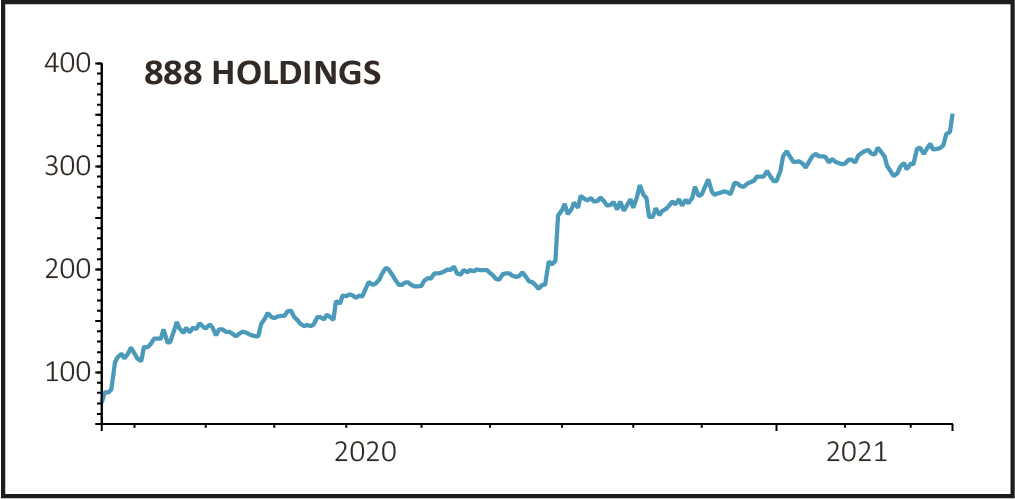

Shares in 888 Holdings (888) jumped 6% to 353.2p on Thursday, reaching a new all-time high after the online gambling company reported full-year revenues and profits ahead of market expectations.

Unsurprisingly during lockdown, the company experienced strong growth in casino, up 63%to $586.8 million and poker up 48% to $63.1 million, driving a 53.5% increase in group revenues to $849.7 million, around 2% above consensus.

In casino, 888’s in-house game developer Section8 released more than 44 new games during 2020 and 888casino won the Gaming Intelligence Awards.

In terms of geography, the US, Italy and the UK reported the strongest revenue growth, up 81%, 69% and 63% respectively, with the company winning back market share in the UK.

After the period end, 888 announced a multi-year extension to its exclusive B2B partnership with Caesars Interactive Entertainment which powers the US’s only interstate shared player liquidity poker network.

STRONG CASH CONVERSION

Adjusted earnings before interest, taxes, depreciation, and amortisation increased 69% to $155.6 million, around 2% higher than analyst expectations.

Strong revenue growth converted into a 122% increase in cash generated from operations to $179.2 million leaving the group with cash and equivalents of $190 million.

The final dividend was increased to 12 cents per share compared with 3 cents per share last year, bringing the total dividend to 18 cents per share.

Chief executive Itai Pazner said: ‘We are pleased with our continued progress in the US, and with three new states set to launch in 2021, we are poised to see the scale benefits of our investments here. We enter 2021 with strong momentum, with a record level of customers.’

Gambling consultancy Regulus Partners commented: ‘888’s renewed operational focus and technology investment is clearly paying dividends, with a broad base of momentum that had eluded the group for a number of years.’