Foreign exchange and alternative banking solutions company Alpha FX (AFX:AIM) enjoyed a strong 2020 despite Covid-19 headwinds as it reported a 31% jump in full-year revenues to £46.2 million and 20% rise in underlying pre-tax profit to £17.5 million.

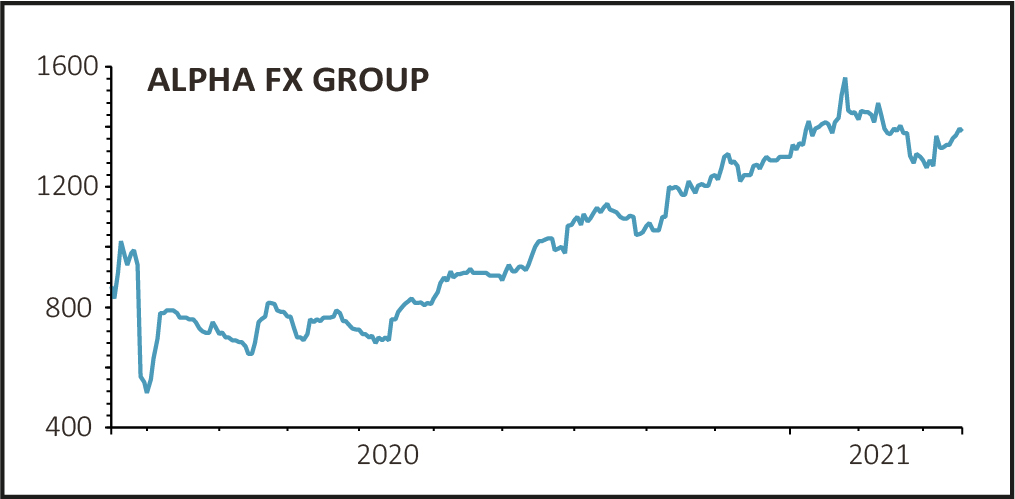

The shares were unchanged at £13.95, having risen 40% over the last six-months, with the results in-line with market expectations.

The group’s core business is supporting corporations and institutions that trade currencies for commercial purposes, from offices in London, Canada and Amsterdam.

Core revenues grew 18% to £40.3 million despite headwinds during the year which caused disruption to the business as sales teams were forced to work from home.

E-WALLET GROWTH

Alternative banking solutions focusses on providing a suite of banking products covering payments, collections and accounts serviced by a specialist team within Alpha Platform Solutions.

Revenues grew 417% to £6 million and now accounts for 13% of group revenues, up from 3.3% in 2019. These revenues have high visibility and cash conversion characteristics as payment is usually in the form of spot trades or fees which convert immediately into cash.

Chief executive and founder Morgan Tillbrook told Shares that providing alternative banking solutions effectively created a ‘captive audience’ for the firm to provide value added services.

STRONG CASH FLOW

In aggregate 52% of revenues were generated from products which convert into cash within a few days of the trade date, compared with 30% in 2019.

This had a positive effect on cash flows with the firm converting 100% of pre-tax profits after capital expenditure into free cash, which reached £52.7 million up 36% year-on-year.

The company is debt-free and well capitalised with net assets of £90 million.

Following the strong results, the board recommended a final dividend of 8 pence per share, payable on 14 May to shareholders on the register at 16 April.

The company said it had ‘barely scratched the surface’ of the total addressable market for foreign exchange risk management and was on track to deliver another year of strong growth.

Liberum analyst Janardan Menon said, ‘We estimate that the company has sufficient free cash collateral to more than double the business to over £100m of revenue.’