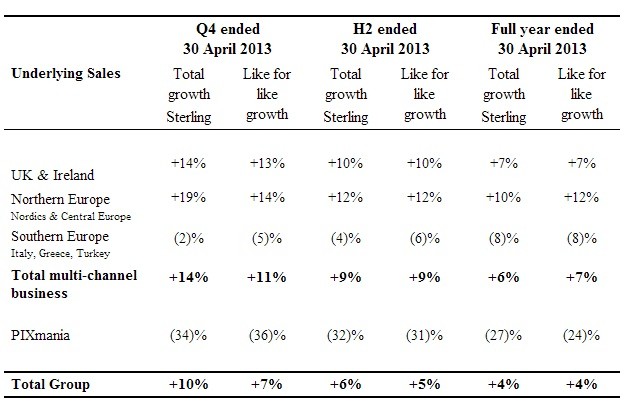

An impressive trading update from Currys-owner Dixons Retail (DXNS) has ignited the share price, rising 6.6% to 38.9p. It says pre-tax profits for the year to 30 April are expected to be at the top end of the £75 million to £85 million forecast range and the business has moved into a net cash position.

The bullish statement will fuel momentum in the share price that has been in a rising trend from 15p since last August. It also puts Dixons in a strong position to keep receiving earnings upgrades from the analyst community.

Stockbroker Panmure Gordon says Dixons is clearly gaining share in the UK and sees 'significant future profit opportunity' as it benefits from the demise of rivals including Comet (which it reckons could add £30 million to earnings before interest and tax) and eliminates losses overseas. 'There is also the added bonus of cash on the balance sheet a year earlier than expected.' It has a 45p price target.

Cantor Fitzgerald sees the biggest value creation opportunity to be the turnaround of the estimated £58 million of PIXmania and Southern European losses in its forecasts over the next few years. It retains a 42p price target.

Dixons has dramatically reinvented itself, as we discussed in a recent Plays of the Week article on the stock (click here). It has made significant improvements to customer service and transformed into a successful multi-channel retailer.

Chief executive officer Sebastian James today says: 'This strong year puts Dixons in the best position it has been in for many years. We have worked hard to improve the conversation that we have with our customers and to improve our shops and our prices. This is paying off as customers increasingly choose us when they need electrical products, and - more importantly - tell us that they like what we are doing. I believe that we have a clear business model that allows us to flourish in an internet world.'