Just Eat, an online portal for ordering takeaway food, confirms months of rumours that it will join the stockmarket. The business plans to raise £100 million of new money and several existing shareholders are expected to sell down some of their holdings. It is targeting an April debut on London's main market and could fetch a valuation of between £700 million and £900 million. We imagine this float will do very well.

The business is profitable and operates in 13 countries including the UK, Canada and Denmark. The intention to float announcement includes a claim that online orders were found to be 30% higher in value than ones placed over the phone, hence why Just Eat may find it easier to win new restaurant clients.

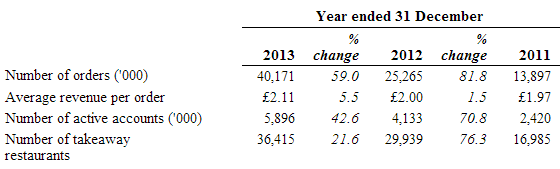

This table is the most important bit of information in the IPO announcement. It shows the scale of Just Eat's activities, its average commission and rapid volume growth.

Just Eat's costs equal £3.70 per active account but the business makes £2.10 average revenue per order. It says half of all consumers use the Just Eat technology platform more than once. Of those repeat visits, the average consumer makes 10 orders per year - illustrating how Just Eat's model looks highly attractive from a financial perspective.

Just Eat wants to expand its service so consumers can order food for collection from restaurants that don't have the capacity to deliver. This would add a new market for the group.

Given that takeaway food is a discretionary spend, any economic setback could have a major impact on Just Eat's earnings as takeaways would be one of the first areas where a consumer would cut their spending if times got tough, alongside dry cleaning. But in a growing economic environment, Just Eat is likely to see increased business. Indeed, the rise in internet and mobile-based orders at Domino's Pizza (DOM) illustrates how consumers are embracing new technology to obtain takeaways, as it is so much easier than having to call a local store.

If you want information on other companies coming to the market, read our IPO guide. It contains all the details of upcoming, rumoured and recent floats. We update the guide on a daily basis.