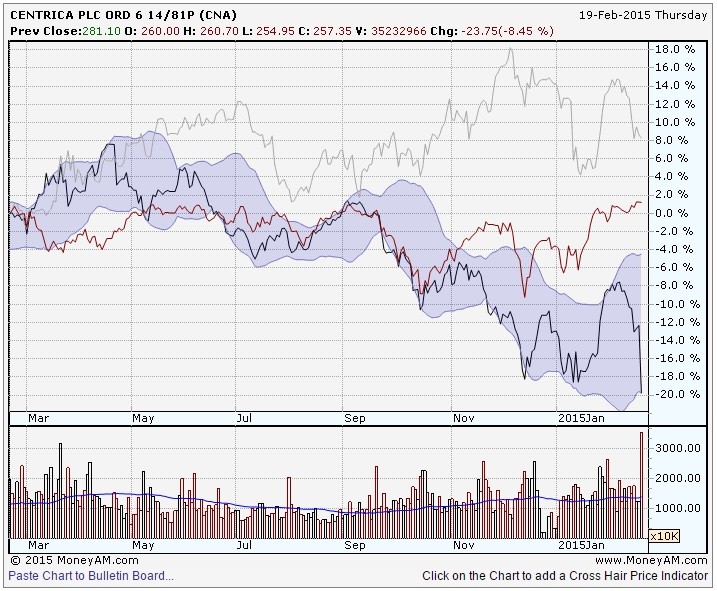

One of the main benefits of investing in highly regulated businesses is supposed to be the transparency, and the hefty income yield, which makes today's shock 30% payout cut by Centrica (CNA) a huge blow. You can read the details for yourselves, but in short, the British Gas-owner has slashed its final dividend, rebased future payout expectations, and is wielding the axe on operating costs and investment. The shares are down 8.5% at 257.3p.

The warmest year (2014) on record, last winters Polar vortex in the US, and the stunning collapse in oil and gas prices are blamed. Annual profit slumped by more than a third, while operating profit at British Gas fell 20% to £823 million. Credit rating agencies Moody’s and Standard & Poor’s have slapped the group on its negative outlook list, posing another threat to its debt and bonds.

A weak operating performance was largely anticipated given the well-known slump in wholesale energy prices, mild weather and rising regulatory and political risks. 2014 adjusted earnings oper share (EPS) may have dropped by 28% to 19.2p, yet this was 'bang in line with expectations,' spells out Emmanuel Retif, research director at boutique broker Raymond James European Equities. Consensus was pitched at 19.3p, according to Morningstar data. Yet the 2015 outlook has also taken a significant turn for the worse. Centrica guided for growth in 2015 adjusted EPS in its November interim management statement, but now says the drop in commodity prices should weigh by 2.5p on 2015 EPS.

A re-allocation of assets may have been needed but Centrica seems to have, to a large degree, waited to be pushed rather than being proactive. In fairness, the group had been trying to flog its US-based combined cycle gas turbine plants, but that flopped given the low bids received.

Iincome-seeking investors can stomach a bit of capital value volatility, but mess with the payout, that's another story. He forward yield has gone from Eyes are likely to turn to rival gas and electricity supplier SSE (SSE), which is facing similar pressures. Its' fiscal year runs until end March, and a trading update towards the end of next month will hotly awaited, or dare I write, dreaded.