Shares in used car dealer Motorpoint (MOTR) are in free-fall after half year results revealed weaker than expected sales and margins.

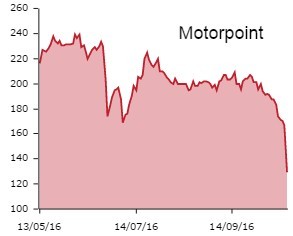

Motorpoint, which joined the stock market in May 2016, is down 24% at 128p and now trades far below its 200p a share initial public offering (IPO) price.

Half year results published today are disappointing, writes Numis analyst Andrew Wade, though some of the factors driving Motorpoint's profit warning may be one-off in nature.

'While clearly disappointing, the soft first half earnings performance appears to be somewhat one-off (and potentially self-induced) in nature, rather than anything more structural,' writes Wade.

'As such, and with the roll-out continuing and ‘positive progress’ being made on a number of new sites, we retain our positive stance, albeit with a lower target price.'

Wade cut full year pre-tax profit estimates by 20% from £21m to £16.7m.

Motorpoint chief executive Mark Carpenter is optimistic about net margins, a key driver of the profit warning, returning to more normal levels in the second half of 2016.

Three new sites over the last year should also bolster full year sales and earnings.

Following Motorpoint's May IPO Shares argued the company's stock price did not deserve to trade at such a large premium to the rest of the market.