13 March 2025

Care REIT plc

("Care REIT" or "CRT" or the "Company" or, together with its subsidiaries, the "Group")

ANNUAL RESULTS FOR THE 12 MONTHS ENDED 31 DECEMBER 2024

Further improvement in rent cover and operational performance, supporting increased rent receipts and fully covered dividend payments

The Board of Directors of Care REIT plc (ticker: CRT), the real estate investment trust which gives investors exposure to a diversified portfolio of UK healthcare real estate assets, in particular care homes, presents the Company's annual results for the 12 months ended 31 December 2024.

Summary

On average, our tenants continue to improve in performance, growing fees above both labour cost and general inflation, with careful cost control and modestly increasing bed occupancy. As a result, our rent cover has increased to 2.2x1, the highest since our IPO in 2017, further enhancing the security of our rental income.

Our total rental income rose, mainly due to the 3.6% increase from annual rent reviews. This has in turn driven a 1.9% increase in adjusted EPS (EPRA EPS up 2.4%). EPRA net tangible assets per share increased by 3.7% and the total accounting return was 9.4%.

Net LTV was up marginally to 28.4% and the Company has £52 million of uncommitted debt facilities. Dividend for the year was up 2.7%, in line with our target, and 107% covered by adjusted EPS.

The Board announced on 11 March 2025 that it is recommending a cash offer at 108 pence per share for the entire issued share capital of the company ("the Offer") by CareTrust REIT, Inc. ("CareTrust"). More information on this is available in that announcement.

|

| Year ended 31 December 2024 | Year ended 31 December 2023 | Change |

| Dividends declared per share | 6.95p | 6.77p | +2.7% |

| Profit before tax | £45.0m | £48.8m | -7.9% |

| Earnings per share ("EPS") | 10.85p | 11.79p | -8.0% |

| EPRA EPS | 8.89p | 8.67p | +2.4% |

| Adjusted earnings per share2 | 7.42p | 7.28p | +1.9% |

| Adjusted earnings dividend cover | 107% | 108% | |

| Contracted annual rent roll3 | £51.4m | £48.8m | +5.3% |

| Property Investments | £679.0m | £651.3m | +4.3% |

| EPRA Net tangible assets ("EPRA NTA") per share | 119.21p | 114.96p | +3.7% |

| Net loan to value (EPRA LTV) | 28.4% | 27.8% | +57bps |

| Total accounting return | 9.4% | 10.8% | -1.4%pts |

| Cash | £10.5m | £9.4m | |

Simon Laffin, Chair, commented:

"This year has been yet another year of progress for Care REIT, with our tenants continuing to strengthen their businesses, which in turn makes our business even more secure. We own quality care homes with good operators and play an ever more important role in the health infrastructure of the UK. The country needs more care homes to cope with an ageing population and to relieve stress on the NHS that struggles to discharge elderly patients with continuing care needs.

The Board believes that our model of inflation-based rent reviews, with high rental cover, in a market where supply is very constrained and demand rising, continues to offer the basis for profitable growth. We believe that we could profitably invest more capital, both to acquire more care homes and to invest in enhancing our existing portfolio, but we remain constrained by high interest rates and the high discounts to net asset value that affect the UK REIT sector generally. This means that we cannot raise more capital to grow the business and achieve our potential."

Financial highlights

· 2.7% increase in dividend target per share 6.95p (2023: 6.77p). This was 107% covered by adjusted EPS and 128% by EPRA EPS.

· 3.6% increase in target dividend for the year to 31 December 2025 to 7.20p per share4.

· Rent reviews in the year added 3.4% to contracted rent, increasing the contracted rent roll by £1.7 million.

· 3.7% increase in EPRA NTA to £493.97 million (119.21 pence per share) and 4.3% increase in property investments, which were independently valued property by property at £679.0 million.

· 9.4% total accounting return, ahead of long-term 9.0% target4.

· Strong balance sheet with year-end EPRA (net) LTV of 28.4% (31 December 2023: 27.8%), and £250.0 million committed bank facilities of which £197.8 million was drawn. The weighted average term of debt facilities (excluding options to extend) was 5.5 years5, with 88% of our drawn debt facilities fixed or hedged against interest rate rises for the remainder of this financial year.

· The average cost of drawn debt was 4.7%. At 31 December 2024, the Group had £52.2 million of undrawn debt facilities and £10.5 million cash, against commitments of £15.7 million.

Operational highlights

· 2.2 times average annual rent cover1, (2023: 2.0 times) which was strong through the year, reflecting our tenants' success in growing their fees, cost control and further increases in occupancy.

· 100% collection of the rent due in the period with no voids. Seven of the Group's properties are on variable-rent leases after being re-tenanted in 2024 from Melrose.

· 89.1%6 underlying resident occupancy at the end of December 2024 (2023: 88.2%).

· In 2024, we significantly ramped up our asset management programme, approving £12.7 million on projects at existing homes. During the year, we invested £14.0 million, up from £4.7 million in 2023. These projects will add a net 47 beds, create new indoor and outdoor spaces for residents, and reduce energy use. At the year end, we had a pipeline of 10 further projects, with anticipated investment of £16.8 million over the next two to three years.

· During the year, we exchanged contracts to purchase an 83-bed care home near Darlington, for £3.8 million, and agreed to invest in the development of a new 72-bed home in Bedale, North Yorkshire, for a capped price of £8.7 million.

· We also continued to optimise our portfolio, to improve its overall quality and generate funds for reinvestment. In 2024, we agreed sales of five non-core assets for a total of £8.8 million, in line with their latest valuation. Two of these disposals had completed by the year end. The sales also reduced our exposure to Minster, our largest tenant.

|

| At 31 December 2024 | At 31 December 2023 | Change |

| Topped-up net initial yield | 6.96% | 6.92% | 4 bps |

| Rents containing inflation-linked uplifts | 100% | 100% | - |

| WAULT to first tenant break | 20.2 years | 20.8 years | -0.6 years |

| Portfolio let | 100% | 100% | - |

| Average annual rent cover1 | 2.2 | 2.0 | +9.4% |

| Rent Collection7 | 100% | 99% | +1.0% |

| Properties | 137 | 140 | -2.1% |

| Beds | 7,655 | 7,721 | -0.9% |

| Tenants8 | 15 | 14 | +1 |

| Assets rated EPC B or better9 | 60% | 57% | +3bps |

Developing plans to improve the social impact and environmental sustainability of our portfolio

· We continued to focus on improvements to the environmental sustainability of our portfolio with a target to achieve net zero status by 2045. We've further improved the energy efficiency of homes through asset management projects and improved energy performance certificate (EPC) ratings through energy efficiency projects. 60% of our homes have an EPC rating of B or above based on English equivalent ratings, making us well positioned to achieve 100% by the year 2030.

· The CO2 emissions from our tenant energy consumption reduced by 3%, but our 2025 target of a 15% reduction from our 2022 baseline is now looking unlikely to be met. We continued to review the best long-term strategy for investing further to improve energy efficiency, balancing environmental and commercial considerations for ourselves and our tenants. We are improving our access to underlying tenant energy performance data through regular direct data capture, enabling us to more accurately identify homes where sustainability improvements are most needed.

ANNUAL RESULTS PRESENTATION

A Company presentation for analysts and investors will take place today at 10.00am (UK) via a live webcast and conference call and Q&A.

To access the live webcast, please register in advance at:

https://brrmedia.news/CRT_FY24

The conference call dial-in is available using the below details:

| Phone numbers: | 020 3514 3188 (UK) 1-412-902-6510 (international) |

| Participant access code: | Care REIT - FY24 Results |

If you would like to ask your questions verbally, please dial into the conference call. Alternatively, you can type questions into the webcast viewer.

The replay of the presentation will also be accessible on demand later in the day on the Company's website: www.carereit.co.uk.

ANNUAL REPORT

A copy of the Annual Report is also available on the Company's website at https://www.carereit.co.uk/investors/reporting-centre/. The Annual Report has also been submitted to the National Storage Mechanism and will shortly be available at https://data.fca.org.uk/#/nsm/nationalstoragemechanism.

