A trio of IPOs (initial public offerings) are announced as the UK market reopens after the long bank holiday weekend. Leading the pack is Clipper Logistics which works for retailers including SuperGroup (SGP), ASOS (ASC:AIM), John Lewis and Tesco (TSCO). Although it has many supermarket clients, the focus is on non-food retailing. It specialises in online fulfilment and returns.

The business is expected to be valued at £130 million upon admission to the main market. Clipper is highly cash generative, profitable and is expanding across Europe. It is owned by the founders and management who are selling down half their holding.

It undertakes product warehousing, distribution and returns management. Clipper reckons that between a quarter and 40% of all clothing and footwear purchases in the UK are returned. Whereas in the past most people would return the product to the store, consumers now prefer to send it back by post. Indeed, one of the big influential factors whether to use certain online retailers is if they offer free returns.

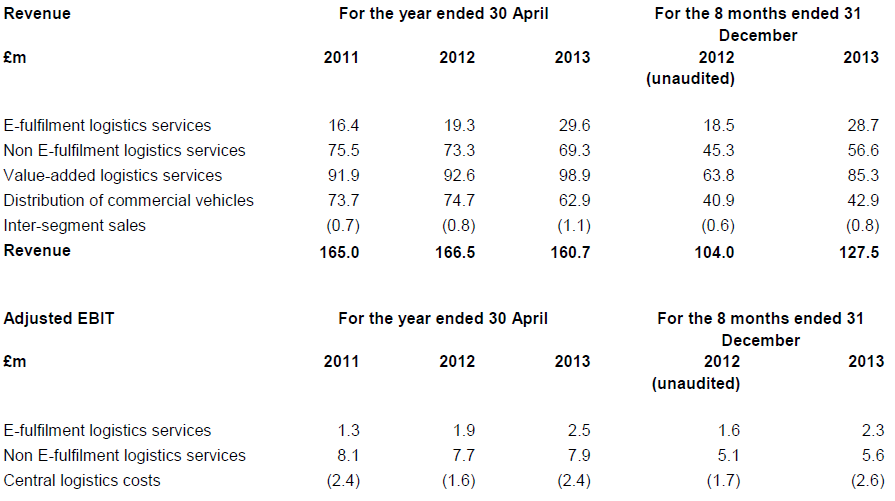

Costs incurred by Clipper are recharged to the customer alongside a management fee. Earnings before interest and tax (EBIT) is expected to have grown by 10.3% in the financial year to 30 April to £9.6 million.

This table gives you a broader look at the company's financials:

The UK logistic contracts business sees Clipper get paid during the month in which services are delivered, hence the business is working capital neutral. The working capital requirements for its commercial vehicles arm is 'substantially funded' by manufacturers.

Advertising expert

Israeli group Marimedia is headed for the UK stockmarket. It works for website publishers to help them make more money from digital advertising via its Qadabra platform. It gathers advertiser bids and creates immediate auctions for the publisher's online advertising space. The business is expected to be valued in the range of £93 million to £112 million when it joins Aim, targeted for May or June.

Marimedia hopes to raise £18 million in new money to fund expansion through opening new offices and acquisitions. A further £12 million will be raised for the founders who are selling down part of their existing holding.

The company is profitable, cash generative, debt free and is expected to pay dividends. The chairman is Tim Weller, head of publishing group Incisive Media which owns titles including Legal Week, Computing and insurance trade magazine Post.

It generated $43.3 million revenue, £8.7 million earnings before interest, tax, depreciation and amortisation (EBITDA) and $7.3 million cash from operations in 2013.

Money man

Irish accounting and payroll software provider for small-to-medium sized business Big Red Cloud is to join Aim with a potential ?20 million valuation. The small cap is seeking to raise ?5 million to further develop its product functionality and expand into the UK and other markets.

The business generates small amount of revenue and made ?72,000 EBITDA in the year to January 2014. It is planning a big market campaign to crack the UK market.