It was a week of ups and downs for the US market as investors awaited Federal Reserve chair Jerome Powell's address to the Jackson Hole Symposium on 23 August.

Overall most indices were trading pretty much flat by close on Thursday and any volatility paled into insignificance compared with the wild swings in markets seen at the beginning of the month.

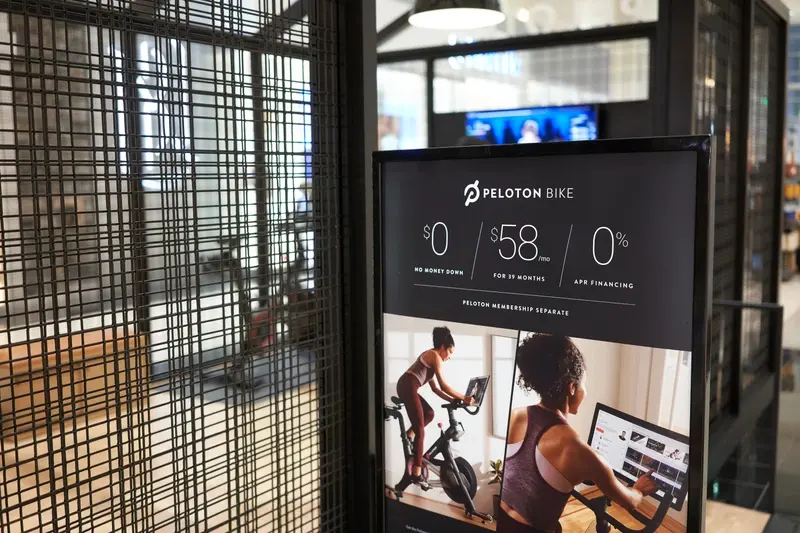

Outside of the S&P 500, high-tech exercise bike maker Peloton (PTON:NASDAQ) was the big mover, surging 35% on signs a years-long turnaround effort was finally starting to pay off.

The company posted a 0.2% increase in sales for the fourth quarter, the first year-on-year growth since the second quarter of 2022. Thanks to cost cutting the company also unveiled positive free cash flow for a second consecutive quarter.

Shares in Moderna (MRNA:NASDAQ) were under pressure despite the approval of a vaccine to protect against new strains of Covid-19, with the company lowering its full-year sales forecast in early August thanks to soft vaccine demand in Europe.

TARGET CORP

In the retail sector, Target’s (TGT:NYSE) shares rallied 15% to $166.1 on forecast-beating second quarter results (21 August) showing a long-awaited return to sales growth, although the discounter cautiously maintained its previous ‘measured’ full year outlook.

Second-quarter sales and earnings blew past Wall Street estimates as price cuts enticed more consumers into stores and discretionary category trends continued to improve.

Revenue of $25.45 billion and earnings per share of $2.57 came in ahead of the $25.21 billion and $2.18 consensus respectively, while comparable sales ticked up by a forecast-beating 2%, Target’s first rise in five quarters.

MACY'S

Heading in the opposite direction was Macy’s (M:NYSE), the iconic department store operator’s stock dropping 10% to $15.99 after it cut its full year sales forecast amid more promotions to attract a more discriminating US shopper.

Second-quarter results were mixed, beating earnings expectations but with revenue falling 3.8% year-on-year to $4.94 billion, shy of the $5.12 billion the market was expecting.

Macy’s now anticipates annual sales of between $22.1 billion and $22.4 billion, below the previously guided $22.3 billion to $22.9 billion range, with chief executive Tony Spring telling business channel CNBC customers are not spending as freely across all of Macy’s brands, including higher end outlet Bloomingdale’s.

ELI LILLY & CO

Leading weight loss and diabetes specialist Eli Lilly (LLY:NYSE) provided reassurance on the long-term effectiveness and safety of tirzepatide, the active ingredient in its diabetes treatment Mounjaro and obesity drug Zepbound on Tuesday (20 August) sending the shares up over 4% to a new all-time high of $964.

The drug maker released data from a three-year assessment of tirzepatide, the longest completed trial to date, following primary findings at 72-weeks, the results of which were published in 2022.

The study showed weekly injections of tirzepatide significantly reduced the risk of progression to type two diabetes by 94% among adults with pre-diabetes and obesity or overweight compared to patients taking the placebo.

The treatment also resulted in sustained weight loss with adults on the higher dosage experiencing a 22.9% average decrease in body weight compared to 2.1% for those on placebo.

Senior vice president of product development, Jeff Emmick said: ‘These data reinforce the potential clinical benefits of long-term therapy for people living with obesity and pre-diabetes’.

Lilly shares are up 766.7% over the last five years compared with a 96.5% gain for the benchmark S&P 500 index.

UNION PACIFIC

Railroad companies rarely hit the headlines and Union Pacific (UNP) is no exception, with the shares having more or less flat-lined since January, but as the saying goes there may be trouble ahead.

North of the border, Canadian Pacific Kansas City (CP:TSE) and Canadian National Railway (CNR:TSE) face a work stoppage by unions after talks over new labour contracts failed to reach an agreement.

Union Pacific, together with BNSF – which is owned by Berkshire Hathway (BRK.B:NYSE) – has a near-duopoly on freight railroad transportation west of the Mississippi River.

Chief executive Jim Vena has warned Canada’s labour minister that a strike could have ‘devastating consequences’ for the US and Canadian economies.

While short line and regional railroads say it is business as usual for now, more than 2,500 of Union Pacific’s rail cars could be prevented from crossing the border meaning huge upheaval to supply chains.

At the same time, Canadian commuters are bracing for strikes by rail traffic controllers in the nation’s three biggest cities with Vancouver set to lose all rail service.