Diversified miner BHP Billiton (BLT) has respondedto press speculation that it will spin out non-core assets into a new business by saying it is studying the 'next phase of simplification'. Reports suggest it will offload aluminium, nickel and manganese interests and focus on its larger iron ore, copper, coal and petroleum operations, giving investors shares in the new company. The shares rise 2.6% to £18.92.

In its response, BHP flags these four commodities as its core focus, adding that potash could be a potential fifth priority. It comments: 'We continue to actively study the next phase of simplification, including structural options, but will only pursue options that maximise value for BHP Billiton shareholders. Any course of action remains subject to detailed review and an assessment of alternatives.'

The response is somewhat oddly-worded with BHP hinting there's some truth to the speculation, yet still leaving room for interpretation. Investec says the announcement 'is certainly an unusual one', but adds that the miner is merely reiterating the same strategy that's been publicised for several years.

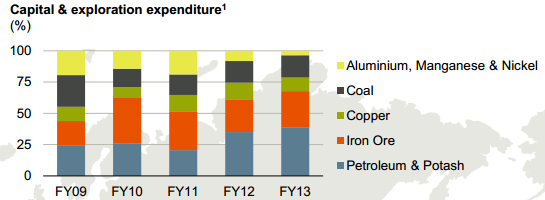

This table shows how the aluminium, manganese and nickel operations have increasingly seen a reduction in funding from BHP over the past few years compared with other commodities.

Former Xstrata boss Mick Davis yesterday said his X2 Resources vehicle had secured $2.5 billion of funding to start buying mining assets. The market has long speculated that X2 would buy BHP nickel assets. X2 doesn't intend to float on the stockmarket, certainly not in the near term.

BHP last spun out assets in 2002 when its flat steel products business became BlueScope Steel. Two years earlier, the long products steel business was spun out to create One Steel.

The miner's next scheduled announcement is a quarterly operational review, due on 16 April.