Global online fashion store ASOS (ASC:AIM) continues to impress the market with today's trading update pushing the stock 3% higher to £41. A tie-up with Primark provides further reason to stay bullish.

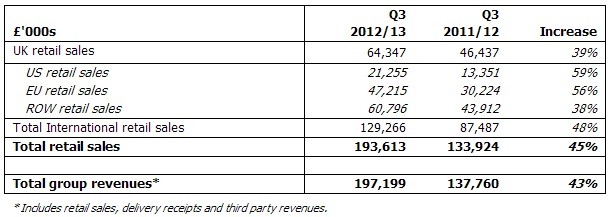

For the quarter ending 31 May, ASOS' retail sales surged 45% higher to £194 million (see table below), driven by near-40% sales growth to £64.3 million in the still struggling UK economy and a 48% rise in international sales to £129.3 million.

ASOS continues to set the trend for using social media and celebrity trends to lure in fashion-forward twenty-somethings, while the £3.3 billion cap's investment in competitive pricing is clearly resonating with an often cash-strapped UK consumer demographic.

While the UK was the stand-out performer, with growth accelerating over the 26% achieved in the first half, it is international sales, which now speak for 67% of the business, that underpin the investment case.

ASOS is seeing the strongest growth rates in countries where it has dedicated websites and in-country teams, notably the US, France, Germany and Australia. The company launched a new Russian website last month and recently disclosed its long-awaited expansion strategy for China, with a launch into the vast Asian market expected in October.

In a further significant development ASOS, which sells both branded and own-label products, has inked a tie-up with budget fashion chain Primark, famed for its focus on physical store expansion at home and across Europe. Owned by Associated British Foods (ABF), up a penny at £17.83 in early dealings, Primark is undertaking a limited trial of online sales with ASOS, which it hopes will give it some insights into online retailing and could prove a money spinner for both businesses.

Analyst reaction to the ASOS statement was generally positive. Numis Securities' Andrew Wade reiterated his 'buy' rating and raised his price target to £50. Full-year profit estimates for the financial year ending August 2013 are ratcheted up from £50.7 million to £52 million this year and from £64 million to £65 million for 2014. He writes: 'We continue to believe that ASOS is a unique global proposition, a profitable fast fashion online pureplay, investing in driving exceptional growth, and squarely targeting the twenty-something fashion market.'

One dissenting voice was Espirito Santo's Sanjay Vidyarthi, who sticks with his 'sell' rating and has a £12 fair value estimate for the stock. He writes: 'Given the sales momentum, it is hard not to see some upside risk to consensus forecasts, albeit we do expect further pressure on the gross margin and operating costs - in line with our longer term thesis.'