McColl’s won’t be the only business to collapse this year

Prime minister Keir Starmer and chancellor Rachel Reeves have made no bones about making ‘painful’ decisions in order to stabilise public finances and grow the economy, so investors are right to be nervous over what might be included in the Labour party’s first Budget since 2009 at the end of this month.

Top of the list of investor concerns is that rather than raising income tax, national insurance or VAT (value-added tax) across the board, which the party has pledged not to do, it will focus on what it calls those with the broadest shoulders by raising the tax on capital gains and reducing the tax breaks on saving and investing.

In this article Shares seeks to identify some of the key areas to watch and examines which parts of the market might be at risk from budget cutbacks or higher taxes.

ISA simplification

A non-revenue raising measure in the Budget could be to simplify ISAs. Potentially by reducing the number of iterations of the tax wrapper and/or allowing you to hold cash and stocks and shares within the same account.

CAPITAL GAINS TAX IN FOCUS

Since coming to power, the Labour party has repeatedly referred to a £22 billion ‘black hole’ in public finances which it inherited from the Conservatives in order to prepare the public for

tax rises.

‘While the chancellor pledged in the election campaign not to raise the rate of income tax, that doesn’t preclude extending the current freeze on thresholds, which is tantamount to raising tax by the back door,’ observes AJ Bell’s head of personal finance Laura Suter.

This wouldn’t be a new policy – the Conservatives used it to raise taxes when wages were rising at a time of high inflation – and the effect may be muted if inflation and wage rises slow, but it is still an easy way to raise tax revenue.

Capital gains tax (CGT), on the other hand, looks like an obvious place for the government to make changes and generate more tax revenue.

‘The most radical option is equalising CGT rates with income tax – which would represent a huge tax increase for investors,’ says Suter.

‘The Office for Tax Simplification previously argued the CGT exemption was too high and the disparity between rates of CGT and income tax distorted decision-making. The CGT free allowance has been slashed in the past two years as Jeremy Hunt sought to balance the books, but that doesn’t rule out further tax increases.’

Yet raising CGT may not be the cash cow the government hopes – indeed its own figures suggest a hike in tax could actually lead to lost revenue because investors would change their behaviour.

This would seem to be confirmed by a recent poll of Financial Times readers which showed many of those who own stocks and shares outside of ISAs have already been selling down their holdings in anticipation of an increase in the tax rate.

‘An alternative would be to get rid of some of the CGT tax breaks for businesses, where business owners selling their company benefit from a lower rate of CGT,’ suggests Suter.

Raising this rate from 10% up to 20% to equalise it with standard CGT rates could generate £710 million for the government by 2027/28, but it would clearly be unpopular with entrepreneurs.

CGT being wiped out on death also creates an incentive in some cases to hold onto assets, so they are taxed as part of the estate under inheritance tax (IHT), potentially paying less or no tax.

However, if the government scrapped this tax break there would likely need to be some allowance made to account for inflation, warns Suter, otherwise people who have owned investments for a long time would be severely punished.

PENSIONS TAX RELIEF UNDER THE MICROSCOPE (AGAIN)

There has regularly been speculation over a cut to pensions tax relief running into major fiscal events and this time is no different.

Among the most obvious avenues the government could go down would be to restrict the entitlement to tax-free cash when an individual retires.

Currently you can take 25% of your pot as tax-free cash from the age of 55, rising to 57 from 2028. This could be lowered or even abolished although this would be unpopular and fraught with complication given the need to avoid retrospectively hitting people who have built-up entitlements under the current regime.

Another possibility would be to introduce a flat rate of pension relief, meaning higher and additional rate taxpayers would get the same as basic rate payers. However, this could create problems with defined benefit schemes in the public sector.

Finally, the Treasury might look to remove the ability to pass on a pension pot tax-free to nominated beneficiaries before the age of 75, and for it to be taxed as income after the age of 75 and not form part of your estate for inheritance tax purposes.

WHAT OTHER TAXES ARE ON THE TABLE?

Given the previous government slashed the dividend tax allowance from £5,000 to just £500, it is debatable whether Labour will cut it any further.