2025 NOTICE OF ANNUAL GENERAL MEETING

The 2025 Notice of Annual General Meeting is now available to view on the Company's website at https://www.carereit.co.uk/investors/reporting-centre/. The Company's Annual General Meeting will be held at 9:30 a.m. on Thursday, 22 May 2025, at the offices of Travers Smith LLP, 10 Snow Hill, London EC1A 2AL.

The formal Notice of the Annual General Meeting will be posted to those shareholders who have requested that the Company should continue with postal correspondence and in accordance with Listing Rule 9.6.1 has been submitted to the Financial Conduct Authority and will shortly be available for inspection from the National Storage Mechanism at https://data.fca.org.uk/#/nsm/nationalstoragemechanism.

The Board encourages Shareholders to vote on any of the matters of business at the AGM in advance by proxy.

FOR FURTHER INFORMATION, PLEASE CONTACT:

| Impact Health Partners LLP | | Via H/Advisors Maitland |

| Andrew Cowley | | |

| Mahesh Patel | | |

| David Yaldron | | |

| | | |

| | | |

| Jefferies International Limited | | 020 7029 8000 |

| Tom Yeadon | tyeadon@jefferies.com | |

| Ollie Nott | onott@jefferies.com | |

| | | |

| | | |

| Winterflood Securities Limited | | 020 3100 0000 |

| Neil Langford | neil.langford@winterflood.com | |

| Joe Winkley | joe.winkley@winterflood.com | |

| | | |

| | | |

| H/Advisors Maitland (Communications advisor) | carereit-maitland@h-advisors.global | |

| James Benjamin | | 07747 113 930 |

| Billy Moran | | 020 7379 5151 |

The Company's LEI is 213800AX3FHPMJL4IJ53.

Further information on Care REIT plc is available at www.carereit.co.uk.

NOTES:

Care REIT plc (formerly Impact Healthcare REIT plc) acquires, renovates, extends and redevelops high quality healthcare real estate assets in the UK and lets these assets on long-term full repairing and insuring leases to high-quality established healthcare operators which offer good quality care, under leases which provide the Company with attractive levels of rent cover.

The Company aims to provide shareholders with an attractive sustainable return, principally in the form of quarterly income distributions and with the potential for capital and income growth, through exposure to a diversified and resilient portfolio of UK healthcare real estate assets, in particular care homes for the elderly.

The Company's dividend policy is to seek to maintain a progressive dividend that is covered by adjusted earnings.

On this basis, the target total dividend for the year ending 31 December 2025 is 7.20 pence per share4, a 0.25 pence or 3.6% increase over the 6.95 pence in dividends paid or declared per ordinary share for the year ended 31 December 2024.

The Group's Ordinary Shares were admitted to trading on the main market of the London Stock Exchange, premium segment, on 8 February 2019. The Company is a constituent of the FTSE EPRA/NAREIT index.

Profit Forecast

The Offer referred to in the section titled "Summary" above is governed by the City Code on Takeovers and Mergers (the "Takeover Code"). In accordance with the rules of the Takeover Code, the Company is required to publish certain confirmations in connection with the information set out in this announcement. These confirmations are set out below.

The following statements in this announcement (the "CRT plc Statements") constitute ordinary course profit forecasts for the purposes of Rule 28.1(a) and Note 2(b) on Rule 28.1 of the Takeover Code:

· "The rental growth built into our leases and the return to rental payments from the former Silverline homes will also support further progression in our earnings and dividend." (Page 4 of the 2024 annual report).

· "Our model delivers predictable and rising revenue, so we can pay a progressive, fully covered dividend." (Page 3 of the 2024 annual report).

· "We aim to deliver a dividend that's fully covered by adjusted earnings. The total dividend for 2024 was 128% covered by EPRA EPS and 107% covered by adjusted EPS. Our dividend target for 2025 is 7.20 pence per share, an increase of 3.6% on 2024." (Page 39 of the 2024 annual report).

Directors' confirmation

With the consent of CareTrust REIT, inc., the Panel on Takeovers and Mergers has granted a dispensation from the Takeover Code requirement for CRT's reporting accountants and financial advisers to prepare reports in respect of the CRT plc Statements.

The CRT Directors confirm that, as at the date of this announcement, the CRT plc Statements remain valid and confirm that they have been properly compiled on the basis of assumptions stated below and that the basis of accounting used is consistent with CRT's accounting policies.

The CRT plc Statements exclude any transaction costs applicable to the Offer or any other associated accounting impacts as a direct result of the Offer.

Assumptions

The CRT plc Statements were prepared on the basis of the following assumptions, any of which could turn out to be incorrect and therefore affect the validity of the CRT plc Statements:

Factors outside the influence or control of the Company's Directors:

· No material change in the political, economic and/or market environment that would materially affect CRT.

· There will be no material changes in market conditions over the period to 31 December 2025 in relation to either tenant demand or competitive environment.

· No significant or one-off events or litigation that would have a material impact on the operating results or financial position of CRT.

· There will be no material adverse change to CRT's tenant relationships.

· No adverse changes to inflation, interest of tax rates compared with CRT's budgeted estimates.

· No material adverse events which will have a significant impact on the operating results or financial position of CRT.

· No material adverse outcome from any ongoing of future disputes with any tenants, competitor, regulator or tax authority.

· No material change in legislation, taxation, regulatory requirements, applicable standards or the position of any regulatory bodies impacting CRT's operations or accounting policies.

Factors within the influence and control of the Company's Directors:

· No additional significant acquisitions, disposals, developments, partnership or joint venture agreements being entered into by CRT which could have a materially dilutive effect on CRT's earnings.

· No material change in the dividend or capital policies.

· No material changes to the Investment Management team of CRT.

· No material changes to CRT's strategy.

· CRT's accounting policies will be consistently applied in the period ending 31 December 2025

Notes

1 Average annual rent cover is a defined term in the Glossary of the 2024 annual report.

2 Adjusted earnings per share reflects underlying cash earnings per share in the period. The adjustments made to EPS in arriving at EPRA and Adjusted EPS are set out in note 11 to the Financial Statements.

3 Contracted rent is a defined term in the Glossary of the 2024 annual report.

4 This is a target only and not a profit forecast. There can be no assurance that the target will be met and it should not be taken as an indicator of the Company's expected or actual results.

5 This assumes the extension of the NatWest facility has not been exercised, including this the weighted average term of debt facilities would be 5.7 years.

6 Excludes closed or under-development homes. Upon opening, these are excluded for up to three years while in build-up. Currently one home is excluded.

7 We've collected 100% of the rent due in respect of 2024. Seven of the Group's properties are on variable-rent leases after being re-tenanted in 2024 from Melrose.

8 Including Croftwood and Minster, which are both part of the Minster Care Group, and Melrose Holdings Limited which is an affiliate.

9 Based on published EPC data for English equivalent rating from Scottish EPCs. The English equivalent for one Scottish property has been estimated based on comparable properties. The EPCs are those currently registered for each property and may be based off historic regulation and are therefore subject to change upon re-inspection.

* EPRA EPS and all other EPRA alternative performance measures have been calculated in line with EPRA best practices recommendation.

Investing in UK care homes for everyone

2024 Annual report and financial statements

About us

Investing in care homes for everyone

Care REIT plc is the new name for Impact Healthcare REIT plc. While our name is different, our business, strategy and the needs we meet are the same.

The UK, like most Western countries, is experiencing a profound demographic change. As our population ages, an unprecedented number of people will require care in later life. While some of this care can be provided at home, demand for care beds will also rise and people entering a care home are likely to have increasingly complex needs, with either advanced frailty or some form of dementia.

However, large numbers of elderly people already have trouble accessing social care, with many thousands stuck in hospital beds because they have nowhere else to go. This leads to worse outcomes for them, more cost for the NHS and fewer hospital beds for the patients who need them. A thriving care home sector is therefore vital to the health and wellbeing of the UK.

The opportunity for us is to help meet the growing pent-up demand for well-run and affordable care homes.

