over the coming months, at the very least flagging up that point that Apple Pay is not the only payware game in town, but also the unveiling of further bells and whistles applications to stimulate consumer acceptance. Read Brandwatch's analysis below:

Is Apple Pay Working? Not for These Thousands of People

Sandwiches have just got a whole lot easier to buy. Apple Pay, the contactless payment system in all iPhone 6's and Apple Watches, has just launched in the UK. With 74.5 million iPhones sold last quarter, and millions of Apple Watches sold to date, a lot of people are ready to buy a halloumi and spinach wrap with their phone today.

At least, in theory. By analysing 26,000 online mentions of the Apple Watch UK launch, we’ve assembled an unwilling focus group of 15,789 people. We’ve learned about their spending habits and that, on the whole, it’s not working so well.

Breaks the banks

Is this the first step in Apple’s financial services takeover? Certainly, the ease of use and ubiquity of Apple Pay is making brick-and-mortar banks much less necessary. Why carry around an extra card when you’ve got your phone on you anyway?

'Your verified fingerprint is your ID, or you can take a photo of your license, Cash is transferred digitally. Checks can be deposited with your iPhone,' writes Andrew Finn of Wait But Why. 'Every one of the 500 million iPhones is a bank branch.'

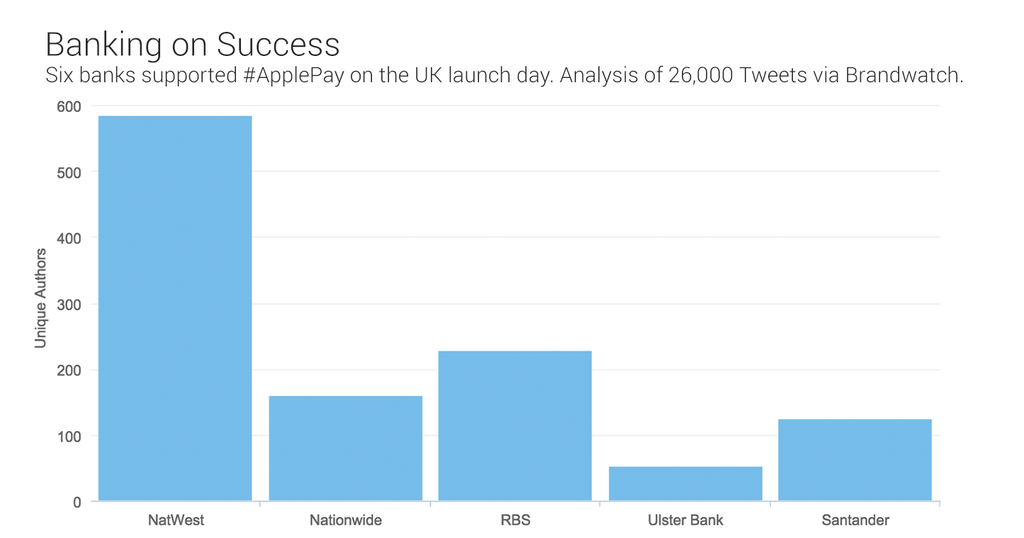

It’s a matter of time until no bank branches exist at all. In the UK, 14 banks have confirmed they’ll be using the service. On Tuesday, the service launched with support for five banks. HSBC was originally slated to be in the first batch, but slipped back due to technical difficulties. It didn’t escape unscathed, with negative mentions outweighing positive ones, five to one.

Banks which launched on Monday, however, have had a much more favourable response. All of them, except Santander, have seen an over 50% positive reaction.

NatWest has been the consumers’ favourite. With 583 NatWest customers tweeting about their use of Apple Pay, it’s had double the uptake of its nearest competitor, RBS. The UK itself has 226 unique authors, Nationwide has 158, Santander has 123, and Ulster Bank of Northern Ireland has 51.