‘HMRC expects to collect almost £18 billion from dividend tax in the current tax year so it is already a meaningful source of revenue,’ points out AJ Bell investment analyst Dan Coatsworth.

‘While slashing the allowance, perhaps to £250, cannot be ruled out, the new government would be incredibly unpopular with investors if it reduced the dividend allowance any further.’

Another option would be to raise the rate of dividend taxation, suggests Coatsworth, although there’s only so much room for manoeuvre with tax rates on dividends already very close to matching income tax rates for higher and additional rate taxpayers.

‘The government will likely tread carefully here. Labour wants to encourage investment into the UK stock market and create a more vibrant place for British businesses to access growth capital. Therefore, taking even more of investors’ returns as tax would mean shooting itself in the foot.’

Again, on the topic of inheritance tax, the government’s only move so far has been to end the use of offshore trusts for tax avoidance, and analysts believe it is unlikely to increase the current headline rate of 40%, although it could tinker with allowances or whittle away some relief.

For example, as it stands a couple leaving their main residence to their children could potentially shelter a £1 million estate from IHT thanks to the personal nil-rate band and the residence nil-rate band, but either of these could be cut.

AIM FIGHTS ITS CORNER, FINALLY

The issue of inheritance tax exemption for investments in stocks listed on AIM is also a live one. There has much been speculation BPR (business property relief) could be abolished in the budget

on the basis some people just use AIM shares as

a way of avoiding tax in the event of their death rather than it having anything to do with the relief’s objectives.

Instead of exempting AIM shares from IHT, some commentators have suggested introducing progressive taxes and giving people up to 10 years to pay.

In the nick of time, Grant Thornton has published a report commissioned by London Stock Exchange Group (LSEG) saying the AIM market ‘continues to play an important role in supporting business growth and in doing so provides a range of investor opportunities, delivering notable economic value to the UK’.

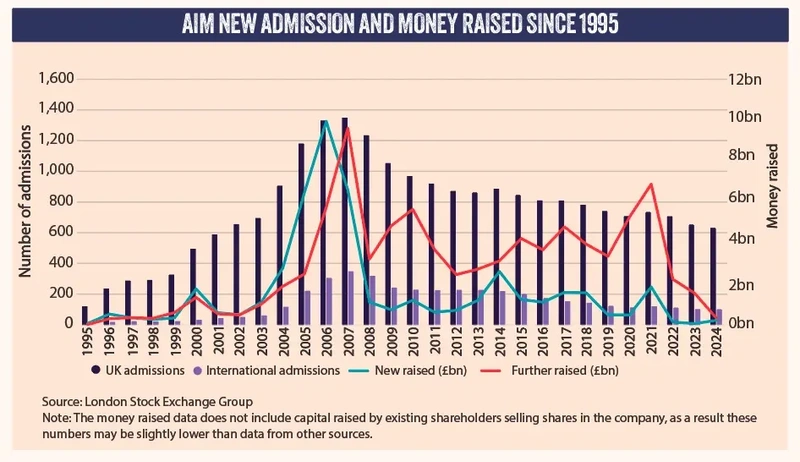

Since its inception, AIM companies have raised £48 billion at admission and followed this with further fundraising amounting to £87 billion, say the authors, although the total money raised in 2023 was admittedly 70% lower than in 2020.

The study also claims AIM companies contributed close to £36 billion of GVA (gross value-added) to UK GDP last year, more than either the arts and entertainment sector, advertising and marketing, or agriculture, forestry and fishing, and directly supported more than 400,000 jobs while generating £5.4 billion in corporation tax for the Treasury.

‘By providing access to the necessary funding, AIM enables new and existing companies to make the investment needed to turn ideas and knowledge into marketable products and services,’ continues the report.

In terms of GVA per job filled, AIM companies are supposedly more productive than the national average with productivity of £87,100 GVA per employee against a national average of £58,327 and a London average of £82,801.

The message is clear – AIM companies represent growth and profitability, and given the government’s mission to ‘support economic growth and create good jobs and productivity in every part of the country’ it should leave well alone, especially when it comes to business relief which incentivises investment.

