Just Eat (JE.) has returned to profit and delivered in-line annual results, yet questions remain over competition from Deliveroo and Uber Eats as the shares dip 0.9% to 773.4p.

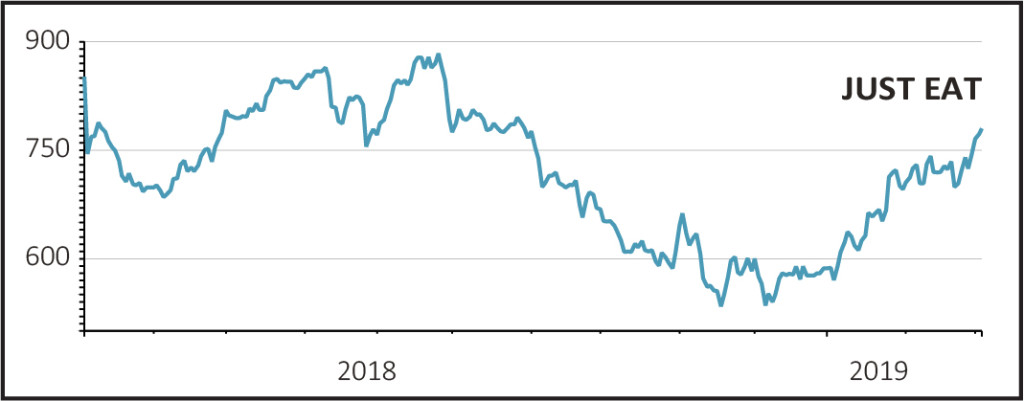

Shares in Just Eat have struggled over the last year following its decision to pour money into a new delivery service, lowering profitability.

READ MORE ABOUT JUST EAT HERE.

US shareholder Cat Rock Capital has recently demanded that the firm look for a potential merger to make it more formidable against rivals - if Just Eat does not get taken over first, which is a possibility according to broker Liberum.

Shares in Just Eat have performed strongly this year but are still 12% below their high of 883p last July.

CANADIAN BUSINESS SET TO TURN A PROFIT

In the year ending 31 December, Just Eat delivered a 43% jump in sales to £779.5m and generated profits of £101.7m compared with losses of £76m in 2017.

Investors should be reassured by the continued strong performance of Canadian business SkipTheDishes, which is expected to deliver its first annual profit by the end of this year.

Just Eat says it will use the increased profits from SkipTheDishes to roll out its technology in the UK and Australia to target the quick service restaurant (QSR) market.

Liberum analyst Ian Whittaker says Just Eat benefits from a similar business model to Rightmove (RMV) as its strong market share attracts more consumers, which attracts more clients hoping to gain customers.

Whittaker argues that Just Eat is on track to become a market leader with over 30% of the current UK food order market, nearly four times the share of Uber Eats and Deliveroo combined.

Despite this, the analyst is forecasting a 4% fall in Just Eat’s overall margins this year due to lower profits in the delivery business.

OPERATING COSTS SOAR

AJ Bell investment director Russ Mould is not convinced by Just Eat’s results, flagging that operating costs have soared from £382.5m in 2017 to £599.9m while profit has barely grown when a one-off 2017 impairment charge is ignored.

He also points out that Just Eat could be hit by a £10m bill according to analysts' estimates if a new UK digital sales tax by Chancellor Phillip Hammond comes into force in 2020.