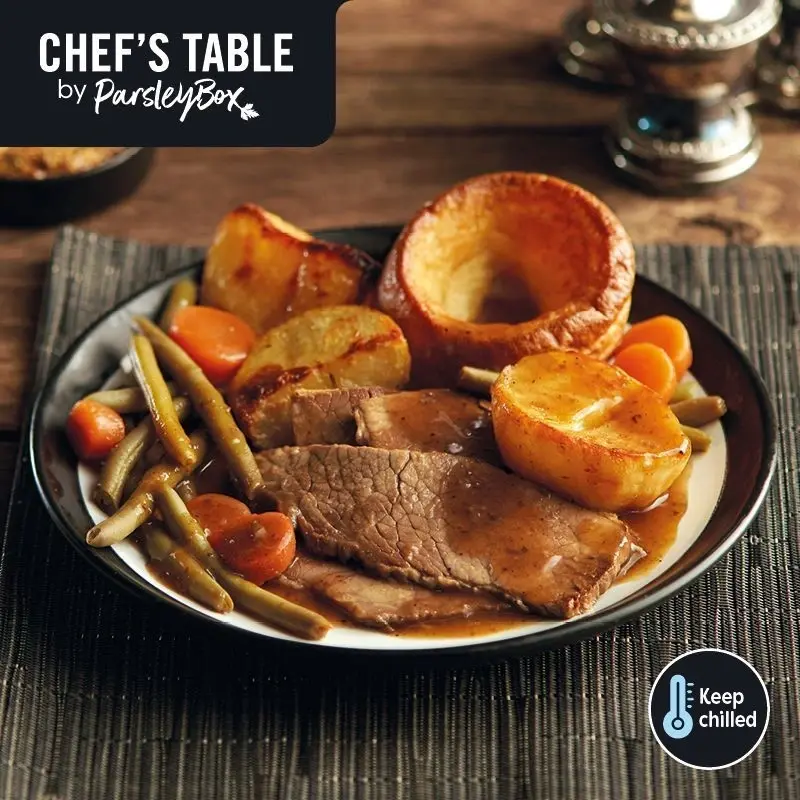

The business may be in the doldrums but Kevin Dorren, chief executive officer of direct to consumer ready meals group Parsley Box (MEAL:AIM) has acquired more than £65,000 worth of shares.

On 13 April, Dorren acquired 320,000 shares at a price of 20.5p. This equates to a value of £65,6000. It brings his total holdings in the group to 13.3%.

INTERESTING TIMING

The timing of Dorren’s share purchase is interesting, because it was a day after the company reported results for the six months to June. These revealed pre-tax losses had increased to £5.4 million compared to a loss of £1.02 million last year.

The company has been beset with disappointments since its listing on AIM in March 2021, gaining unwelcome notoriety for being the worst performing IPO in 2021.

Shares in the firm slumped in July 2021 after it warned of a slowdown of sales following the loosening of Covid-19 restrictions. A subsequent profits warning was blamed on supply chain issues.

In March this year the group raised £5.9 million through a new share placing to boost growth, with an additional £1.1 million targeted through an open offer.

The directors contributed £4.2 million to the fundraising that was undertaken at a price of 20p.

Commenting on the most recent set of results, Dorren revealed his optimistic outlook: ‘Looking ahead, our target customer base is projected to grow by around 30% between 2020 and 2040 - this offers considerable opportunities for expansion and growth as many of these Baby Boomers will seek convenient, quality, provision of ready meals.’

SMART METERING SHARES SNAPPED UP

A director at Smart Metering Systems (SMS:AIM) has acquired shares worth just under £40,000 in the group, which installs and manages electricity meters on behalf of energy suppliers.

On 11 April Graeme Bissett bought 4,818 shares at a price of 830.04p. This equates to a value of just under £40,000. Following this transaction Bissett has an interest of 22,911 ordinary shares which represents 0.017% of the company.

Recent full year results for 2021 announced on 15 March were encouraging, with the group recording a 12% increase in index-linked annualised recurring revenues of £86 million.

The positive nature of the results was reflected in a 10% hike in the dividend.

Significantly the pace rate of meter installations during the first quarter of 2022 is on track to meet management’s full year forecast.

The shares have reacted positively to these results rising 17.5% over the last month. However year to date the stock is down 1%.