Outlets

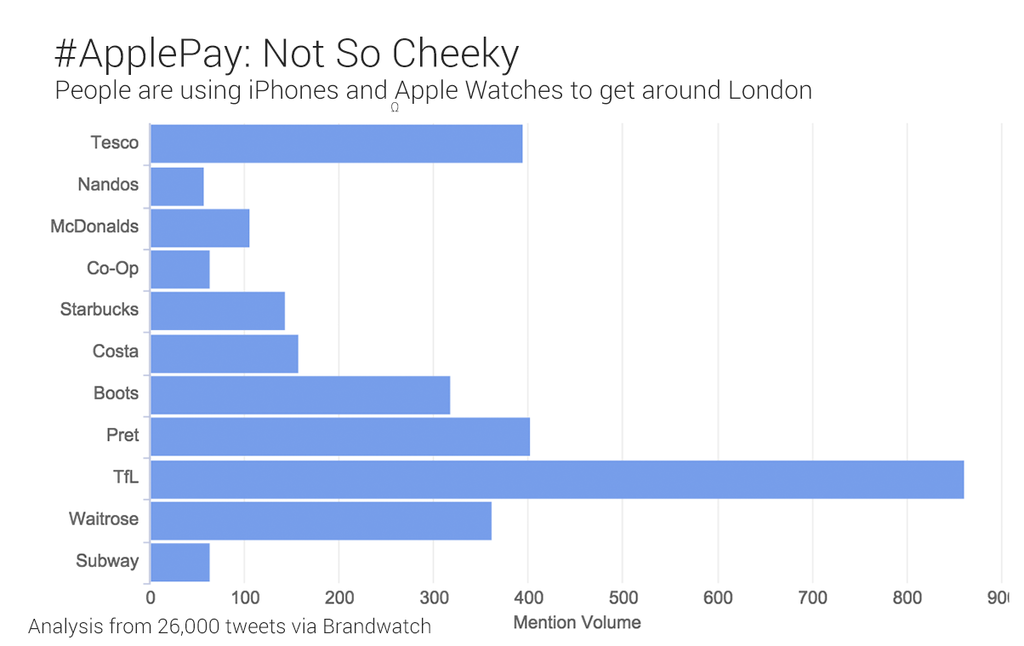

Shops don’t have the same support issue that banks do. If the shop you’re in has a contactless card reader, you can use Apple Pay. The most popular use of Apple Pay in the UK, so far, is on Transport for London’s bus, tube and rail network. People use it for TfL twice as much as Pret.

TfL, Pret, Waitrose, Tesco (TSCO) and Boots are the top five brands with the most Apple Pay evangelists. Nando’s, Co-op, Subway, McDonalds and Starbucks have the least.

'We’re surprised to see Nando’s, a typically strong brand on social media, gain so few Apple Pay mentions,' says Natalie Meehan, Brandwatch’s marketing insights analyst. 'It’s fitting with our research that Nando’s is frequented by only the cheekiest of lads who can’t afford Apple Watches.'

Teething trouble

Already, people are struggling to get Apple pay to work. Rory Kellan-Jones, the BBC’s technology correspondent described the service as having 'wrinkles.' He couldn’t use his iPhone to buy a small latte in the Cafe Nero next to the BBC’s west London HQ. The video has been shared widely on social media.

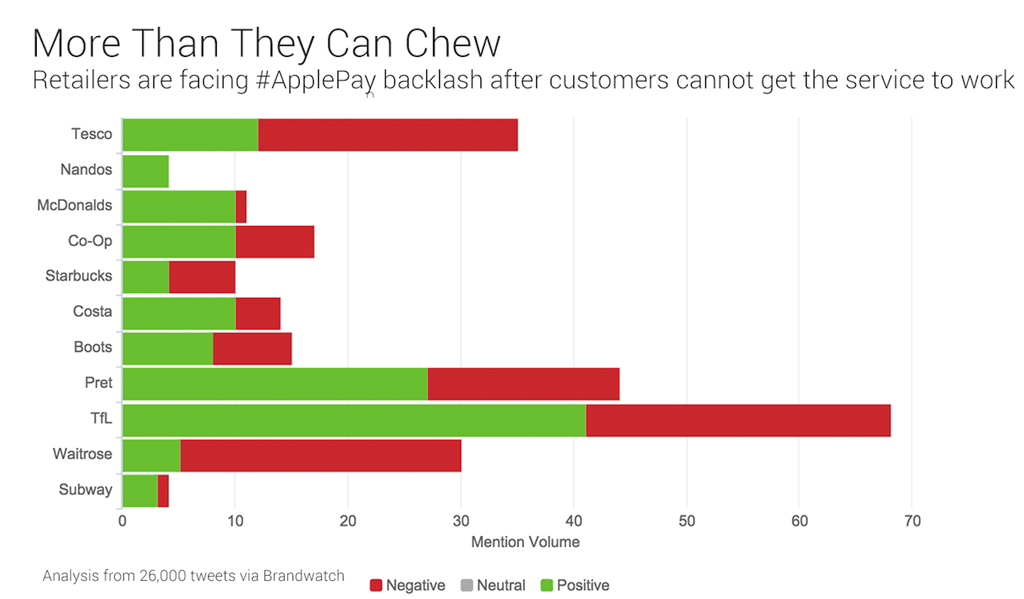

We analyzed over 26,000 tweets for this short study. 10% of all of them about how people can’t get the service to work.

'Technology like this lives or dies on word of mouth,” Meehan said. “Apple Pay is positioned as being the fastest and easiest way to pay. If you think there’s a 50% chance it could fail, you’ll just reach for your credit card instead.'

Retailers are getting caught in the firing line, too. When it comes to them, negative mentions almost outweigh positive ones. Some customers are complaining they have been charged twice, while others complain that their local stores don’t have contactless readers yet.

Launching a service like Apple Pay involves a lot of big name stakeholders. If one link in tarnished, it casts doubt on the whole system. Getting a holistic view of customer opinions is vital. “One million halloumi wraps bought with Apple Watch” is a great headline, but it doesn’t tell the story of cursing into a Yoga Bunny Detox after the second failed payment attempt.

Source: Brandwatch research