As a specialist and responsible owner of care homes, we're deeply immersed in the social infrastructure of the UK. We're proud to own care homes that cater for everyone, with around 70% of our tenants' residents funded by local authorities or the NHS.

We take a long-term view and look to generate secure and growing income, so we can offer attractive and progressive dividends to our shareholders and the potential for capital growth.

Find us online:

www.carereit.co.uk

Key statistics

| | Year ended 31 December 2024 | Year ended 31 December 2023 | Change |

| Properties | 137 | 140 | (2.1)% |

| Beds | 7,655 | 7,721 | (0.9)% |

| Tenants1 | 15 | 14 | +1 |

| Portfolio valuation | £679.0m | £651.3m | +4.3% |

| Contracted rent roll2 | £51.4m | £48.8m | +5.3% |

| Weighted average unexpired lease term (WAULT) | 20.2 years | 20.8 years | (2.9)% |

| Inflation-linked leases | 100% | 100% | |

| Dividend per share for 2024 | 6.95p | 6.77p | +2.7% |

| Assets rated EPC B or better3 | 60% | 57% | +3% |

| Average home ratings on carehome.co.uk | 9.3 | 9.0 | |

1. Includes Minster and Croftwood, which are subsidiaries of Minster Care Group.

2. Contracted rent roll is defined in the glossary.

3. For assets outside England, this is based on an English-equivalent rating.

Our purpose, strategy and values

Our purpose is to work with tenants to provide quality, affordable and sustainable care homes, in order to deliver an attractive risk‑adjusted return.

This purpose determines our strategic priorities, which are to:

| Work with our tenants to form long-term, mutually beneficial partnerships, so we can grow together | Focus on quality by investing in our buildings and supporting our tenants to provide quality care to their residents | Focus on affordability by setting rents at levels our tenants can afford now and in the long term, enabling them to charge fees that are more affordable to residents

|

| Increase our sustainability by continuing to improve our portfolio's social and environmental performance | Optimise our business to provide more care home beds that are fit for our purpose | We've used these priorities to structure this report, to show how we're putting our purpose into practice.

|

Our values

Care homes are vital to both the people who live and work in them and society as a whole. We have a responsibility to make decisions that take account of all our stakeholders' needs, particularly the impact on our tenants' residents. Throughout this report, you'll see examples of our values in action, from the way we work with our tenants to support their provision of care, to our investment in our homes to keep them fit for the future.

Our core values are to:

· focus on the long-term sustainability of our business;

· act openly and transparently with our stakeholders;

· be a dependable partner who's trusted to deliver; and

· combine the strengths of a listed company with entrepreneurship.

Our Investment Manager

Impact Health Partners LLP, our Investment Manager (IM), plays a vital role in our success. Its senior team has decades of experience of owning and operating healthcare real estate, and their knowledge, skills and relationships give us an important advantage in our market.

2024 in brief

The Group grew adjusted earnings and its net assets in 2024

The Group performed well in 2024, as shown below:

| | Year ended 31 December 2024 | Year ended 31 December 2023 | Year ended 31 December 2022 | Year ended 31 December 2021 | Year ended 31 December 2020 |

| Profit before tax | £45.0m (7.95)% | £48.8m | £16.9m | £32.0m | £28.8m |

| Adjusted EPS1 | 7.42p +1.9% | 7.28p | 7.11p | 6.68p | 5.93p |

| EPRA EPS1,3 | 8.89p +2.4% | 8.67p | 8.40p | 8.05p | 7.25p |

| Property investments1 | £679.0m +4.3% | £651.3m | £568.8m | £496.9m | £418.8m |

| EPRA NTA1 per share | 119.21p +3.7% | 114.96p | 110.08p | 112.41p | 109.58p |

| EPRA (net) LTV1 | 28.42% +0.57% pts | 27.85% | 24.10% | 23.17% | 17.06% |

Our new name

In October 2024, we announced that we had changed the Company's name from Impact Healthcare REIT plc to Care REIT plc.

This complies with the Financial Conduct Authority's updated Sustainability Disclosure Rules, which limits the use of the word "impact".

Our new name better reflects that we're a real estate business that invests in care homes. Our investment policy, strategy and objectives remain the same and we are firmly focused on the significant opportunity we see in the care home sector over the coming years.

Putting our purpose into practice: delivering attractive risk-adjusted returns

The value of our property investments increased by 5.0% on a like-for-like basis, mainly due to inflation-linked rental growth, contributing to 3.7% growth in EPRA NTA per share1.

This performance enabled us to achieve our return objectives, which are:

| Objective | Performance in 2024 |

| A progressive dividend that's fully covered by adjusted EPS | We met our dividend target of 6.95 pence per share, up 2.7% (2023: 6.77 pence per share), which was 107% covered by adjusted EPS and 128% by EPRA EPS3.

|

| An average total accounting return of 9.0% per annum1,2 | Our total accounting return was 9.4% (2023: 10.8%), slightly ahead of our target. |

Our dividend target for 2025 is 7.20 pence per share2, up 3.6%.

Putting our purpose into practice: working with our tenants

We work closely with our tenants, with our long-term partnership approach reflected in the WAULT of 20.2 years at 31 December 2024 (31 December 2023: 20.8 years).

We transferred the operation of seven of our care homes to two new tenants. They replaced Melrose, an affiliate of Minster, which had stabilised the homes' performance as part of a recovery plan we announced in June 2023. As a result of these changes, we had 15 tenants4 at the year end, a net increase of one in the year.

1. For further discussion of these metrics see pages 113 to 119 of the 2024 annual report. EPRA alternative performance measures have been calculated in line with EPRA best practices recommendation.

2. This is a target only and not a profit forecast. There can be no assurance that the target will be met and it should not be taken as an indicator of the Company's expected or actual results.

3. The comparative EPRA earnings have been restated in line with updated guidance from EPRA released in 2024 revising the calculation to include cash income received on interest rate derivatives.

4. Includes Minster and Croftwood, which are subsidiaries of Minster Care Group.

Putting our purpose into practice: our focus on quality

Improving the quality of our assets

In 2024 we significantly ramped up our asset management programme, approving £12.7 million on projects at existing homes and a further £8.7 million investment in the development of a new home. During the year we invested £14.0 million, up from £4.7 million in 2023. Overall, these projects will add a net 119 beds, create new indoor and outdoor spaces for residents, and reduce energy use. At the year end, we had a further ten projects in the pipeline, with anticipated funding of £16.8 million over the next two to three years.

Our tenants continue to provide good care

While the quality of our assets is important, the quality of care our tenants provide to their residents is paramount. A great building won't compensate for poor care and great care can be delivered in many different types of building. The government has publicly raised concerns over the reliability of the Care Quality Commission (CQC), which is the regulator in England; this is evidenced by our own portfolio where some of the ratings from inspectors are now more than five years old. We are currently reviewing different ways in which we can monitor quality of care by our tenants, including website ratings and secret shopper inspections.

Putting our purpose into practice: our focus on affordability

With our leases running for up to 35 years, it's vital that our rents remain affordable to tenants in the long term. We therefore set initial rents at sustainable levels and almost all our leases set out rent increases in line with general inflation but with minimum and maximum annual increases, typically 2% and 4% respectively.

Rent cover is one of our most important key performance indicators (KPIs). The increase in the year to 2.2x (2023: 2.0x) reflects continued improvement in occupancy and in particular our tenants' ability to raise their fees in line with, or ahead of, inflation. Our tenants have continued to focus on efficiency and further reducing agency staff costs, which, along with lower inflation in utility costs, the capped increases in our rents and the increase in average weekly fees they charge, has helped them to pay for wage increases for their staff.

Rent reviews in the year added 3.4% to contracted rent, increasing the contracted rent roll by £1.7 million. We collected 100% of rent due in respect of the year.

