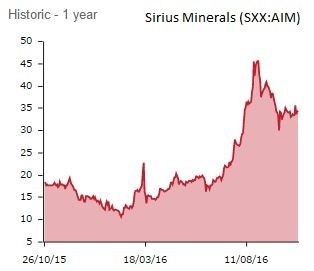

Sirius Minerals' (SXX:AIM) financing tie-up with Australian mining billionaire Gina Rinehart sparked frenzied trading in the hour after markets opened.

Shares in Sirius traded half their average daily volume in early deals after it revealed a $250m (£204m) investment from Rinehart’s privately-held Hancock Prospecting vehicle.

In return, Sirius will make royalty payments from its North Yorkshire potash project when it moves into production.

Rinehart, Australia's wealthiest individual with a fortune topping $8.8 billion, is a mining magnate with interests in Australian media assets.

'This project delivers a new and natural product which is relevant to Hancock's focus on agriculture and after years of field tests and across many crop types, demonstrated improved yields,' Rinehart said in an interview with the Australian Financial Review.

'Sirius has a large, high quality mineral resource and is located in a stable jurisdiction with a competitive tax rate. The project has the potential to become one of the world's leading producers of multi-nutrient fertiliser, and could have a life of 100 years - this fits with my approach of investing in strategic areas for the long term.'

Sirius chief executive Chris Fraser says the agreement is an important part of financing plans for the project, which was estimated by analysts at Liberum in May to have a net present value of $7.1bn.

Fraser estimates the business, which has a market value of £801m, needs to raise close to $3bn to fund development of its potash resource, a raw material used as fertiliser in agricultural production.

Stage one of its financing plan is to find $1.1bn of external capital. Investments required to move the project into production include new ship loading facilities, a conveyor linkage to a handing facility and purchases of land and property, on top of capital required for extraction.

Sirius' cash resources totaled just £16m at 30 June 2016.

‘Successful financing would be the largest re-rating catalyst to date,’ wrote Liberum analyst Richard Knights in a May research note.

China industrial outfit Dian Huang has already agreed to buy some of Sirius’ future production in an offtake agreement.

‘We are delighted to have signed this agreement with such an experienced party in the mining industry, as well as one that has very successful and strong leadership and a long term and growing agricultural interest,’ said Fraser.

Rinehart's Hancock Prospecting also has the option to buy $50m of shares in the business, subject to conditions not disclosed by the company.

Shares in Sirius trade 5.7% higher at 56p.