US technology giant Apple (AAPL:NDQ) is expected to launch the latest version of its globally popular iPhone at an invitation-only launch event on 9 September. This promises to exert influence that extends far beyond the remit of technology watchers and gadget geeks. While everyone may be focused on Apple's shares, savvy investors should also keep their eyes on a couple of UK-based component manufacturers that are vital to the North American group?s supply chain, being Laird (LRD) and Imagination Technologies (IMG).

Apple?s launch events have lost some of their pizzazz over the past year for investors, certainly on this side of the pond. Yet as the chart shows, shares in the world?s most valuable company have never been more popular, trading at an all-time high of $102.50. Investors can expect a range of shiny new products to get excited about, news that could also stir the shares of the two UK-based component suppliers.

Several rumours have been doing the rounds in the run-up to the launch event, but the biggest news is likely to surround the expected launch of the latest iteration of Apple?s widely popular iPhone and possibly a long-mooted iWatch. The iPhone has sold millions of units worldwide since it was first released in June 2007 and analysts predict that the iPhone 6 will spark another sales bonanza. ?I?m expecting it to be huge with a capital ?H,? says Avi Greengart, a research director at data group Current Analysis.

Bigger and better

Experts are predicting that the new handset will be bigger, stronger and filled with new applications. The smartphone is expected to have a 5.5-inch display rather than the traditional 4.7-inch screen, although a possible second model option at 4.7-inches is also thought likely to be offered.

That bigger display is also anticipated to be made of Sapphire Glass, a synthetic sapphire material made from discs of crystallised aluminium oxide. It?s produced using very high temperatures, cut with diamond-coated saws and polished to make a display significantly tougher than the Gorilla Glass used in many smartphones, potentially making the iPhone?s completely scratch proof, even smash-proof.

The new iPhone is expected to be powered by an updated version of Apple?s iOS operating system. There are rumours that near-field communication will also be a prominent feature, allowing the handset to work as a pre-paid card in much the same way London?s Oyster travel pass. That could provide the push to get ?mobile payments into the mainstream,? believes Panmure Gordon technology analyst George O?Connor, with talks thought to be ongoing between Apple, banks and credit card companies.

According to the website Macworld, Apple could also unveil a new iPhone Air, an iPad 6, an iPad mini 3, a new Apple TV, several new iMac laptops and a long-awaited iWatch that might act as a health and fitness application as well as providing convenient connectivity to other Apple devices.

Yet underneath these glitzy extras Laird and Imagination are still likely to provide fundamental kit, including electromagnetic isolation (EMI) shielding components supplied by Laird, and graphics processing unit (GPU) chipsets, where Imagination is a world leader.

(Click on chart to enlarge)

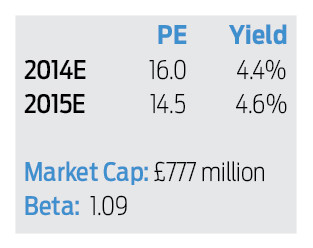

This could be particularly significant for Laird shareholders. Shares in the £780 million cap have a habit of rallying into, and beyond big launch events by Apple. A year ago, ahead of Apple?s iPhone 5 launch 10 September 2013, shares in Laird re-rated substantially, rising by more than 40% to 330p by February 2014. The stock has eased back a bit since but the next run higher looks due, especially given the company?s robust half-year results on 31 July, which were ?slightly ahead of our expectations,? according to analysts at broker Numis.

Those results showed underlying revenue growth of 10% year-on-year to $415 million after stripping out the impact of sterling strength and the modest $7 million acquisition of Model Solutions. That seems decent enough yet looking at the quarter-on-quarter figures there?s an accelerating growth trend, with April to June organic revenues rising 14%, double the 7% equivalent figure in the first quarter of 2014. Tallying with the iPhone 6 launch, EMI shielding revenues increased 12% with Numis flagging ?market share gains? in automotive, smartphone markets and from increasing demand for 4G infrastructure components.

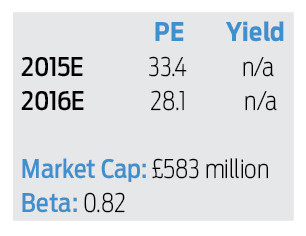

Hertfordshire-based Imagination also re-rated higher a year ago, rising 42% to 352.6p, although its positive run proved short-lived as the company ran into slew of problems. Those included weak licence wins, slowing unit shipments and ongoing sales declines at its PURE digital radio arm. Those issues sparked a messy year of forecast misses and a double-digit miss on first half adjusted pre-tax profit back in December.

Yet overall there is promise in full-year results released 24 June even if it remains early days. Analysts remain cautious about the pace and scale of growth in the immediate future, largely unsurprising considering a hat-trick of hefty forecast downgrades to estimates in the past 18 months.

?We expect material consensus upgrades of 10%-plus,? explained Investec in June, before qualifying that remark with a nod to remaining doubts. ?Our residual concern is guidance for a rise in core royalty unit shipments in the second half of 2015, considering these have fallen for three consecutive halves,? the broker pointed out.

[buy_or_sell b]

Imagination has started to see its share price stage something of a recovery, the stock up a little more than 20% since the start of August. Shares flagged the potential to bounce back early this year (see Shares, Cover Story, 6 Feb). While we were a little early in that regard, the anticipated iPhone 6 launch could provide catalyst for the recent strength to run higher still. We also like the outlook for Laird.

Laird (LRD) 294.1p

Growth: MEDIUM

Wise research and development investment is putting new products in the pipeline. Laird is already a market leader in EMI shielding components, which provides to the far wider electronic devices market, not just Apple.

Risk: MEDIUM

The timing of shipment volumes remain tricky to predict and Laird has little direct control over the cycle. Net debt continues to creep higher as cash is channelled into growth, while dividend cover of just 1.6-times needs rebuilding.

Quality: MEDIUM

Management has failed to get the right balance before and the product mix and timings make earnings anything but predictable. But Laird is exposed to long-term, high-growth markets (4G, mobile devices, automotive connectivity).

[buy_or_sell]

[broker_consensus 4 2 0 0]

Imagination Technologies (IMG) 209.7p

Growth: HIGH

No longer a GPU specialist Imagination has ambitions to offer a genuine alternative to ARM in CPUs, eyeing 25% market share. Dual-sourcing in the semiconductors space means licences are not necessarily a binary win or lose.

Risk: HIGH

Margins could face further stress with significant investment needed to put MIPS (bought in 2013) on the map and defend core GPU revenues from competition. Royalty rates could come under pressure and licence wins could slow.

Quality: MEDIUM

Smartphone, tablet, smart TV markets provide very strong base for growth but competition is getting increasingly fierce. Imagination needs licence growth to drive royalty revenues, profits and the shares.

[buy_or_sell]

[broker_consensus 2 5 5 0]