Babcock International (BAB) is to raise £1.1 billion through a fully-underwritten rights issue at 790p per share to buy helicopter rescue group Avincis for £920 million. Babcock will also assume £705 million of Avincis' net debt. The deal will broaden Babcock's expertise and geographical footprint.

The news shouldn't surprise investors as takeover discussions were leaked to the media last November. Avincis is owned by private equity and has a strong record of earnings growth. It undertakes aviation services for mission-critical operations like medical emergencies, civil protection, search and rescue and fire fighting.

The acquisition is expected to enhance Babcock's earnings after its first full-year of ownership. It will achieve a return on invested capital above Babcock's current cost of capital after the second year of ownership.

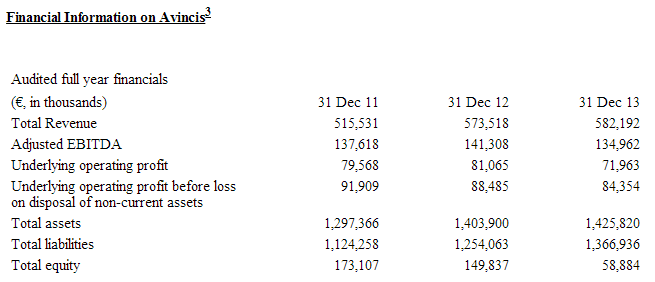

Babcock is paying 14 times 2013 adjusted EBITDA (earnings before interest, tax, depreciation and amortisation). That's a relatively high price for an acquisition. Indeed there's no immediate revenue synergies with the company saying this is a 'medium term' synergy opportunity.

Yet the deal does look logical if Babcock can accelerate Avincis' growth. As it stands, the target has very good earnings visibility. Approximately 85% of budgeted 2014 revenue is in the order book or at the preferred bidder stage; likewise 56% for 2015.

The order book stood at ?2.3 billion as of 31 December 2013 and there's a ?7 billion pipeline of opportunities as of 10 March 2014. Contract tender decisions are made much faster than in Babcock's existing space.

The rights issue will see existing shareholders be eligible to snap up five new shares for every 13 existing ones. The new stock is priced at a 42.2% discount to last night's closing price. The theoretical ex-rights price is £12.06. Babcock's shares today fall 4.8% to £13.