Newsagent chain McColl's is to join the stockmarket next month, representing the first retail IPO of 2014. The UK-based group hopes to raise £50 million to reduce debt. The float will also provide a chance for existing shareholder Cavendish Square Partners and various members of McColl's staff to sell down part of their holding.

McColl's has 1,276 stores split across three formats. There are 714 McColl's branded convenience stores which sell a wide range of products and services. It plans to upgrade 70 of these sites into 'premium' higher-quality stores and roll-out this concept via the acquisition of 32 independent convenience stores.

It has 94 Food and Wine stores. This number is expected to rise sharply over time as its converts a good slug of its 562 newsagent stores into the grocery and alcohol-led format.

The group plans to extend its total store portfolio by 1,350 stores over the next three years.

The company believes its wide range of services make it stand out from the competition. This includes post office services which it plans to extend across more sites in the near future. It also offers bill payments, mobile phone top-ups, newspaper and magazine deliveries and the collection and delivery of goods bought via the internet. Apart from the post office facilities, you could argue that most non-rural newsagents offer most or all of these services which means McColl's competitive edge is not as strong as its IPO document may lead you to believe.

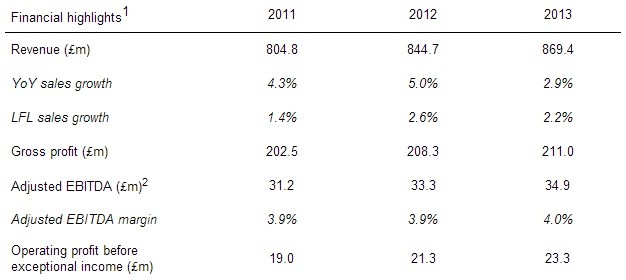

This table shows you the company's financial performance over the past three years. This is clearly a low margin business and one that has growing competition in the form of supermarket convenience stores.

Stockbroker Numis is floating the company and it will be interesting to read its sales pitch for the shares once the blackout period expires on its research. At first glance of today's intention to float announcement, we're not convinced this will be a big IPO success. But we're ready to be proved wrong and will look at the stock more closely in a future issue of Shares once we've had a chance to talk to management and view the earnings forecasts.