A better-than-expected performance in 2012 has made rat-catcher Rentokil Initial (RTO) one of the best FTSE performers, rising 10.5% to 100p. This puts the shares back to their highest level since May 2011, somewhat surprising given that its City Link operation remains loss-making after years of efforts by management to nurse the division back to profit.

Rentokil has reported £191.1 million adjusted pre-tax profit for 2012. Consensus forecast was £186 million. Cost savings are ahead of expectations and management are upbeat about the business.

But here's the ongoing problem. City Link's £26.4 million loss is slightly worse than guidance (£25 million), so the company's goal of break-even in the 2013 financial year could be unachievable.

Analysts says the stock could be deemed as cheap, given that Rentokil trades on 11.4 times 2013 earnings forecasts compared with the outsourcing sub-sector average of 13.5 times. But the shares are obviously cheap for a reason and that is the inability to make City Link an economically-viable proposition.

Canaccord Genuity makes an interesting point in saying that the stock may not be as cheap as first believed, if you add in the one-off costs that regularly accompany Rentokil's results. HSBC flagged up in January that Rentokil had reported 32 consecutive quarters of group-wide exceptional items. It is fair to exclude exceptionals when analysing the health of the business if they are truly one-off events. Yet Rentokil doesn't seem to know the meaning of 'one-off'.

The fourth quarter of 2012 saw £25 million of reorganisation costs and one-off items, including £10 million of write-offs and costs on Belgian flat linen.

Analysts are not clambering over themselves with 'buy' ratings. Espirito Santo is bullish, citing Rentokil's numerous divisions capable of generating 'a sustainable high margin and return-on-invested-capital'. Yet its 95p 'fair value' price has already been exceeded by this morning's share price gain. Investec sits on the fence with a 'hold', saying the shares are worth 94p based on a sum-of-the-parts valuation. Bank of America Merrill Lynch has a 'neutral' rating. Canaccord Genuity is a seller with 72p price target.

Rentokil has enjoyed several share price rallies in the past year as the market reckons the business is worth a lot more - if you exclude City Link's losses. HSBC flagged in January that the market is pricing in a sale, fix or closure of the business, hence why the share price has seen decent gains. 'A bigger, less risk-laden, multiple could be applied to earnings not dragged down by the losses of City Link,' it said. 'However, very few of the consensus earnings forecasts appear to assume anything less than a return to breakeven for City Link within one to two years.'

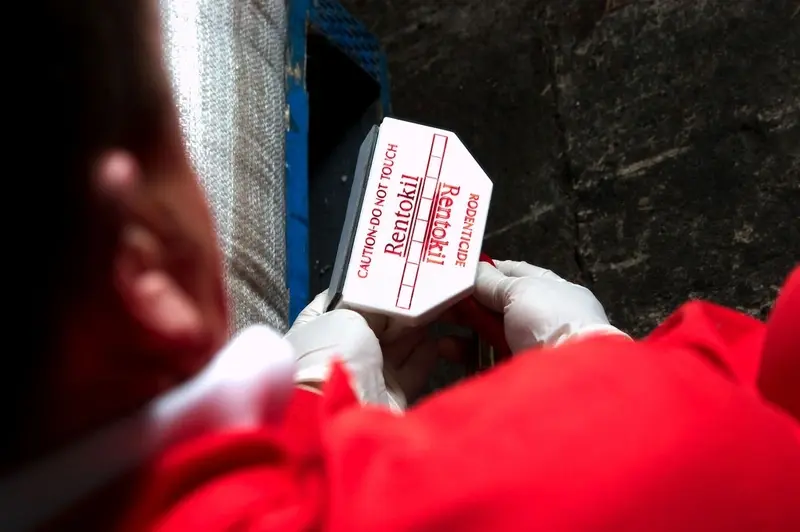

In Rentokil's defence, credit must be given to management with the way they have driven the Pest Control division given that its end market isn't overly-healthy. Revenue grew by 2.8% (0.4% organic) in 2012, helped by some bolt-on acquisitions. The strongest performance came from North America, up 10.3% (5.5% organic). The Facilities arm also enjoyed slow but steady gains with 2.1% higher revenue. If you exclude the Spanish operations where business is being scaled down then the divisional revenue grew by 3.8%.