Putting our purpose into practice: increasing our sustainability

We continued to focus on improvements to the environmental sustainability of our portfolio with a target to achieve net zero status by 2045. We've further improved the energy efficiency of homes through asset management projects and improved energy performance certificate (EPC) ratings through energy efficiency projects. 60% of our homes have an EPC rating of B or above, making us well positioned to achieve 100% by the year 2030. The CO2 emissions from our tenant energy consumption reduced by 3%, but our target of a 15% reduction from our 2022 baseline is unlikely to be met. We continue to review the best long-term strategy for investing further to improve energy efficiency, balancing environmental and commercial considerations for ourselves and our tenants.

Putting our purpose into practice: optimising our business

In 2024, rising interest rates and conditions in the equity market meant that most REITs, ourselves included, had share prices at a significant discount to net asset values.

These factors made the Group focus on using existing cash flow and disposals to fund the business rather than trying to raise new equity or borrow significantly more.

Therefore, we continued to invest modestly in the portfolio using our existing financial resources and the proceeds from selling assets. This has allowed us to grow income and bed numbers internally through asset management (see above) and to add new assets to the portfolio, while keeping our debt levels stable.

During the year, we exchanged contracts to purchase an 83-bed care home near Darlington, for £3.8 million, and agreed to invest in the development of a new 72-bed home in Bedale, North Yorkshire, for a capped price of £8.7 million.

We also continued to optimise our portfolio, to improve its overall quality and generate funds for reinvestment. In 2024, we agreed sales of five non-core assets for a total of £8.8 million, in line with their latest valuation. Two of these disposals had completed by the year end. The sales also reduced our exposure to Minster, our largest tenant.

Prudently financing the business

We continued to maintain our existing debt financing to support our investments and increase returns, ensuring that we have kept a strong balance sheet. At the year end our gross loan to value (LTV) of 28.3% was well within the maximum in our policy of 35%. We had committed bank facilities of £250 million and significant liquidity available, with £52.2 million of undrawn facilities and £10.5 million of cash, against commitments of £15.7 million.

A successful continuation vote

In common with other investment trusts, the Company doesn't have a fixed life. Instead, shareholders have the opportunity to vote from time to time on whether it should carry on or be wound up. Our first continuation vote took place at the Annual General Meeting (AGM) in May 2024. We were delighted to receive 100% of votes in favour of this resolution and thank shareholders for their support.

Outlook

We remain well positioned to continue to deliver long-term sustainable returns to shareholders. The key themes influencing our market - an ageing population, the growing demand for higher-acuity care and the affordability of social care - play to our strengths and will offer opportunities for us for many years to come. However at present the difficulty we have in raising new capital with high market interest rates and a share price well below net asset value constrains our ability to deliver on these opportunities.

In the year ahead, we'll continue to actively manage our portfolio and dispose of non-core assets. We'll also consider selling homes where we've completed our asset management plan, so we can recycle the capital into other high-return opportunities. The rental growth built into our leases and the return to rental payments from the former Silverline homes will also support further progression in our earnings and dividend.

As announced on 11 March 2025, the Company's directors have reached agreement on the terms of a recommended cash acquisition of the ordinary share capital of the Company (the "Acquisition"). The background to and reasons for the directors' recommendation for the Acquisition is set out in the announcement made on 11 March 2025. If the Acquisition is completed, this will result in a change of control of the Company.

The growing demand for care beds for the elderly

Real estate opportunities are often underpinned by powerful structural trends.

We've seen this in the last decade, with the growth in e-commerce, digitisation and student numbers fuelling huge demand for logistics assets, data centres and student accommodation. An ageing society underpins the demand, and therefore investment rationale, in our segment of healthcare.

| Last decade | Structural trend | Real estate opportunity |

| | E-commerce | Industrial/Logistics |

| | Digitisation | Data centres |

| | Education

| Student accommodation |

| Next decade | Ageing societies | Healthcare

|

We believe that the challenge of caring for an ageing society is the next structural trend, with the potential to create attractive returns for care home owners who choose the right assets and partner with the right operators.

Within this trend we see three main themes: ageing, acuity and affordability.

Ageing

A growth market created by an ageing population

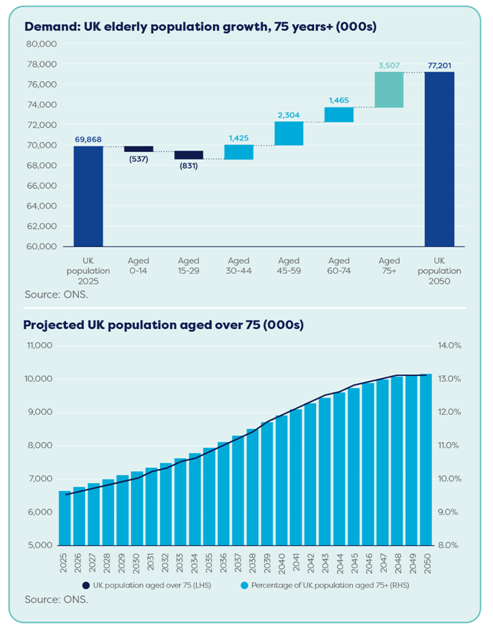

The UK will be home to an unprecedented number of older people in the coming decades. There are currently 6.5 million people aged over 75 in the UK and that number is forecast to increase by 55%, to 10.1 million, over the next 25 years. This change will happen during the lifetime of most of our leases.

Rising numbers of older people will directly lead to more demand for care home beds. However, the market has not responded by increasing supply. In fact, between 2012 and 2021, the supply of beds in nursing and residential care homes fell from 11.3 per 100 people aged over 75 to 9.4 - a 17% decrease. This reflects the high cost of developing new homes (see Affordability below), coupled with inefficient smaller operators leaving the market.

Acuity

An ageing population means care needs are becoming more complex

While rising life expectancies are good news, the downside is that most people will spend the last 15 years of their life with some ill health1. Around 10% of people over 80 have care needs that make it difficult for them to live at home.

Dementia is the most common acute condition affecting people in care homes. Around 70% of care home residents suffer from some form of memory loss, which ranges from mild confusion to severe dementia. The Alzheimer's Society projects that the number of people in the UK with some form of dementia will rise from just over 1.1 million in 2025 to 1.6 million in 2040, with the greatest rise being among people with a severe form of the condition. Dementia and Alzheimer's disease is already the leading cause of death in England and Wales, accounting for 11.4% of deaths in 2022 (source: ONS).

Since the COVID-19 pandemic, our tenants have reported that people are moving into care homes later than before, that they're more likely to be frail or ill and that their stays are shorter. This is creating a longer‑term shift in the industry, with increasing demand for care providers who can deliver higher‑acuity care.

However, many people are kept longer in hospital due to the shortage of care home beds and their inability to pay for residential or home care. This means they're in the wrong setting for the care they need, particularly if they have dementia. On average during 2023 there were just over 12,000 people2 in hospital every night who had no clinical reason to be there but could not be safely discharged. Half of those people, nearly all of them elderly, had been waiting more than 21 days to be discharged. This "bed blocking" increases costs for the NHS and has a knock-on effect on other patients, who can't be admitted to hospital without a vacant bed. The government has made reducing NHS waiting lists one of its main political aims. Achieving this will require adequate capacity in properly funded care homes.

1. Source: ONS: Healthy life expectancy in England and Wales: between 2011 to 2013 and 2021 to 2023.

2. https://www.cqc.org.uk/publications/major-report/state-care/2022-2023/access-to-care#waits

Affordability

The solution to rising demand must be affordable for care funders

Most care home residents in England are state-funded, with this source of funding being particularly important for people living in the Midlands and the North.

However, there is no national government budget for adult social care in England and a person's care needs might be met by their local authority's social services budget or by their local NHS Trust. The individual or their relatives may also have to contribute to the cost. Most local authorities support their adult social care costs through a council tax levy and, in certain situations, local authority or NHS funding is means tested.

This complexity and the pressure on public sector finances mean waiting lists for social care have grown in recent years, with a doubling of the number of people waiting for over six months. While waiting lists for NHS care are well known, the waiting lists for social care are much less publicised.

