We live in an age of data, there's tons of it. According to some experts, 90% of the ocean of digital stats, facts, figures and information (structured and unstructured) that people find themselves swimming in today has been created in the past two years. That's just how potent we have become at producing mountains of megabytes, gigabytes, terrabytes, petabytes etc.

Organising and analysing this digital deluge is tough, often the most meaningful tune is drowned out in the background din. Reacting to this problem, many investment professionals home in on what they believe to be the real key to the data castle, the handfuls of information that best spell out a story and paint the clearest picture.

The US economy is still the world's biggest by a substantial margin, even if China is shrinking the advantage by the year, and when the US sneezes, we still all get a cold. So analysts at investment bank UBS concentrate their research on three core data points in order to get a decent hint at where the US economy is going, and why.

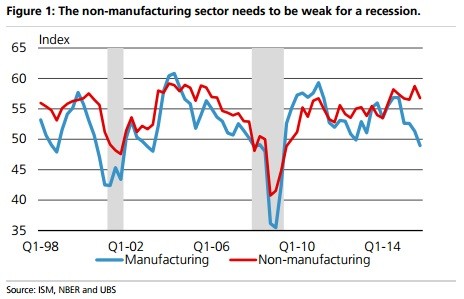

'Rather than try to make sense of every odd data point, it may be helpful to focus on more timely, less managed data sets that could provide an early warning of economic trouble in the United States,' argues Drew T Matus, one of the bank's Global Macro Team economists. Like a monopoly expert, Matus avoids 'Go' and goes directly to Institute for Management Supply (ISM) surveys.

'ISM surveys have long histories and are reasonably simple to answer. Orders, for example, were up, down or flat versus the previous month,' the UBS man says. 'Current ISM surveys shows a minor reduction in manufacturing activity over the past few months which has been somewhat offset by continued relative strength in non-manufacturing activity.'

Significant sustained weakness in both of these surveys would be a sign that forecasters are too upbeat and need to reign in their optimism.

Then there's unemployment insurance. It's a relatively simple exercise, adding up recorded filings for unemployment insurance. It stands to reason that, if the economy was weak and firms were worried about the outlook, that someone, somewhere, would be getting laid off.

'We likely wouldn't be near all-time lows in the number of unemployment insurance filings, after you adjust them for the size of the eligible population,' explains the UBS macro team. 'Until the economy sees firms firing enough workers to push this ratio off these lows, it is difficult to spend too much time worrying about the overall health of the US economy.'

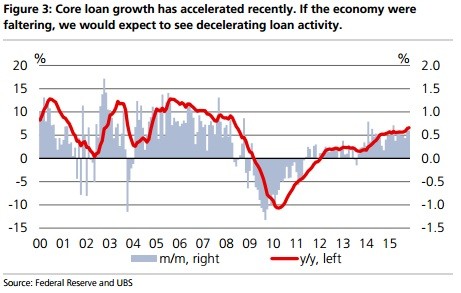

Lastly, Matus likes to keep a clolse eye on bank lending, it's continued growth or lack thereof. 'Banks likely know what their loan portfolio looks like at any moment in time. Core loan growth has posted four months of acceleration in its year-over-year rate of growth and that growth rate is now almost 7%,' Matus says.

Interestingly, according to the economic expert, core loan growth is seeing contributions from all three components: commercial and industrial (C&I), mortgage and consumer loans. 'Although loan growth can be fickle, if the economy was doing badly, we would expect to see loan growth falling, or at least slowing, not accelerating.'