Shares' deep-value pick from a couple of months back, carpet manufacturer Airea (AIEA:AIM), has stunned the market with huge gains in earnings.

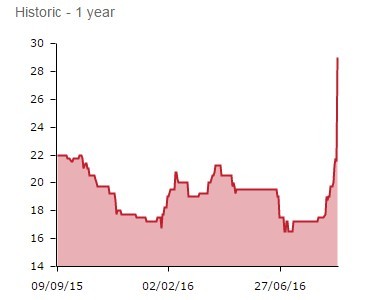

Airea's stock price is up 39% today at 30p, and more than 50% since Shares' bullish call on the stock in a 25 February cover story.

Gains today are on the back of full-year results which reveal a knock-out 48% gain in underlying earnings before interest, tax, depreciation and amortisation (EBITDA) to £2.8 million.

Key to our call on Airea was a reduction in oil prices, which has a major impact on input costs at carpet manufacturers, comprising half of the product's total value, as well as the stock trading at or around tangible book value.

Cost reductions appear to have played a roll in Airea's strong performance. Operating profit gained 86% at the full-year stage to £2.0 million with margins expanding from 4.7% to 8.2% even though revenue was down around 4% at £24.6 million.

As well as a benefit from lower input costs, Airea's management cited the consolidation of manufacturing sites as another reason for improvement in the underlying operating margin.

A note of caution is worthwhile, however, as some of Airea's earnings improvement was delivered by way of a reorganisation of its pension scheme, which delivered a one-off credit of £1.3 million. This was offset in the results by a similar amount of exceptional costs incurred on consolidating its production facilities.

Airea's pension deficit remains a key potential stumbling block in its attempts to deliver shareholder value, totalling £7 million even after recent changes to the scheme.

Higher profitability will go some way to mitigating this risk in the short-term. And a shareholder-friendly management team, led by chief executive Neil Rylance, which bought back stock at low prices over the past few years, could also be a factor.

Airea's buybacks mean earnings per share gained more than operating profit and EBITDA, because of a lower share count, up 133% to 3p.

While enjoying their time in the sun at the moment - sector peer Victoria (VCP:AIM) is up more than 500% in only a few years - investors should always recognise that carpet businesses tend to be cyclical and this remains one of the major risks.