Focus on profits and cash set digital commerce specialist apart

Since spearheading the so-called gig economy over the past decade, Uber Technologies (UBER:NYSE) has emerged as a volatile investment.

Having whipped up a frenzy among investors with valuation pitches of up to $120 billion ahead of its 2019 IPO (initial public offering), bigger even than Facebook’s $104 billion 2012 float. In the end, its debut was a disaster, the $45 stock plunging on day-one to chalk-up one of America’s biggest debut flops ever and wiping more than $7 billion off the market cap.

The world has turned, and much has changed yet investors seem to retain a love/hate relationship with the stock, with sharp share price rallies interspersed with prolonged spells in the doldrums. During the past 15-months, Uber stock has more than doubled, a rally which included hitting a record $81.39 in February 2024, before losing oomph and drifting back to the current $64.56.

It is a run that was preceded by a near two-year slide, halving the $60-plus levels of early 2021. Not everyone wants a ticket to this kind of investment roller-coaster. Others are comfortable accepting more risk in their portfolios, but is Uber worth the hassle?

UBER IN A NUTSHELL

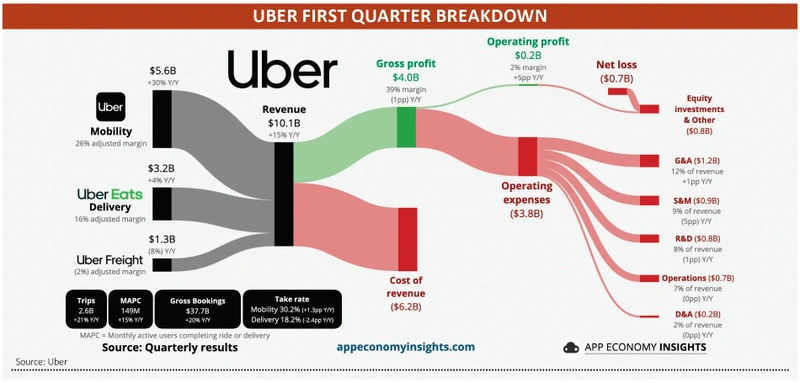

Uber’s rise has been rapid. In barely a decade and a half it has turned the simple cab ride industry on its head, becoming a verb for ride hailing in much the same way we talk of ‘googling’ in internet search. The $106 billion company operates across three clear markets: ride-hailing (roughly 55% of revenue in first quarter 2024), food delivery (32%) and freight services (13%).

After years of aggressively investing in its platforms and marketing to grow sales and the user base, Uber has seemingly turned the financial corner. In 2023 (to 31 Dec) it posted a $1.31billion operating profit on just shy of $37.3 billion revenue.

The company threw off $3.36 billion of free cash flow. Gross bookings last year jumped 19% to $137.9 billion and rose again in the Q1 of the current year, up 21% (at constant currencies) to $37.7 billion, smack bang in the middle of the $37 billion to $38.5 billion range issued in February 2024.

‘Uber continues to execute on all fronts, further strengthening its network effect, as seen in its growth in users, requests, frequency, user monetisation, and suppliers,’ says Morningstar analyst Ali Mogharabi.

Network effects create a virtuous circle for the company. Put simply, the more drivers/riders/restaurants it has, the more users will be attracted by increased availability and choice, and as user numbers rise, so more drivers/riders/food outlets sign-up to the platform, making it more valuable to all stakeholders, including shareholders.

Morningstar’s Mogharabi also flagged Uber’s efforts to further diversify its services. Grocery delivery is on pace to represent more than 50% of the company’s total gross bookings (45% in 2023), he says, with strengthened cross-selling capabilities due to its network effect.

‘We think Uber is likely to attract and maintain more users and limit growth on other platforms, including Instacart (CART:NASDAQ).’

BACK TO MARGINS

Sharp-eyed readers may have noted 2023 operating margins at 3.5%, the sort of ballpark you might get from a supermarket, not a high-growth internet business. Optimists will say it is not where they are now that matters, but where margins are going.

The firm also provided better-than-expected margin expansion guidance on its analyst day in February this year, says Morningstar. Based on consensus data from Koyfin, that’s between 10% and 11% for full year 2025, 200% up on 2023.

‘Uber’s network effect, leaner operation, and continuing gross bookings and revenue growth will likely create further operating leverage and drive an impressive 30% to 40% average annual adjusted EBITDA (earnings before interest, tax, depreciation and amortisation) growth over the next three years, with more than a 90% free cash flow conversion,’ says Mogharabi.

According to Gridwise, the average Uber driver earned $1,410 in gross monthly earnings in 2023, which was down 17% year-on-year. That sum is still significantly higher than Lyft (LYFT:NASDAQ) drivers made (although they do work less). Uber Eats saw a similar double-digit decline for monthly earnings. Drivers who feel they aren’t getting compensated fairly could stop working for Uber or instigate strike action.

Clearly, there’s a limit to how much a user will be willing to pay for food delivery and cab rides, which could leave Uber squeezed in the middle. The emergence of driverless vehicles could change the dynamics, but we are years away from fleets of driverless vehicles on our streets, such are the yawning gaps technological and regulatory framework gaps.

In the meantime, there are questions about Uber’s capital allocation, with return on capital employed sat at just 5.7%, according to Stockopedia data. The firm’s new $7 billion share buyback programme may provide some reassurance of a more mature handling of capital going forward, but Stockopedia has Uber on a 17 out of 100 rating for value.

Morningstar reckons the stock could hit $80 over the next 12 to 18 months, yet on a 2025 price to earnings multiple that tops 30, shareholders may well feel that the threat of pratfalls is not balanced attractively enough to the upside potential.