With local authority budgets likely to remain hugely constrained and demand continuing to rise, the affordability of care home places will be crucial. The economics of our sector mean that existing homes are more likely to meet this affordability test than new developments. An existing home providing good care can cost less than £100,000 per bed. In contrast, a high-quality new care home is often £200,000 or more per bed, reflecting high construction costs and limited land supply. The higher build costs of new homes lead to higher rents for tenants - up to 20%1 of their revenues as opposed to our average of 12.5% - which they have to pass on through higher fees for residents.

This restricts the size and growth of this segment of the market and means that higher fees don't automatically translate into better care, which depends more on the quality and stability of the staff than the building.

From an investment perspective, an existing home generally offers us better risk-adjusted returns. We can buy a home at less than its replacement cost and invest in it to add more beds, allow the tenant to offer more services such as dementia care, and improve its facilities and environmental performance. A bed in a well-run existing home is likely to be in high demand, generating a long-term and steadily growing income stream, which supports its capital value.

A highly fragmented market creates long‑term opportunity for us

There are currently just over 10,7002 registered care homes in the UK. The market is unusually fragmented and over the past 15 years that fragmentation has increased, as the market share of the top ten care providers has declined from a peak of 27% in 2006 to 19% in 2024. The market share of sole traders operating one or two care homes has also declined, from over 80% in the early 1990s to under 30% today. Mid-sized care providers, operating between three and 80 homes, have grown to fill this gap. Developing partnerships with operators in this space has allowed us to acquire good-quality assets at attractive yields, with the confidence that our tenants will run them well.

We currently own 1.7%2 of the market, which means we have substantial scope for long‑term growth when economic conditions allow. We will continue to generate growth internally, by adding beds to our existing homes, and when opportunities arise acquire more assets; to help meet the need for good‑quality, affordable care homes.

1. Illustrative numbers of "Typical Care Home Financials" published by a developer selling new care homes.

2. Source: LaingBuisson.

Delivering attractive risk-adjusted returns

Our business model

What we do

Select tenants

We have a diversified portfolio of tenants that includes national, regional and local businesses. When selecting a new tenant we consider:

· their track record and financial performance;

· the strength of their business plan;

· their ability to provide high-quality care to residents; and

· their ability to deliver strong trading returns over the longer term, which will support our investment.

Identify and appraise assets

We often identify assets we'd like to acquire and engage with existing and new tenants to evaluate operational performance, the affordable rent and their interest in becoming the operator. On other occasions, a tenant will bring an asset acquisition opportunity to us. When considering a transaction, we check every aspect of the homes, including reviewing their local market and the building's environmental sustainability. Our disciplined approach means we can buy at attractive prices, which are often less than the cost of replacing the asset.

Agree leases

Our leases are typically for 25 years or more and balance rental growth with ensuring rent remains affordable to tenants. The leases require tenants to spend a minimum amount every year on repairs and maintenance, and all our leases since 2020 include "green" clauses, to help us work with tenants on our ESG objectives.

Monitor tenants' performance

We keep a careful watch on many aspects of our tenants' performance, including their financial results and the quality of their care, which we discuss with our tenants on a quarterly basis.

Work with tenants to improve our assets

We agree plans with our tenants to upgrade and extend our homes. This makes them better places to live and work, increases their capacity, improves their sustainability and can broaden their offer. We can also work with tenants to develop new homes in areas with strong demand. These activities increase our rent, the value of our homes and our tenants' revenues.

Optimise the portfolio

We regularly review our assets and categorise them as core, value-add or non‑core. Value-add assets are candidates for asset management. We may sell non‑core assets, so we can reinvest the proceeds and create more value, while improving overall portfolio quality.

Manage risk

We consider risk from many angles, from ensuring our balance sheet stays strong, to the way we pick tenants and make sure they're performing well, to our focus on sustainability improvements to the resilience of our portfolio through asset management.

Our competitive advantages

Our competitive advantages come from:

· our strategic focus on mid-market care homes, which we can acquire at below replacement cost with rents at affordable rates;

· the IM's deep sector knowledge and understanding of how care businesses work, which helps with everything from buying the right assets to forming and maintaining supportive tenant partnerships;

· the IM's relationships with care home owners, the agents they work with and with potential new tenants. Great relationships and a proven track record can help us to buy assets off‑market or beat the competition even when we're not the highest bidder. These relationships also help us when targeting disposals across the portfolio; and

· the IM's asset management and development skills. We can identify how to improve a care home before we buy it, successfully complete each project and improve returns by developing new homes.

The value we create

Our high-quality business generates attractive and sustainable value for our stakeholders.

| Tenants Tenants can grow their business alongside ours, in a long-term relationship with affordable rents, which benefits both of us.

| Shareholders Our model delivers predictable and rising revenue, so we can pay a progressive, fully covered dividend. There is also the potential for capital growth, which supports an attractive total return.

Careful cost control enables us to benefit from economies of scale as we grow. Many of our costs are fixed and some variable costs will step down as our asset value rises (including the IM fee which reduces from 1.0% to 0.7% of NAV above £500 million). Along with our conservative approach to debt finance, this helps to maximise the total return we can deliver to shareholders. |

| Residents and their carers As a landlord we support both residents and their carers through our willingness to invest in their homes, to improve the spaces they live and work in.

| |

| Lenders Our lenders can provide long-term finance to us on attractive terms, knowing we have a secure and resilient business, with strong cash flows. |

How we manage risk

Delivering attractive risk-adjusted returns requires us to build risk management into everything we do. The process starts with the board, which reviews and sets our appetite for different risks each year. While our appetite for particular risks might vary over time, in general we maintain a balanced overall level of risk, which is appropriate for achieving our purpose.

The diagram on page 11 of the 2024 annual report shows our principal risks and uncertainties, in order of the risk that remains after we've taken account of the mitigations we've put in place (known as the residual risk). As the diagram shows, two of our risks are outside our risk tolerance and we're looking to mitigate them further.

· For significant tenant default, we want no more than 25% of our contracted rent to come from a single tenant. The Minster Group and its affiliates are currently 32% of our contracted rent (31 December 2023: 37%), with the reduction in 2024 resulting from adding two tenants and selling assets Minster manages. We'll continue to diversify our income over time.

· For underinvestment in care homes, the board and the IM are working to understand what the care home of the future will look like, to focus on value‑enhancing opportunities and improvements to the environment for both tenants' residents and their staff alongside the cost and delivery plan for achieving our net zero carbon target by 2045. We're looking at whether we can do this by investing in the homes in return for higher rents, whether our tenants could fund the work through increased fees for residents or if it might have to be a landlord cost.

Putting our purpose into practice

1 | Working with our tenants

| | Year ended | Year ended | |

| | 31 December | 31 December | |

| | 2024 | 2023 | Change |

| WAULT | 20.2 years | 20.8 years | (2.9)% |

| Bed occupancy | 89.1% | 88.2% | +0.9% |

We don't manage or operate our care homes, so we partner with tenants who'll operate them well and who share our focus on providing high-quality, and increasingly higher-acuity, care.

We keep in close contact with our tenants throughout the year and they provide us with detailed reports, so we can monitor their performance.

The business model describes how we choose our tenants. We also have important choices to make as we grow our portfolio, including the right balance between adding tenants and growing with existing tenants.

Our strategy: adding tenants and growing with them

When we buy assets, we can select a new tenant to run them and reduce our reliance on our existing tenants. Alternatively, we can increase the number of homes an existing tenant operates, strengthening their business and supporting our long-term partnership.

We're expanding our relationship with Prestige Group, through the transactions described on page 15 of the 2024 annual report. We've also reduced our reliance on Minster through the asset disposals discussed on page 14 of the 2024 annual report and by transferring the operations of the ex-Silverline homes from Melrose, an affiliate of Minster, to two new tenants, We Care and Fulcrum Care. See the key board decision on page 14 of the 2024 annual report for more information.

How we measure our progress

The portfolio's weighted average unexpired lease term (WAULT) is a KPI for us.

| | Year ended | Year ended |

| | 31 December | 31 December |

| | 2024 | 2023 |

| WAULT | 20.2 years | 20.8 years |

The WAULT decreased by 0.6 years, with the passage of time offsetting the benefits of new leases and lease extensions following our asset management projects.

