Hayward Tyler (HAYT:AIM) is a gainer in a falling market today as fund manager Richard Sneller lifted a personal stake in the small cap engineer to 6.5%.

Hayward's gearing towards the US, China and India, where it sells its industrial pumps, may have played a part in emerging markets specialist Sneller's decision to invest, Shares understands.

Sneller has good knowledge of Hayward's key markets and this may have given him an insight into the possible long-term value the company could be able to deliver, a source added.

Co-manager of the Baillie Gifford Emerging Markets Growth (GB006017825) fund with Mike Gush, Sneller has made personal investments in a number of small cap stocks over the last year. As well as building a stake in Hayward worth £3.2m at market prices, Sneller also upped investments in mobile payments provider Bango (BGO:AIM) and pharma outfit Omega Diagnostics (ODX).

Cryptotex (CRX:AIM), another pharma business in which Sneller owns shares, is currently subject to a takeover offer from Germany-listed research and development specialist Evotec.

Sneller's Baillie Gifford Emerging Markets Growth fund has outperformed peers by around 7.7% in total over the last five years, according to FE Trustnet.

Performance over five years is 43.1% or 7.4% annualised in what has until recently been a tough environment to deliver returns in emerging markets.

Top picks in the Baillie Gifford fund could not be much different to Hayward, a specialist pumps manufacturer founded in 1815. The emerging markets fund’s biggest investments include technology companies Tencent, Naspers and Alibaba as well as Samsung and Taiwan Semiconductor Manufacturing.

| EARNINGS ESTIMATES | |||

| Hayward Tyler - Key metrics (£m) | |||

| 2016 | 2017e | 2018e | |

| Revenue | 61.6 | 80.2 | 82.3 |

| Adj. EBITDA | 7.2 | 10.3 | 11.1 |

| Adj. Profit-before-tax | 5.1 | 6.4 | 7.1 |

| Adj. EPS | 8.1p | 8.2p | 9.1p |

Source: Finncap, house broker (9 August 2016)

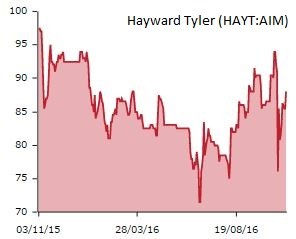

Sneller's investment in Hayward may have been prompted by a share price sell-off after a 20 October update which said the business lost £5.5m in the six months to 30 September.

Hayward now needs to deliver a profit in the six months to 31 March 2017 of around £12m to hit broker operating profit estimates of £7.2m for the full year. That is almost as much profit as it delivered in the last three years combined.

Hayward chief executive Ewan Lloyd-Baker and analyst William Game at house broker Cantor Fitzgerald, who produced the £7.2m estimate, say the business is capable of hitting expectations because of a strong order book, which totalled £48m at 30 September.

And Sneller clearly believes the stock offers good value at current prices, though the fund manager's investment time frame is typically three to five years in the Baillie Gifford fund he manages.

Key risks at Hayward include its ability to convert customer orders into sales and a high level of exposure to global demand from energy and industrial customers.

Shares in Hayward trade 3.3% higher on low volume at 88p versus a share price around 90p at the time of its October trading update.