Distribution deals put small cap in a brighter place

A further improvement today (29 Aug) in the weekly US unemployment claims statistics, as published by the Labor Department, would auger well for next week’s (6 Sept) key non-farm payrolls (NFP) report and renewed dollar strength.

Despite mixed signals from both the manufacturing and housing sectors, the NFP figures will be the key focus of the US Federal Reserve when it comes to deciding on tapering quantitative easing (QE) at next month’s Federal Open Market Committee meeting (17 -18 Sept).

The prospect of tightening monetary policy has been reflected in an increase in the yield on 10-year Treasuries but the benchmark bond has rallied (and its yield fallen, along with the dollar) on the back of Monday’s (27 Aug) poor core and non-core US durable goods orders data for July.

A 0.6% drop in core durables bucked expectations while the non-core figure, plunging 7.3%, was even more disappointing. After Shares had gone to press the National Association of Realtors released (28 Aug) its July pending home sales figures following Friday's (23 Aug) disappointing new housing sales report.

But strong claims numbers today would put the prospect of tapering next month back on the table, just as eurozone concerns rise ahead of Germany’s elections (22 Sept) while talk of a third Greek bail-out continue to stalk the single currency.

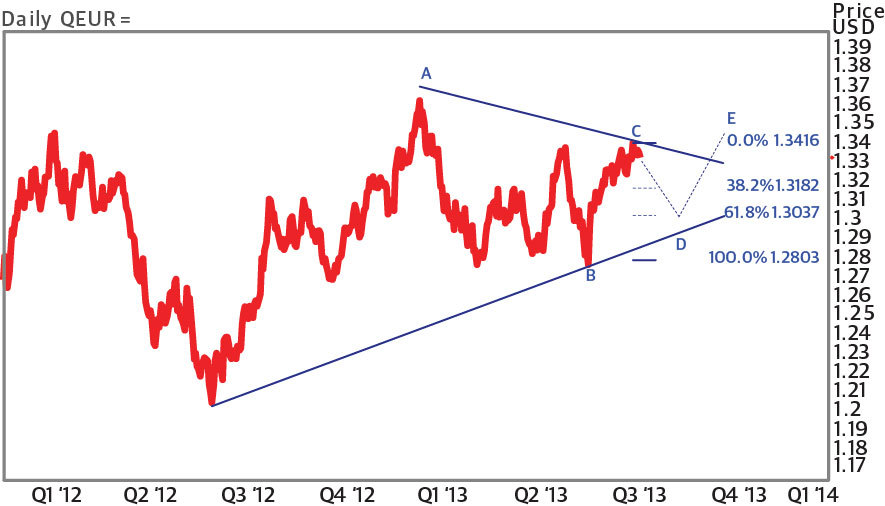

Key levels: The EUR/USD is trading in what appears to be an ending diagonal in a five-wave move (see chart) currently in a D-wave lower after posting a recent C-wave high of $1.3416.

In the scenario of an ending diagonal, the B and D waves are corrective (bearish) both of which post higher lows from the pair’s previous bottom. In keeping with that trend, the current move lower could encounter support at $1.3037 (61.8% Fib projection), before beginning the fifth and final E-wave move higher.

A move higher may see the previous peak of $1.3416 re-tested and broken through.