Our shortest care home leases are currently 12.3 years and we are actively exploring ways to increase these as part of our asset management activities.

At the year end, our tenant base was as follows:

| | Contracted | | |

| Tenant | rent (%) | Properties | Beds |

| Minster Care1 | 20% | 28 | 1,631 |

| Welford | 20% | 17 | 1,102 |

| Holmes Care Group | 14% | 21 | 1,129 |

| Croftwood Care1 | 12% | 28 | 1,158 |

| Prestige Group | 7% | 5 | 469 |

| Maria Mallaband and Countrywide Group | 5% | 7 | 508 |

| Careport | 5% | 9 | 443 |

| Electus Care | 4% | 5 | 340 |

| Belmont Healthcare | 3% | 2 | 168 |

| Carlton Hall | 2% | 22 | 86 |

| Renaissance Care | 2% | 2 | 128 |

| Optima | 2% | 2 | 99 |

| Fulcrum Care | 2% | 4 | 212 |

| We Care | 1% | 3 | 182 |

| NCUH NHS Trust | 1% | 2 | n/a3 |

| | 100% | 137 | 7,655 |

1. Minster and Croftwood are both part of the Minster Care Group.

2. Carlton Hall includes a development site with planning permission for 72 beds. This is included in "homes" but excluded from "beds" until completed.

3. Assets leased to the NHS are not care homes but other healthcare facilities, hence bed numbers are not applicable.

Our strategy: choosing long-term tenant relationships

The length of new leases is an important decision for us. We favour leases of 25 years or more, since this generates long-term and growing income for our shareholders, encourages tenants to take a partnership approach, and gives residents and care home staff a stable environment to live and work in. Leases of this length also require us to be very selective when signing new tenants.

During the year, we agreed nine new leases: two with Prestige Group, four with Fulcrum Care, all of which will run for 35 years, and three with We Care which also include landlord and tenant options to increase the term to 35 years.

Monitoring our tenants' performance

The IM engages with tenants on a weekly and monthly basis and in more depth each quarter, when it receives detailed reports from tenants setting out their financial and operating performance. We also run an annual tenant survey to get their feedback.

The main factors affecting our tenants' financial performance and their ability to pay our rents are their occupancy, fees for residents, staff costs (including agency staff use) and utility costs. Trends in occupancy and fees remained positive in 2024 and in aggregate our tenants improved their financial performance and rent cover.

Staff costs have stabilised as a percentage of tenant income, with our tenants generally able to recruit more permanent employees and reduce their use of expensive agency staff, resulting in stable staffing levels overall. Staff costs will rise further from April 2025 because of the increase in the minimum wage and higher employer's National Insurance. However, our tenants are in good shape and have a track record of growing fees in line with or ahead of inflation, so we're confident they can manage these cost increases. Utility costs have improved after substantial increases in previous years and our tenants have continued to focus in 2024 on their operational efficiency.

Section 172: business relationships

The directors must consider the Group's business relationships, including with our tenants. In addition to receiving regular updates and detailed reports from the IM on each of our tenants, the directors all took part in calls with tenants during the year, without the IM being present. This allowed them to hear first-hand what tenants think of the Company as a landlord and their relationship with the IM, and to discuss how their business is going and the issues they're facing. The directors shared file notes on each call and discussed the feedback at their November board meeting.

Tenant feedback continued to be positive and while some would like us to be able to acquire more assets and help them to grow more quickly, they were very complimentary about their relationship with the IM and the support they receive.

Key board decision - approving the transfer of operations to new tenants

Our 2023 annual report included an extensive explanation of our decision to replace Silverline Group as the tenant for seven of our homes. Melrose, an affiliate of Minster, temporarily stepped in as the tenant to stabilise the homes' performance and work with us to develop a long-term strategy for them.

During 2024, we were pleased to announce that We Care had taken on the operation of the three care homes in Bradford, and Fulcrum Care was the new tenant for the four homes in Scotland. The board carefully considered whether to approve the transfers and looked at the alternatives, such as selling the homes.

The directors discussed the risks of transferring underperforming homes to new tenants, the operators' experience of turning homes around and the commercial terms, including lease incentives and working capital facilities, the Company was offering to support the new tenants. The directors considered the interests of the relevant stakeholders, including the potential impact on residents and staff, and concluded that the transfers were in the best interests of all stakeholders.

Case study

Growing with our tenants

| | Year ended | |

| | 31 December |

|

| | 2024 | Change |

| Number of additional beds | 155 | +33% |

| Anticipated yield on cost | 8% | |

Extending our partnership with Prestige Group

During the fourth quarter of 2024, we invested in two value-add opportunities in the North of England, partnering with one of our existing tenants, Prestige Group.

The first opportunity was to acquire Middleton Manor, an 83-bed purpose-built nursing home which Prestige owned and operated. We're leasing the asset back to Prestige, which is repositioning it to provide much‑needed higher-acuity care for residents requiring both dementia and nursing care. This transaction, which exchanged in 2024 and is awaiting CQC re‑registration before it completes, reflects our strategic focus on homes which provide higher-acuity care in communities with significant unmet demand, as is prevalent in the North of England, and which we can acquire below replacement cost.

The second opportunity was to forward fund the development of Bedale, a 72-bed care home. It is pre‑let to Prestige and will be developed by Prestige's sister development company, which completed the successful Merlin Manor scheme in 2022. The Prestige Group has significant experience of developing and launching care homes in the North of England and makes a strong partner for us on the Bedale investment. The home will be built to the latest specifications for both care and real estate. The design is mindful of energy efficiency, with the home being fully electric, and it is expected to achieve an EPC A rating on completion.

Structuring investments to control risk and capture increased value

In structuring the transactions, the IM focused on mitigating the risks while ensuring we can benefit from uplifts in value. For Middleton Manor, we'll pay £3.8 million upfront, with a £2.1 million deferred payment depending on the success of the repositioning and resulting improvement in the home's profitability. This will also trigger an increase in the rent we receive. This structure is very similar to a previous investment with Prestige, Yew Tree.

The forward funding of Bedale is expected to generate a highly attractive net yield on cost of over 8%. We've mitigated the risk posed by new developments by capping the price here at £8.7 million, with the developer required to cover any unexpected costs.

Creating a win-win-win investment through investment in strategic partnerships

Partnering with existing tenants benefits us, our tenants and society. Supporting the growth of good regional and national care operators such as Prestige diversifies our rental stream, giving our investors greater income security. It also reduces risk for us, since our existing relationship and ability to structure the investment based on previous successful transactions gives us confidence in Prestige's ability to deliver on the business plans. Finally, and most importantly, these partnerships add to the UK's essential social infrastructure, creating new beds in local communities and enabling care for some of the country's most vulnerable people.

Putting our purpose into practice

2 | Our focus on quality

| | Year ended | Year ended |

| | 31 December | 31 December |

| | 2024 | 2023 |

| Capex invested in improving homes for residents and staff | £14.0m | £4.7m |

Quality has two main aspects: care and buildings.

Both determine how full the homes are, how much our tenants can charge and how secure our income is. However, the quality of care is paramount for both us and our tenants. Without this, the homes cannot succeed.

Our strategic choices include how much capital we should allocate to asset management, what sort of improvements we should target, and the extent to which we should fund new developments.

Our tenants are responsible for repairing and maintaining the buildings and for their quality of care. We monitor both of these and discuss them with our tenants at least once per quarter.

Our strategy: increasing quality by investing in our assets

Our returns on asset management are higher than on most asset acquisitions. The lease terms typically allow us to rentalise the investment at 8%, with the potential for valuation uplift on the capital invested, giving a rate of return above the yield alone. These projects are also generally lower risk, since we and the tenant have a good understanding of the home and how the project will improve its performance.

However, we have to carefully consider how much to invest each year, since we also want to continue to grow the portfolio within our leverage limits and need to retain enough capital to buy assets. Our tenants also have to balance a project's longer-term benefits with the short-term disruption to the home, which can reduce their income while work is under way. We therefore need our tenant's permission for a project to go ahead.

