Survival of the fittest has long been the mantra of the notoriously cut-throat airline industry.

In the past, any number of small issues from overcapacity to the vagaries of the oil price have been enough for some airlines to go under.

Now, across the world the industry is facing an unprecedented crisis, with draconian travel bans by several countries making passenger numbers, as Scandinavian Airlines put it, ‘virtually non-existent’.

With cancellations and refunds galore, and barely anybody making new bookings, airlines are having to ground planes like never before.

'WAVE GOODBYE TO DIVIDENDS'

To survive, airlines will need access to significant levels of funding, be it lines of credit or chunky cash piles, according to AJ Bell investment director Russ Mould.

He warned, ‘Shareholders can wave goodbye to any dividends and airlines certainly won’t be buying back shares in the current environment, even though their stock may look very cheap compared to recent history.’

As British Airways chief executive Alex Cruz told employees on Friday, in the current climate ‘airlines with a weak balance sheet, or carrying large debts, are facing a dire future.’

BILLION DOLLAR ROUTE CLOSED

International Consolidated Airlines (IAG), the owner of British Airways, has been particularly affected in recent days, reducing capacity by at least 75% as it comes into the crosshairs of travel bans affecting some of its most profitable routes.

For example, a travel ban between the US and UK will directly affect British Airways’ transatlantic flights between London and New York.

That flight is known as the ‘billion dollar route’ for British Airways, as the demand and margin it makes on business class seats in particular on that route means it has in the past generated up to $1.15bn in annual revenue for the airline.

So it’s little surprise IAG shares have crashed today, tumbling 23% to 270p in mid-morning trading.

JET2 BIGGEST FALLER AS SPANISH LOCKDOWN BITES

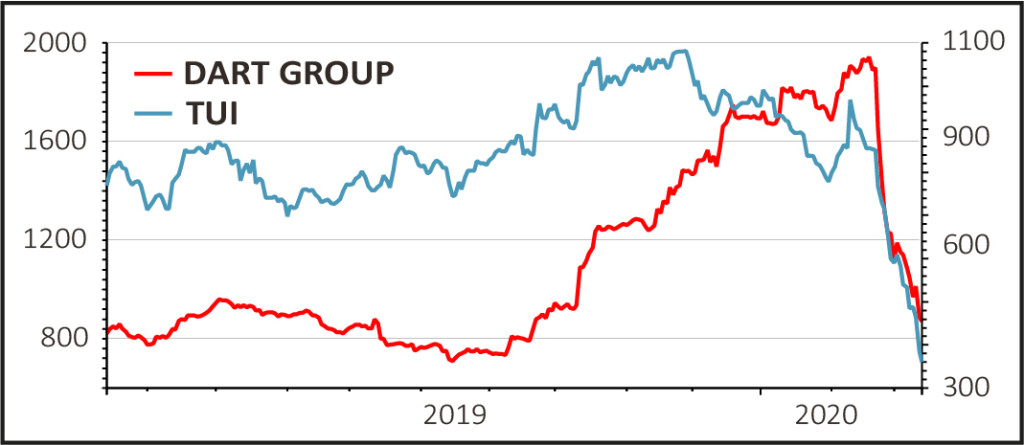

Another huge faller has been Dart Group (DTG:AIM), owner of the Jet2 airline and package holiday operator, whose shares have dived over 35% to 562p.

Spain accounts for about half of Jet2’s seat total, and its rush to snap up capacity following the collapse of Thomas Cook - though it made sense at the time - couldn’t have come at a worse point.

With the country having gone into lockdown, Jet2 has had to suspend all holiday and flight bookings to Spain.

Unsurprisingly, among airline stocks Dart Group has been the biggest faller in the year-to-date with its shares tumbling 69%.

Dart’s big rival TUI (TUI) has been equally affected, its shares plummeting 30% to 252p having suspended the ‘vast majority’ of its global operations over the weekend.

Kicked out of the FTSE 100 recently as it continues to struggle, the Anglo-German tour operator has applied for state aid as it looks for support until normal operations are resumed.

A big concern regarding TUI is its net debt, which stood at €5bn on 31 December 2019.

HUBRIS HAUNTS WIZZ AIR

For the budget carriers, some of their share price falls are slightly less steep, but Wizz Air (WIZZ) may be regretting its hubris at the weekend - boasting of a strong balance sheet with €1.3bn in free cash - following a travel ban imposed by the Polish government.

Poland accounts for 20% of Wizz Air’s capacity, but following the ban the airline has been forced to suspend all flights to and from the country until further notice.

Wizz Air shares have tumbled 20.8% this morning to £21.66.

BUDGET AIRLINES IN A BETTER PLACE

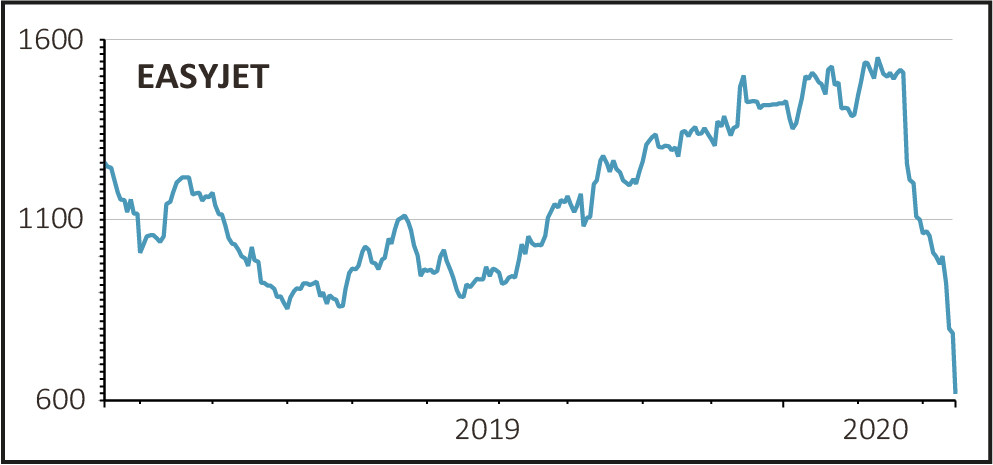

Low-cost carriers were also hit by the travel bans, with EasyJet (EZJ) down 21.8% to 615p and rival Ryanair (RYA) down 17.5% to €8.66.

EasyJet confirmed ‘further significant cancellations’ as governments impose more travel restrictions, and also blamed ‘significantly reduced levels of customer demand’.

Despite the difficulties they face, investors are less concerned about the financial health of the budget airlines than they are some other carriers.

Analysts at Citi have calculated that a three-month shutdown would leave Ryanair’s net debt to earnings at a multiple of 1.2 and EasyJet’s at 1.9. Generally a ratio above four or five is considered high.

MUCH WIDER IMPACT

The travel bans and widespread grounding of plans doesn’t just affect the airlines, according to Mould.

‘The knock-on effect is that staff will be forced to take leave and airport service companies such as John Menzies (MNZS) which helps to clean and load EasyJet planes when they land will not be able to do their job,' he noted.

‘Travelers won’t be spending money in the airport, thus hurting the likes of WH Smith (SMWH), SSP (SSPG) and Restaurant Group (RTN), all of whom run concessions in departures lounges.

‘Hotel chains like Whitbread (WTB)’s Premier Inn will be suffering from reduced business and the suppliers to these outlets will also be feeling the pain. The trickle-down effect will stretch even further’ he cautioned.