Investors have been getting a kick out of BT (BT.A) for months. Long seen as a legacy network operator bumping its head on a growth ceiling and left with little choice than to hack away at costs to drive earnings, the £30.8 billion group has cleverly used its robust cash flow to emerge as a changed company.

?Solid cash generation from the copper network has enabled BT to invest heavily in fibre to the cabinet (FTTC) as well as BT Sport, with the fruits now evident in an unprecedented 10% rise in Consumer revenues,? say analysts at IT and telecoms consultancy Megabuyte after first quarter results (31 Jul). That?s more impressive than anything chief rivals British Sky Broadcasting (BSY) (Sky), TalkTalk (TALK) or Virgin Media are managing, and beats anything recently put up by the major mobile network operators.

Since first announcing its content ambitions in 2012 BT has pursued its ?invest to grow? strategy aggressively and it is working. ?BT is in a sweet spot, after years of underperformance, it is using fibre and BT Sport to take market share in a market that is sustainably increasing pricing,? remark analysts at investment bank Berenberg.

Wisely, BT has been bleeding fibre into its base on the back of a BT Sport offer, improving customer quality and bolstering average revenue per user (ARPU). In the three months to 30 June ARPU increased 8% to £398, while BT took 64% of broadband market net additions and grew its fibre base by 10% in the quarter to 2.3 million customers.

(Click on table to enlarge)

With Premier League screening rights due to go up for auction, probably in early 2015, BT looks likely to try to expand its coverage further. Price inflation is inevitable yet the wider content market (movies, TV box-sets etc) is seen to be functioning efficiently. BT, which unlike Sky has no major self-funded TV content to defend, seems to have the advantage as the content market develops.

The next battle lines are being drawn in mobile where BT will launch its own mobile virtual network operator (MVNO) service using partner EE?s infrastructure. That will be another useful bundle tool to further bolster APRU and cap churn.

Challenges await

But the strategy is not without risk. The elephant in the room remains Vodafone (VOD), which could be provoked into starting its own fixed-line consumer service in response through its Cable & Wireless Worldwide business. Yet having sold its modest 37,000 consumer fixed-line customers to BT only two years ago, doubts remain.

BT also faces possible regulatory risks as watchdog Ofcom decides how best to supervise fibre networks in the long-term. We won?t second guess any outcomes but do point out that BT remains the most credible telecom infrastructure investor the UK, and Ofcom will not want to jeopodise future investment by strangling BT with red tape.

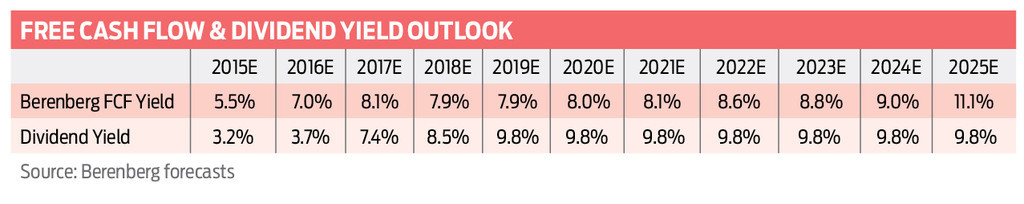

Cash flow remains key for BT?s future plans as it has a substantial pension deficit to reduce and payout ratio to maintain. But this seems manageable. Berenberg raised its free cash flow (FCF) forecast for the group in May from £2.3 billion to £2.6 billion, while an extra £1 billion-plus of fat is believed to be available to hack from operating costs.

Investors are gradually coming round to the idea that BT is no longer a growth-capped, debt hamstrung business.