Our portfolio management process identifies homes with the potential to add value through asset management. We then target projects that:

· improve the home for residents and staff, such as adding en-suite bedrooms and upgrading kitchens, laundries and other facilities;

· improve the environmental performance of the home and future-proof it against obsolescence; and

· expand the services our tenants can offer, such as adding specialist beds for dementia care.

Our progress in 2024

During 2024, we approved £12.7 million of new asset management projects, of which £6.7 million was spent in the year and £6 million remains outstanding. These projects are adding beds, improving the living and working environment and enhancing the homes' energy efficiency. In total, our approved projects will increase bed numbers by 47 and add £1 million to contracted rent.

Our largest current projects are shown in the table below. The case studies below give more insight on the projects at Wombwell Hall and Yew Tree:

Our pipeline currently has a further ten projects at various stages, with total funding of up to £16.8 million over the next two to three years. These projects have the potential to add 85 beds and £1.3 million of annual rent. We'll support them if they improve the quality of care and the building, create value for shareholders and we have the financial resources to deploy.

|

| Amount |

|

| Home and tenant | committed | Project benefits |

| Wombwell Hall Belmont | £2.5m | Reconfiguration of 30-bed unit into 22 beds, all with wet rooms. Refurbishment of main entrance and office into "hub" with café, seating and hair salon. Upgrade to mechanical and electrical installations and window replacement. |

| Kingston Court Careport | £1.0m | Internal reconfiguration to create four additional bedrooms and a dementia-orientated wing, with café. Installation of solar PV. |

| Turnpike Court Croftwood | £1.1m | Extension to create eight additional bedrooms and new residents' lounge. Installation of solar PV on the roof. Improved EPC (C to B). |

| Elm House Croftwood | £3.0m | Extension and internal reconfiguration to form 21 new beds (a net increase of 19), new day spaces, entrance lobby and reception, and sensory garden. Improved EPC (C to B). |

| Amberley Minster | £2.5m | Demolition of existing wing and replacement with 21 new‑build rooms (net increase of seven). Electric heating to new wing with air source heat pump. Improved EPC (C to B). |

| Yew Tree Prestige | £2.5m | New-build 25-bed unit alongside existing 76-bed Yew Tree Care Centre. All new rooms have wet rooms and are fully electric with air source heat pumps and solar PV. The unit is targeting an EPC A rating. |

| Leycester House Croftwood | £1.2m | Infill extension and internal reconfiguration to create additional wet room bedrooms and improved lounge and dining space, resulting in a net increase of five bedrooms. Improved EPC (C to B). |

Yew Tree Grange case study

Yew Tree Grange is a purpose-built care home comprising 25 bedrooms located alongside the existing Yew Tree Care Centre in Redcar, Teesside. Our tenant, Prestige, developed the building to provide premium rooms to complement the existing 76-bedroom nursing home. Yew Tree Grange is self‑contained and includes residents' lounges and dining areas, with all bedrooms benefiting from generously sized en-suite wet rooms. Care REIT invested £2.5 million in the project with a return in excess of 8%.

The building has been constructed to high environmental standards with an EPC A rating. Heating and hot water is provided from air source heat pumps and solar panels, meaning there is no need for a traditional gas-fired boiler.

Wombwell Hall case study

The first phase of work at Wombwell Hall in Gravesend, Kent was completed in November 2024. This comprised the reconfiguration of an existing 30-bed unit into 22 bedrooms with full en‑suite wet room provision and new dining and lounge areas for residents. A central reception and administration building has been converted into a "hub" with café area, salon and meeting place for residents and families. A comprehensive upgrade of the mechanical and electrical systems has also been completed, future-proofing the home for years to come. Care REIT invested £2.5 million with a return of 8.12% on the works, which form part of a longer-term strategy to reposition the home as a centre for dementia care alongside its core nursing provision. The works have resulted in an improved EPC B rating through additional insulation and new high-performance windows and external doors.

Quote from Wombwell Hall home manager: "The newly refurbished unit is an inspiring example of how we can reimagine care for those living with dementia. We've created a space that not only offers security but also enhances the quality of life of our residents."

Ensuring our tenants maintain our buildings

Regular repairs and maintenance protect the value of our homes and keep them up to standard for residents and staff.

Our leases specify the minimum amount our tenants need to spend, which totalled nearly £14 million in 2024. We monitor this carefully, looking at spend in the current year and the total over the last three years. The IM regularly visits homes to inspect them and check progress, with 124 visits taking place in 2024. Our valuer, surveyors, environmental specialists and other advisers support the IM in reviewing the quality of our buildings, with the valuers alone undertaking 46 home inspections in the year as part of their commitment to visit each property at least every three years.

Where we identify concerns, we engage with the tenant to resolve them. This may be because the tenant has fallen behind on the repairs and maintenance required by the lease terms or because we have a more general concern that the home isn't being maintained to the standards we expect.

Monitoring the quality of care

The main ways we look after residents' interests are through our oversight of care quality ratings and ensuring the homes are well maintained, as described above. Our tenants are responsible for their residents and we don't directly engage with them, except when we meet them during home visits.

The IM tracks reports and ratings from regulators, and regularly reviews customer feedback on the homes. If the regulator rates a home as inadequate or requires improvement, the IM reviews the report in detail and discusses the findings with the tenant's operations director. This allows us to understand the issues, the actions the tenant is taking and whether there are any broader operational concerns the tenant is looking to address. In addition to this the IM visits the home and meets with the home manager to better understand the issues on the ground. Where appropriate, we'll seek independent support to help resolve any ongoing issues.

How we measure our portfolio quality

The following KPIs reflect the overall quality of our assets. Our total accounting return, the WAULT and our 0% vacancy rate are also important measures of quality:

| | Year ended | Year ended |

| | 31 December | 31 December |

| | 2024 | 2023 |

| EPRA topped-up net initial yield (NIY)

EPRA topped-up NIY had a marginal movement of 4bps across the year, reflecting stable market conditions. | 6.96% | 6.92% |

| Occupancy

Occupancy across the portfolio continued to increase during the year as it recovered to pre‑COVID levels (see the chart below). This reflects both the continued attractiveness of our homes and the essential nature of the service our tenants provide. | 89.1% | 88.2% |

The CQC (the regulator for England) carried out inspections for only 10% of the portfolio of homes in England.

In contrast, the Care Inspectorate (Scotland's care regulator) continued to carry out their regular inspections, with almost 75% of the portfolio's Scottish homes being inspected during 2024.

The government has announced its intention to improve the effectiveness and efficiency of key patient safety organisations, particularly the CQC. The new chief executive of the CQC has acknowledged that the public can no longer rely on the safety ratings of care homes in England: "Effectively, the CQC is not delivering on its operational performance." With the average age of CQC assessments currently around four years1, we will be closely monitoring how this progresses. In the meantime, we're considering other indicators we can use to monitor care quality, such as ratings and reviews from residents and their families on carehome.co.uk. While online ratings are imperfect, they are regularly updated and may give us early visibility of trends in performance.

1. Source: Health and Social Care Committee on 15 January 2025, UK Parliament.

Average home ratings on carehome.co.uk

9.3 average score for our operators by home on carehome.co.uk

Above the national average of 9.0

We monitor ratings closely for individual homes and our tenants, reporting results to the board on a quarterly basis.

Section 172: community impact and business reputation

In addition to the financial implications of building and care quality discussed above, the directors must consider how these issues can affect the community and the Group's reputation. Poor buildings or care have a direct impact on residents' quality of life and the working environment for staff, and therefore the community within which they operate. Badly maintained buildings and poor care could do significant damage to tenants' reputations, which in turn could harm perceptions of the Group.

Asset management timeline

| January | April | May | September | October |

| Handover of refurbished bedrooms at Fairview House.

Spend (in year) £0.1m | Works commence on reconfiguration of Copperfield unit at Wombwell Hall.

