Yes, today's £388 million takeover offer from the Dutch subsidiary of NYSE-listed Keysight Technologies (KEYS:NYSE) for Anite (AIE) may have been recommended by the board but the fat lady hasn't yet started her serenade yet. There's a handful of peers that could, in theory, throw their hats into the ring for UK software and mobile testing business. That the shares are up 24% at 127.5p, above the 126p offer price, implies modest market optimism that another offer may be tabled.

Privately-owned tech testing firm Tektronix looks the most likely to us, but science kit tester Agilent Technologies (A.NYSE), electronic test and measurement equipment firm Rohde & Schwarz could be interested, as could Cap Gemini (CAPP:PA), the French IT outsourcing group. Who knows, maybe even our own Sprient (SPT) could be a contender, even if its testing business operates in similar but the same direct market.

At 126p per share, this is not necessarily a generous offer. True, it represents a 22% premium to Tuesday's (16 June) 103p close, and values the business at around 10.6-times EV/EBITDA, or enterprise value to earnings before interest, tax, depreciation and amortisation.

'We think that this will go down to the wire as investors look to sniff out a competitive bid,' says Panmure's George O'Connor, and we agree. As Shares explained recently, a re-rating for the share price might have been on the cards anyway, with some analyst price targets pitched as high as 142p, and that was before today's news.

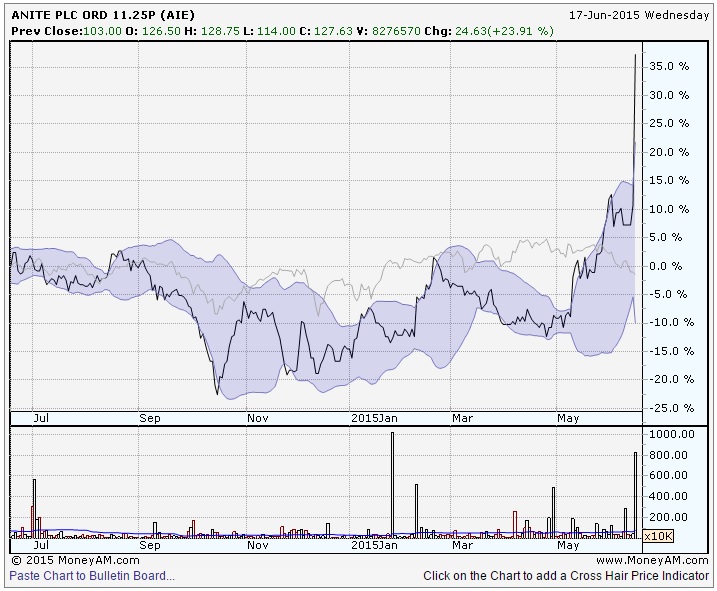

'Anite is a company well positioned in the advancing mobile market, although a lack of short term revenue visibility has led a both positive and negative financial surprises in recent years,' spells out Megabuyte's Lee Prout. The result has been a bumpy old share price performance, from 79p lows to 159p peaks since 2012.

FinnCap's Lorne Daniel, however, feels that this is a 'good deal for Anite shareholders.' The analyst points out that, as a predominantly hardware sale, Anite’s handset business has remained lumpy and it has struggled to find scale in a massive global market competing against German and Japanese rivals. 'The growth of the Chinese mobile industry has brought additional challenges with handset and component manufacturers tending to use shared government testing centres rather than setting up their own,' Daniel explains.

Either way, there is limited risk that a deal will be called of, most agreed takeover tend to go through, so there seems to little reason to jump the gun and sell now.