WHICH SECTORS COULD BE AT RISK?

The new chancellor has already set out a target to halve the amount it spends on external consultants and contractors in a push to save more than £1 billion annually, with work being passed to the civil service instead.

According to a Labour spokesman quoted by Reuters, ‘We are taking action to stop all non-essential government consultancy spending in 2024-25 and halve government spending on consultancy in future years, with a target saving of £550 million in 2024-25 and £680 million in 2025-26.’

Consulting firms have been told any contract above £100,000 must be signed off in future by a permanent secretary, and contracts above £600,000 will need approval from the relevant secretary of state.

Transport and infrastructure providers are also likely to see their budgets squeezed as the chancellor seeks more savings to plug the deficit.

The electrification of the Manchester-to-Leeds train line, which has been delayed for years due to tinkering by ministers and other interested parties, is apparently being studied to see whether the contractors can find savings out of the £11.5 billion budget.

Meanwhile, despite London mayor Sadiq Khan’s enthusiasm for working with a Labour government, none of his £50 billion of unfunded projects – like extending the Bakerloo line south to Hayes, building a North-South ‘Crossrail 2’ between Wood Green and Wimbledon or a West London orbital suburban line joining up Hendon and Hounslow – are likely to find a friendly ear in Westminster.

Two years after the Elizabeth Line opened, and for the first time in two decades, there are no large public transport projects being built in London other than the HS2 rail link, which is technically an inter-city link and isn’t aimed at improving transport inside London.

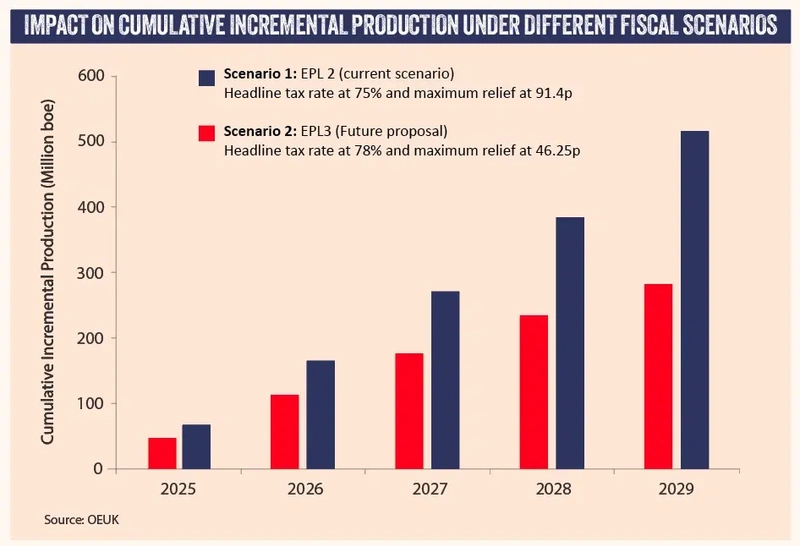

Another sector which doesn’t have much to look forward to in the budget is North Sea oil and gas production, which faces tax proposals described by energy consultants Wood Mackenzie as likely to cause ‘irreversible damage’.

Energy firms have already scaled back their activity this year, including halting new projects, while they wait for a decision on windfall taxes and relief on capital spending.

As things stand, from November companies will have to pay 78% tax on their profits after an increase in the energy profits levy which was introduced by the previous government in response to the jump in energy prices following the invasion of Ukraine.

Wood Mackenzie suggests if the energy levy remains in place and all allowances for investment are removed it ‘would wipe out £19 billion or 65% of the UK’s remaining development capital expenditure, halve UK production by 2030 and all but eliminate industry cash flows by the 2030s’.

The consultants also warn that under this scenario smaller companies will likely fail leaving their partners – and possibly the UK government – on the hook for future decommissioning costs which could run to £40 billion according to the North Sea Transition Authority.

DISCLAIMER: Financial services company AJ Bell referenced in this article owns Shares magazine. The author (Ian Conway) and editor (Tom Sieber) of this article own shares in AJ Bell.