Shares in cash shell Haversham Holdings (HAV:AIM) have been suspendedamid talk it is about to reveala deal to buy Britain's largest seller of used vehicles, BCA. That business had tried to float on the stock market in late 2014 but pulled the deal amid market volatility. It may now finally become a listed entity if Haversham can secure a rumoured £1.2 billion.

Haversham floated in November 2014, raising £30 million to acquire and develop businesses in a variety of sectors including automotive. Although you might think there's a big difference between £30 million for its current cash position and the sky-high price tag attached to BCA, Haversham always intended to strike deals with an enterprise value of circa £250 million to £1 billion.

Cash shells often raise a small amount of cash to cover due diligence costs for potential acquisitions, and then go and find much larger amounts of money once they've found the right deal to make.

Haversham was formed by Avril Palmer-Baunack, who recently lasted a mere 10 weeks as chairman of transport group Stobart (STOB), and investment management company Marwyn. The latter is known as one of the key financiers behind Peppa Pig merchandise and TV rights specialist Entertainment One (ETO), now worth £880 million.

Marywn has also become a cornerstone investor in Zegona, the cash shell set up by various former directors of Virgin Media who want to 'buy, fix, sell' in the telecoms space. We revealed Zegona's plans in this recent article.

Marwyn has taken a 5.84% stake (based on net asset value) in Zegona which it set to join AIM on 19 March.

BCA brings together professional buyers and sellers in the wholesale part of the used vehicle market. Via its vehicle remarketing division, it operates physical and online auctions. Buyers, including franchise dealers, light commercial vehicle (LCV) dealers and used-car traders use it to search for inventory.

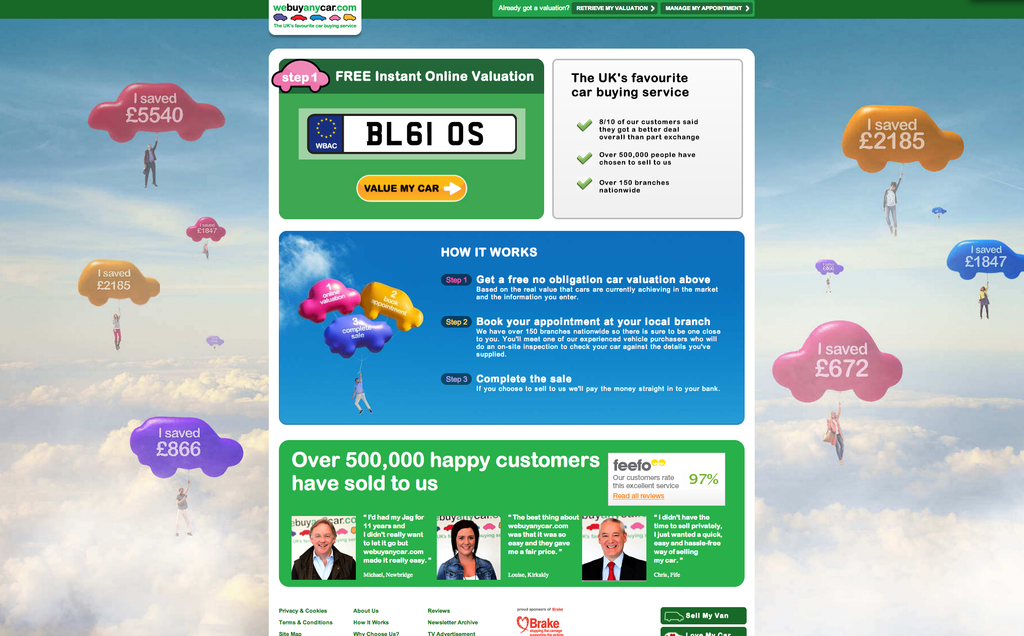

Vendors including manufacturers, leasing and rental companies, some of the biggest car dealership groups and finance houses across Europe, supply the stock. BCA also owns the retail-focused car buying website webuyanycar.

We discussed the investment appeal of BCA in this detailed article from October 2014, written around the time the business was trying to float.