Spend (in year) £2.5m

| Works commence on new eight‑bedroom extension at Turnpike Court and roof-mounted solar panels.

Spend (in year) £1.1m

Additional bedrooms 8 | +15.1%

| Works complete at Karam Court to create four new bedrooms and new reception area.

Spend (in year) £0.2m

Additional bedrooms 4 | +8.5%

| Handover of Copperfield unit at Wombwell Hall. |

| March | April | July | July | December |

| Works commence on refurbishment and four additional bedrooms at Kingston Court.

Spend (in year) £1.0m

Additional bedrooms 4 | +5.3%

| Work commences at Leycester House to form an additional five bedrooms and enhance the lounge and dining space.

Spend (in year) £1.1m

Additional bedrooms 5 | +12.5%

| Handover of new-build 25-bed unit at Yew Tree Care Centre. EPC A rated with air source heat pump and solar panels.

Spend (in year) £2.5m

Additional bedrooms 25 | +32.9%

| Work commences on extension at Birchlands to form four additional bedrooms, reception area and manager's office.

Spend (in year) £0.9m

Additional bedrooms 4 | +7.4%

| Work commences on eight‑bedroom extension and new dining area at Duncote Hall.

Additional bedrooms 8 | +20.0%

|

Putting our purpose into practice

3 | Our focus on affordability

| | Year ended | Year ended | |

| | 31 December | 31 December | |

| | 2024 | 2023 | Change |

| Rent cover | 2.2x | 2.0x | +9.4% |

For our business to be sustainable, our tenants must be able to attract a sufficient number of residents at appropriate fee rates, both private and publicly funded. Additionally, the rent we charge our tenants has to be affordable over the long term.

Our strategic choices relate to the rents we set when we first agree leases and how we structure our rent review clauses.

Strategy: setting initial rents and ensuring sustainable rental growth

We believe that all our stakeholders will be better off in the long run if we make sure rents remain affordable. With this in mind we typically set initial rents to ensure strong rent cover from day one, and all our leases include annual inflation-linked rental growth, with minimum and maximum increases each year. For most leases, these are set at 2% and 4% respectively.

This structure shares risk between us and our tenants. It guarantees that our income will grow every year, including when inflation is low, while protecting our tenants when inflation is high.

Care REIT leases inflation linkage

| Percentage of Care REIT leases with RPI linkage | 99% |

| Percentage of Care REIT leases with CPI linkage | 1% |

Care REIT leases caps and collars

| Percentage with floor 2%/cap 4% | 84% |

| Percentage with floor 1%/cap 5% | 15% |

| Percentage with upwards-only inflation linkage | 1% |

Section 172: long-term impact and business reputation

The way we set initial rents and structure rent reviews are good examples of our focus on the long term. If rents become too high, we'll lose tenants and hence income, causing major disruption to residents and staff, reducing the value of our assets and risking damage to our reputation. Balancing rental growth with affordability is therefore a key part of providing sustainable returns for shareholders.

How we measure affordability

Rent cover is one of the most important KPIs for our business. We also track our rental growth and the amount of rent that's overdue:

| | Year ended | Year ended |

| | 31 December | 31 December |

| | 2024 | 2023 |

| Rent cover

Rent cover was strong through the year, reflecting our tenants' success in growing their fees, as well as further increases in occupancy. | 2.2x | 2.0x |

| Average rental growth

In total, 131 rent reviews added £1.7 million to our contracted rent in 2024. | 3.6% | 4.1% |

| Rent collection

We've collected 100% of the rent due in respect of 2024. Seven of the Group's properties are on variable-rent leases after being re-tenanted in 2024 from Melrose.

| 100% | 99% |

The chart below shows rent cover over time, demonstrating that rents have been consistently affordable for our tenants, as well as the scale of the improvement over the last 18 months:

The chart below sets out the rental growth we've achieved over the last seven years and compares the percentage increase with the rate of inflation. It shows that we've received above-inflation increases for much of this period, with our tenants being protected from high inflation during 2023 and 2024.

Affordability of our tenants' rent

An important indicator of whether our tenants' rent is affordable is whether their fees increase at or ahead of the rate of inflation. As shown below, care home operators have a long history of achieving this:

This continued in 2024. Across our portfolio, the average weekly fee (AWF) rose by 6.7% to £1,119, contributing to rising tenant profitability and rent cover.

In 2024 we invested £1 million in improving Kingston Court. On completion of the capex we had a Q&A with the home manager:

Q: What improvements did you want to make to the home and why?

A: The aim was two-fold; to increase the number of wet rooms and create a more comprehensive dementia-friendly environment.

We added 24 wet rooms to existing bedrooms and converted two unused lounges into four new wet room bedrooms. Alongside bedroom upgrades and additions, we enhanced our dementia-friendly environment with the addition of a library-themed coffee shop, local market-themed shop, a revitalised hair salon and themed corridors.

The new wet rooms we felt gave the home a more premium feel for those who prefer their own showering facilities over the communal, yet well-apportioned, bathrooms.

The dementia-specific areas were intended to enhance the lives of those living with dementia, providing destination areas to reminisce, discuss and reflect.

Q: How did you manage the works; was there any disruption?

A: Through planning with our project management team, contractor and our care teams we facilitated the works programme as smoothly as possible. Residents and families were made aware of the works programme well in advance to keep them informed and seek feedback.

Given our high occupancy level, it was important to keep a tight programme of works to release bedrooms and move residents to ensure there was no delay or unnecessarily empty bedrooms. The building contractor was flawless in managing this, as well as quiet and considerate. Disruption was kept to an absolute minimum.

Overall our residents were excited by the works and the improvements to come.

Q: What has been the response of residents, families and staff to the improvements that have been made?

A: The new wet rooms and bedrooms have been well received by current residents and have proved useful in attracting new residents to the home.

The library-themed coffee shop, local market-themed shop, revitalised hair salon and themed corridors have been a hit with residents - enriching their lives, sparking conversations and providing places to visit. New residents and their families are typically pleased with the quality of these areas and can quickly see the benefits the new facilities provide.

Our staff have always been committed to the residents and the home and the upgrades have further enhanced this commitment. Staff are immensely proud of the great care they deliver and now have an even better environment to match.

Q: How do you think those residents living with dementia will benefit?

A: The new dementia features have benefited our residents in many ways by promoting social interactions, engagement and activity, feelings of familiarity, calming, a sense of normal, physical movement and places for residents and staff or families to interact and reminisce.

It's great to see these benefits in action every day, and pleasing to hear visiting health and social care professionals delighted with further improvements in residents' lives we are delivering here.

Q: Have you noticed any difference in the electricity bills after you installed the solar panels on the roof?

A: Yes, the solar panels are contributing a healthy amount of electricity to the care home which we can monitor via a web portal. And at 80 bedrooms, it's all well used in both the summer and the winter months. It's also great for the planet and we are pleased to be playing our own small part in reducing the home's carbon footprint.

Kingston Court summary

Number of beds

80

2024 average occupancy

94%

Public/private fee split

85%/15%

Average EBITDARM margin (since January 2020)

27.5%

Putting our purpose into practice

4 | Increasing our sustainability

| | Year ended | Year ended | |

| | 31 December | 31 December | |

| | 2024 | 2023 | Change |

| EPCs rated B and above | 60% | 57% | |

| Carbon intensity (kg CO2e per m2 per year) | 51kg | 53kg | (3)% |

Care homes are an important part of the UK's social infrastructure and are set to play an increasing role in supporting older and vulnerable people.

Our ESG framework sets out our approach to implementation of ESG across the business. We invest in care homes which deliver positive social outcomes in the heart of the community.

Key pillars of our ESG framework

| Environment | Social | Governance |

| Priorities Strategic investment in our portfolio to improve environmental impact.

Improving EPCs through enhancements to our properties' energy efficiency and reduction in carbon emissions in line with our net zero pathway.

| Priorities Having a positive impact on the people living and working in our homes.

Recognising the vital social role care homes play and investing in homes that provide high-quality care to a range of residents. | Priorities Robust governance and transparent reporting to all stakeholders.